The 90-Day Flip Rule: The Hidden Timeline That Quietly Destroys Profitable Flips

The 90-Day Flip Rule quietly kills deals when FHA buyers get denied at the last minute. Learn how to model timelines, returns, and exits correctly before it costs you real money.

When I help clients analyze flips, this rule shows up more often than almost any other surprise.

And it is usually expensive.

I have seen solid, profitable deals turn into stressful holding situations because someone modeled a sixty-day flip that could never legally close in sixty days.

That gap between expectation and reality is where returns quietly disappear.

Understanding the 90-Day Flip Rule is not about memorizing FHA policy.

It is about modeling time correctly, protecting returns, and avoiding avoidable mistakes.

What the 90-Day Flip Rule Actually Is

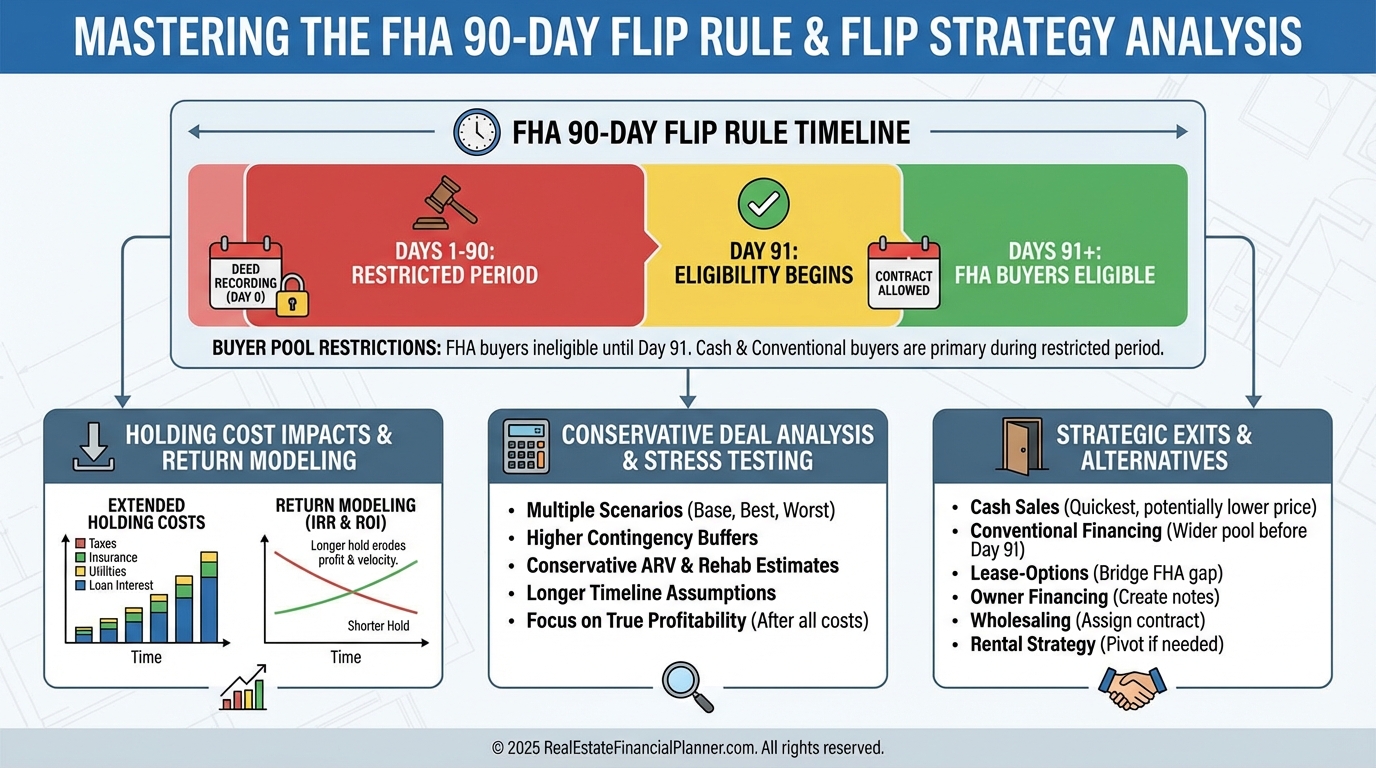

The 90-Day Flip Rule is an FHA restriction that prevents buyers using FHA loans from purchasing a property until at least ninety days after the seller acquired it.

