The Problem of Points for Real Estate Investors

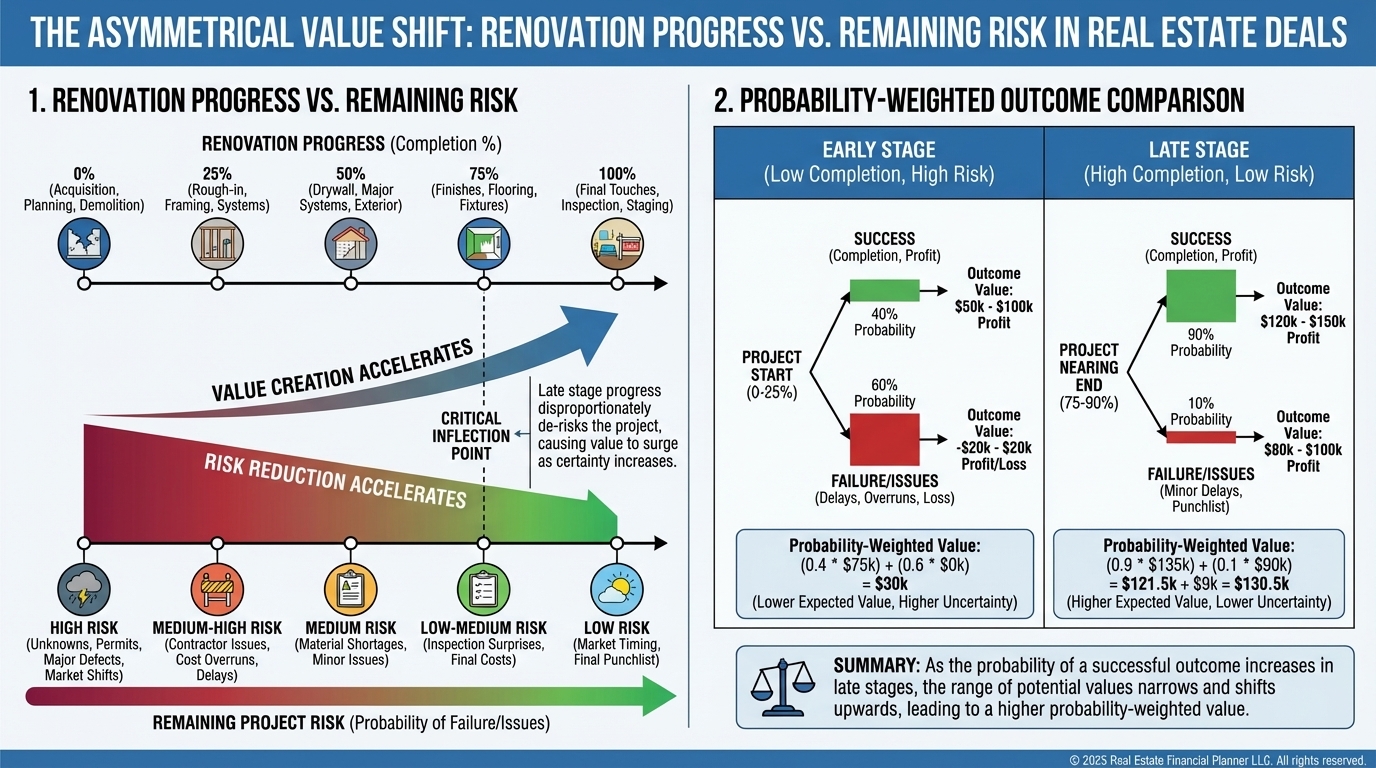

This article shows how the Problem of Points appears in real estate deals that stall, renegotiate, or unwind mid-process. You’ll learn why equal splits often misprice risk once uncertainty has already been resolved.

Why Mid-Deal Fairness Is Often Mispriced

Real estate deals rarely end cleanly.

They pause.

They renegotiate.

They unwind halfway through execution.

When that happens, investors often default to “splitting the difference.”

That instinct usually misprices the deal.

Where the Problem of Points Appears in Real Estate

You’ll see it in situations like:

•

Partnership buyouts

•

Renovations paused mid-project

•

Seller concessions late in escrow

•

Disputes over unfinished value-add work

In each case, the question isn’t what’s been done.

It’s what’s likely to happen next.

Example: A Partner Wants Out Mid-Renovation

You and a partner buy a value-add property.

Eighty percent of the renovation is complete.

Major risks are resolved.

Remaining work is minor and predictable.

Your partner wants out and suggests splitting remaining value evenly.

That feels fair.

It isn’t.

Most uncertainty is gone.

Most risk is behind you.

An even split prices the deal as if nothing has been resolved.

The Investor Mindset Shift

The Problem of Points reframes negotiations around:

•

Probability of successful exit

•

Capital still at risk

•

Time remaining to resolution

It replaces emotional arguments with analytical clarity.

This doesn’t eliminate compromise.

It improves its accuracy.

Final Thought

In real estate, most value is created after uncertainty collapses.

Investors who understand the Problem of Points don’t just negotiate better.

They allocate capital more intelligently over time.