88 Ways to Improve Cash Flow on Rental Properties (A Comprehensive Investor’s Guide)

Unlock 88 ways to improve cash flow on rental properties using smarter financing, strategy selection, and property optimization. Learn how small tweaks, strategic moves, and advanced modeling can boost returns and accelerate your path to financial independence.

When I first began rebuilding after my bankruptcy, I became obsessed with one question: how much of my journey to financial independence could be accelerated simply by improving cash flow?

The answer surprised me.

A lot.

Some improvements are tiny—ten or twenty dollars per month. Others create thousands of dollars of additional cash flow in the first year alone. When I help clients model properties inside the Real Estate Financial Planner™ software, they’re usually shocked by how many levers can move the cash flow needle.

You won’t use all eighty-eight strategies.

Some directly contradict others.

But the right combination—applied at the right stage—can meaningfully improve Return in Dollars™, Return on Investment™, and True Cash Flow™.

Below is the structured approach I teach clients, organized by the stage of the investment lifecycle.

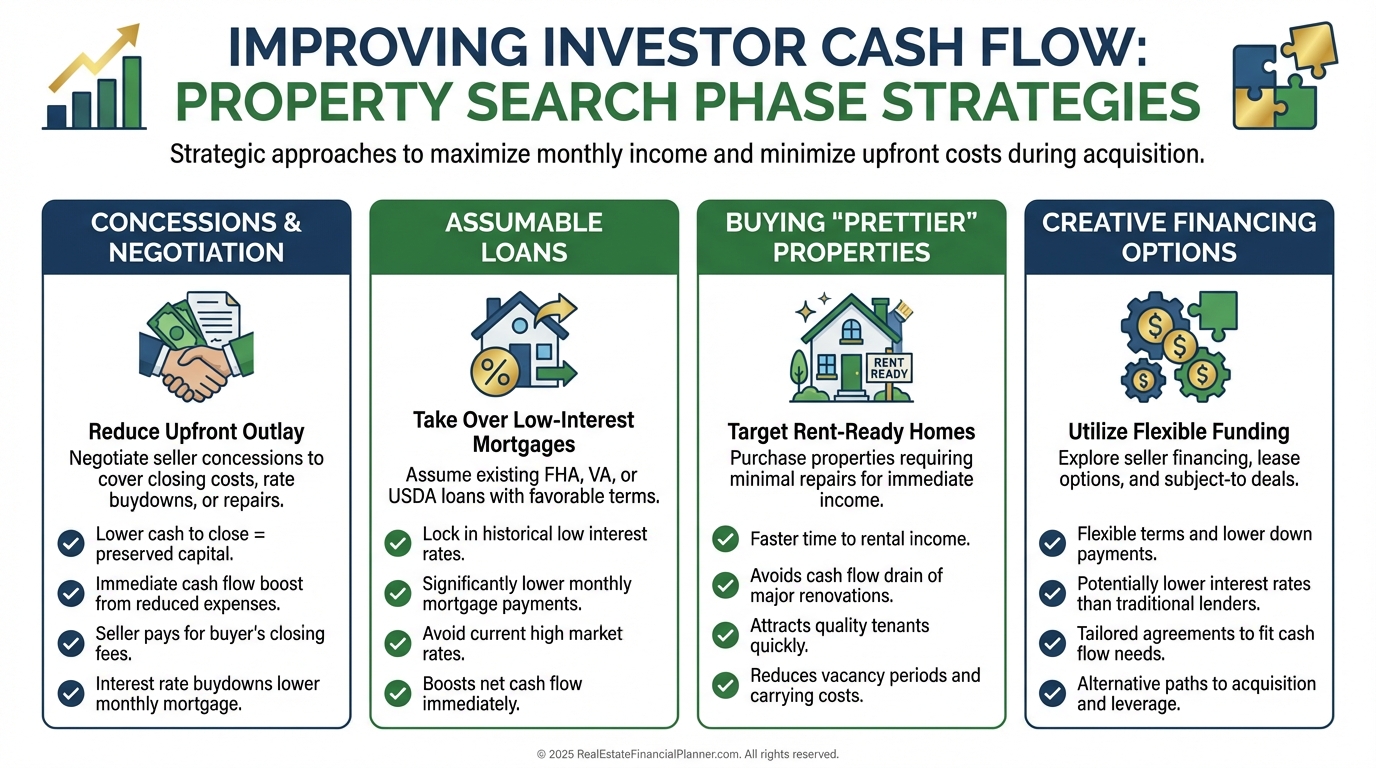

Searching for a Rental Property

The search phase matters more than most investors realize.

The wrong property requires you to “fix” cash flow later.

The right one hands you built-in advantages from day one.

Here are ten questions I ask clients when evaluating properties:

•

Pretty Properties – Could you buy a place that doesn’t require rent-ready repairs, so that cash can instead fund your rate buydown or down payment?

•

Subject To / Wraps – Could the seller’s existing financing improve your monthly payment?

•

Seller Financing – Could the seller carry back a portion so you lower your loan-to-value and rate?

•

Lock/Float – Should you lock your rate or gamble on downward movement?

•

Search for Concessions – Are there sellers offering credits you can use to buy down your payment?

•

Search Less Expensive Homes – Does a lower purchase price give you better rent-to-price ratios?

•

Assumable Loans – Can you inherit better terms than today’s market offers?

•

Owner or Creative Financing – Could more favorable terms exist outside conventional lending?

•

Installment Land Contract – Could spreading payments out create better cash flow?