This rule applies only to FHA financing.

It does not apply to conventional loans, portfolio loans, or cash buyers.

That distinction matters more than most investors realize.

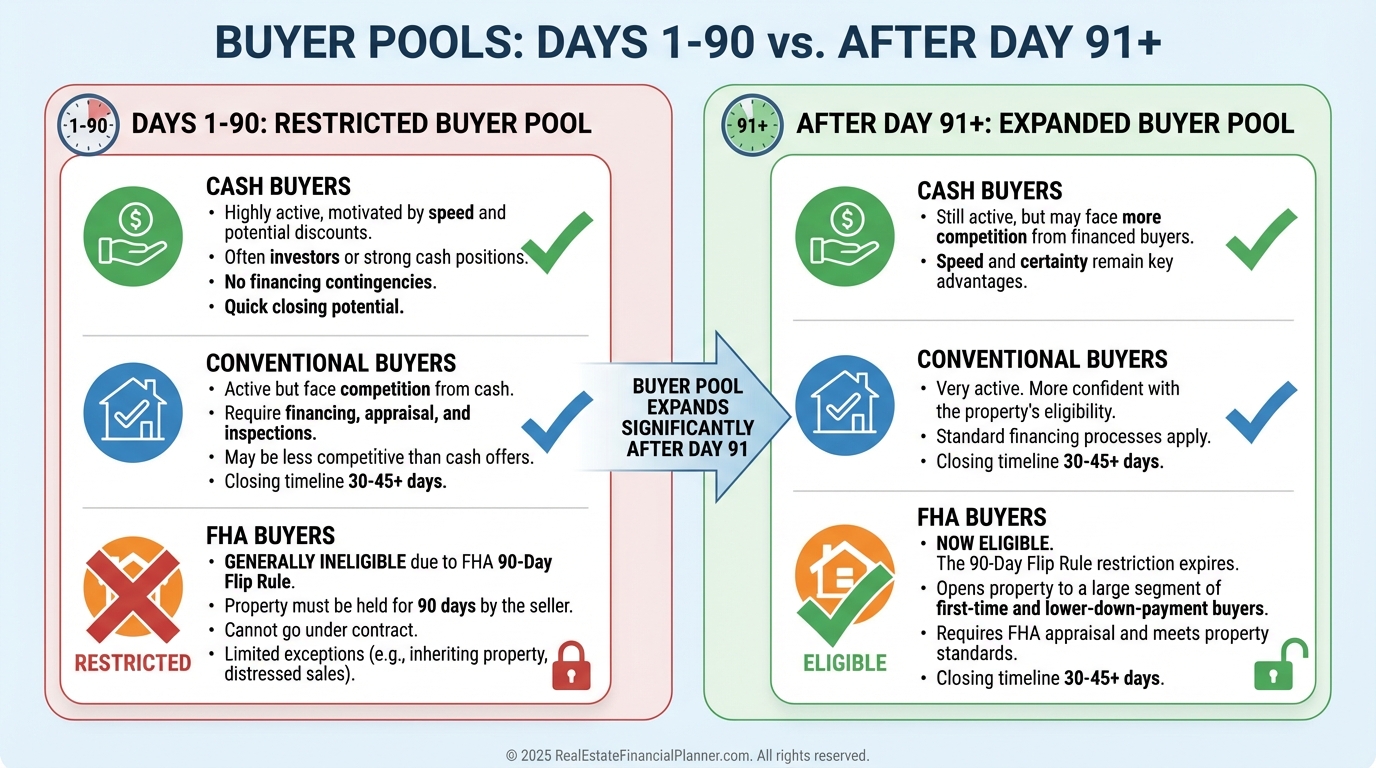

In many entry-level neighborhoods, FHA buyers represent twenty to forty percent of demand.

Eliminating that segment for three months reshapes your exit options whether you planned for it or not.

Why This Rule Shows Up in My Deal Analysis Every Time

When I rebuilt after bankruptcy and foreclosures, I became far more conservative about timelines.

That experience shaped how I evaluate flips today.

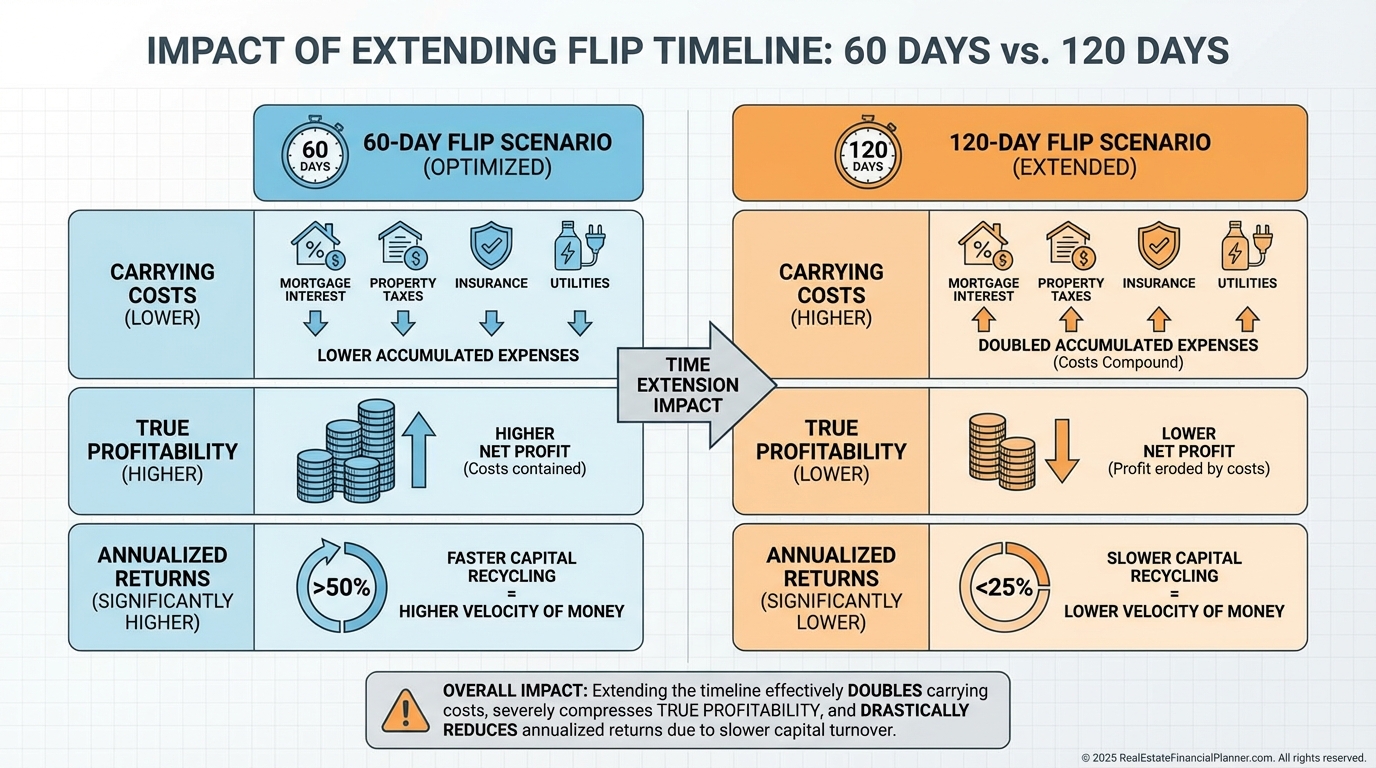

Time is not neutral.

Time has a cost.

When I review a flip using the Return in Dollars Quadrant™ and Return on Investment Quadrant™, the holding period drives everything else.

A deal that looks incredible on paper at sixty days can look mediocre at one hundred twenty.

This is why I never let clients assume the best-case timeline.

We model reality.

When the 90-Day Clock Actually Starts

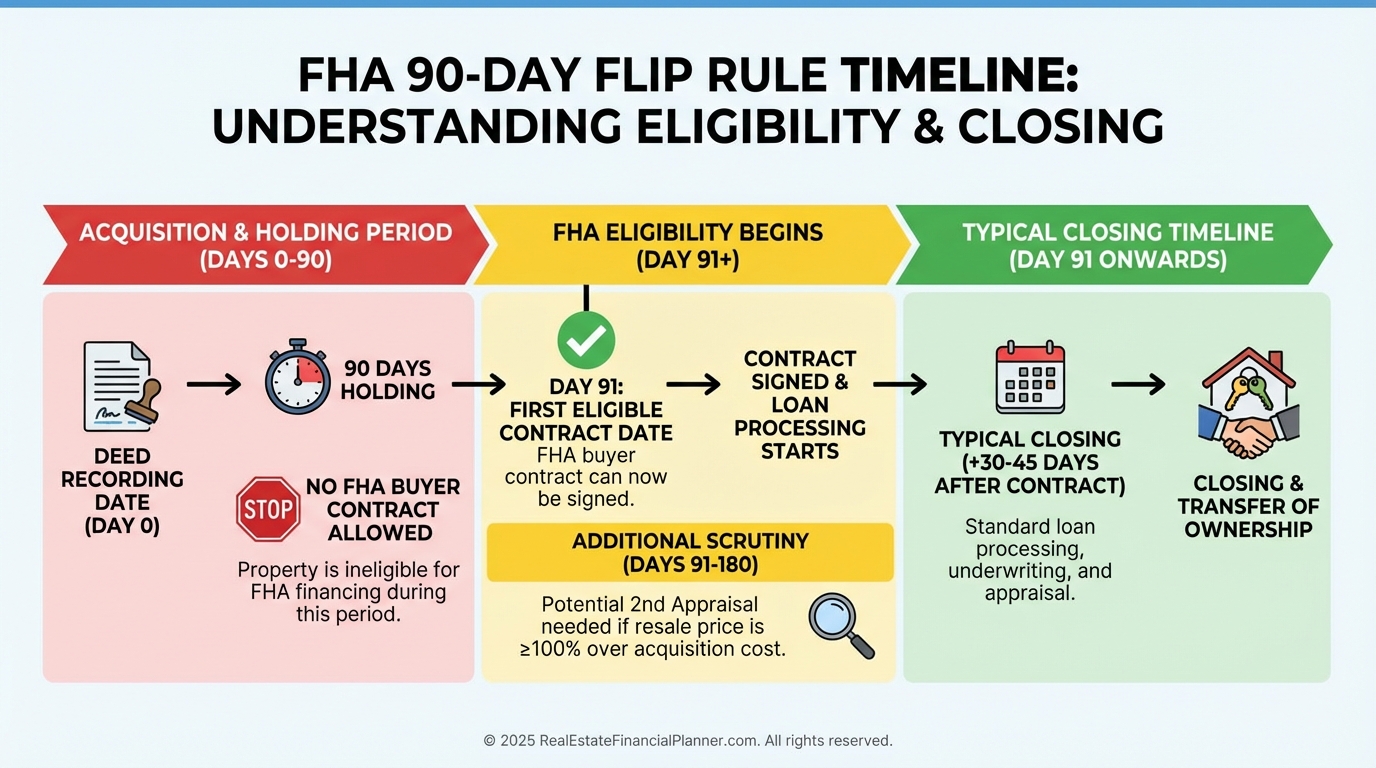

The most common and most expensive misunderstanding is when the ninety days begin.

The clock starts on the deed recording date.

Not the contract date.

Not even the closing date.

In some counties, recording happens days after closing.

Those days count.

Day ninety-one is the first day an FHA buyer can legally go under contract.

Even then, closing still takes time.

When I model flips, I assume one hundred twenty to one hundred thirty-five days unless proven otherwise.

That single assumption prevents most surprises.

How the 90-Day Rule Changes Your Returns

This rule does not just delay closings.

It reshapes returns.

When I calculate True Net Equity™ on a flip, extended holding periods quietly drain spendable profit.

The nominal profit might still look fine, but the efficiency of the deal collapses.

This is why I warn clients that fast flips are rare and fragile.

Slow flips are normal.

Planned slow flips are profitable.

Buyer Pool Reality During the First 90 Days

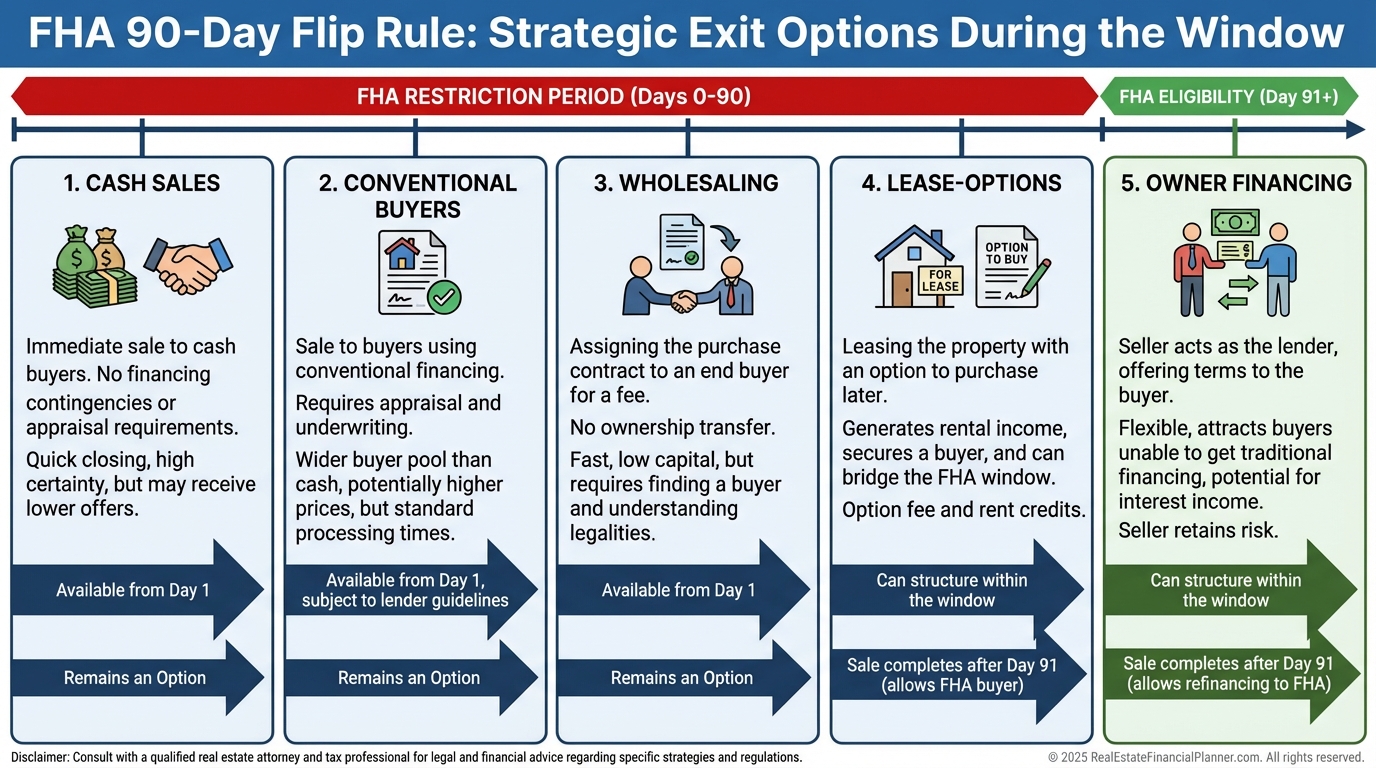

For the first ninety days, your buyers are limited to cash and conventional financing.

That usually means:

•

Fewer buyers

•

More negotiation leverage for buyers

•

Slightly lower prices in many markets

If you price as if FHA buyers are available when they are not, listings go stale.

Stale listings cost money.

When I help clients plan exits, we explicitly identify which buyer pool we are targeting during each phase of ownership.

Common Mistakes I See Over and Over

Even experienced investors repeat the same errors.

They list too early.

They accept FHA offers too soon.

They calculate returns on fantasy timelines.

The most dangerous mistake is assuming financing rules will work themselves out.

They never do.

Another common error is failing to document renovations.

In some cases, FHA allows exceptions when improvements exceed twenty percent of the purchase price.

If you do not document everything, that option disappears.

Turning the 90-Day Rule Into a Strategic Advantage

Smart investors plan around the rule instead of fighting it.

They stagger acquisitions.

They line up cash and conventional buyers early.

They structure marketing in phases.

In some cases, they wholesale instead of flipping.

In others, they pivot to short-term rentals or lease-options during the holding period.

How I Model This Inside Real Estate Financial Planner™

Inside Real Estate Financial Planner™, I never let timelines hide.

I run scenarios at ninety, one hundred twenty, and one hundred fifty days.

If a deal only works under perfect conditions, it does not work.

This approach forces clarity.

It protects capital.

It keeps emotions out of decision-making.

The Real Lesson Behind the 90-Day Flip Rule

The 90-Day Flip Rule is not a nuisance.

It is a test.

It tests whether you model reality or hope.

It tests whether you understand time as a cost.

It tests whether your margins are real.

Investors who respect this rule stay in control.

Investors who ignore it pay tuition.

Before your next flip, revisit your assumptions.

Extend your timelines.

Recalculate your returns.

The deal you walk away from is often the one that saves you the most money.