•

Agent Selection – Some agents offer rebates. That rebate can instantly improve your cash flow calculus.

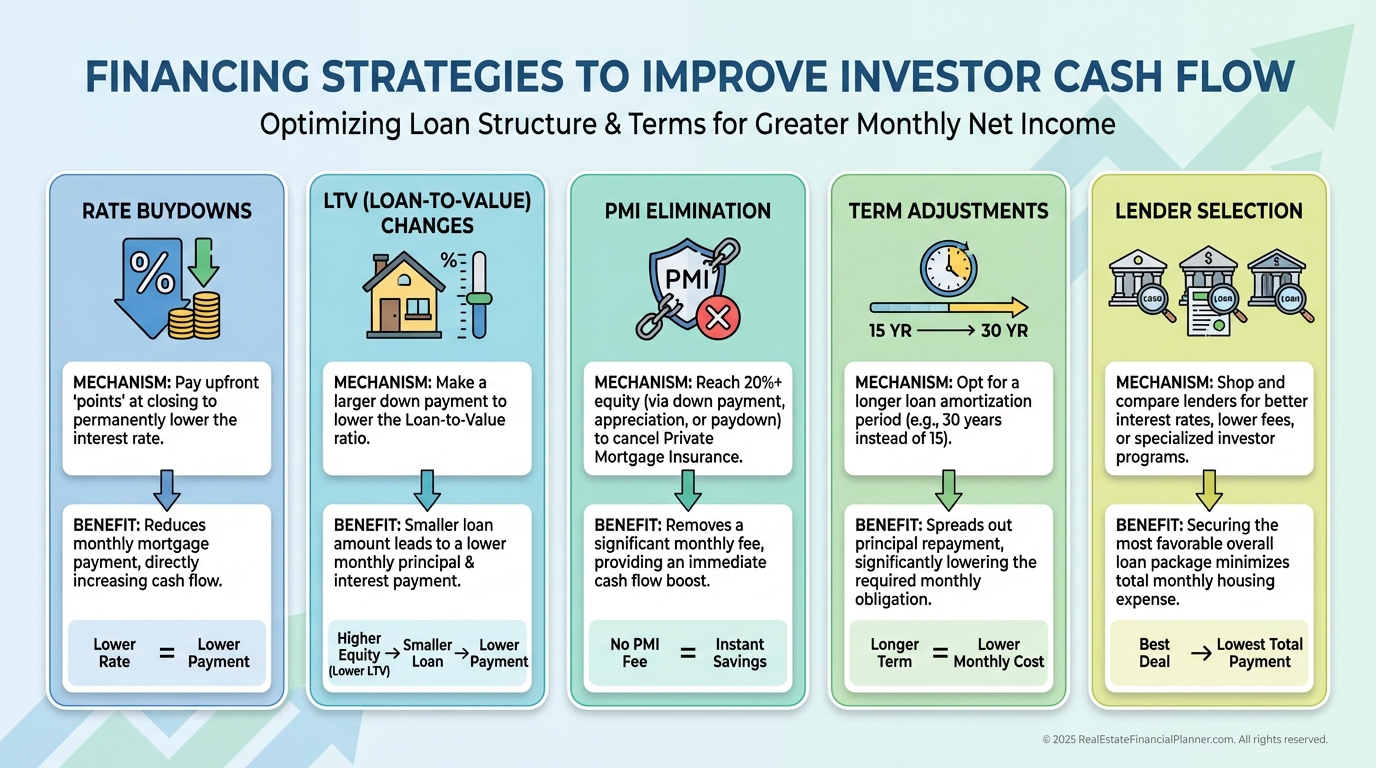

Financing a Rental Property

Financing is where many investors unknowingly leave thousands of dollars on the table. I see it every week when reviewing client deal analyses.

A modest rate improvement or a shifted loan term can change the entire trajectory of True Net Equity™ and long-term wealth.

Here are some of the financing strategies I review with clients:

•

Pay Closing Costs in Cash to avoid increasing your monthly payment.

•

Private or Wrap Financing when personal relationships or the seller offer better terms.

Interest-Only Loans to temporarily increase cash flow.

More Down Payment to reduce borrowing costs.

Lower LTV for Better Rates when larger down payments trigger pricing improvements.

Select Loans by Closing Costs if you’re financing those costs.

Buy Down the Rate when the long-term ROI justifies it.

Change the Loan Term to reduce monthly payments.

Eliminate PMI by improving equity or paying PMI upfront.

Adjustable Rate Mortgages when short-term ownership is planned.

Improve Your Credit Score to qualify for better pricing tiers.

Add or Remove a Borrower to achieve better loan terms.

Ask for Seller Concessions specifically to improve financing.

Find a Better Lender—one of the simplest, highest-impact moves.

Use Cash-Out from Another Property to create a larger down payment or eliminate PMI.

Offer Less when the numbers demand it.

Pay Cash if it meaningfully changes your long-term modeling.

Improving Your Real Estate Investing Strategy

Sometimes the strategy—not the property—is the cash flow problem.

When I coach Nomad™ investors, for example, the shift from a traditional rental to a lease-option exit can dramatically reshape their cash flow profile.

Here are key strategic pivots:

Shorter or Alternative Lease Terms such as weekly rentals or seasonal pricing.

Lease-Option Exits to increase income and reduce maintenance.

Niche Rentals like corporate housing.

Roommates—especially for Nomad™ properties.

Rent by the Bedroom for student or workforce housing.

Rent by Parts such as parking spaces, garages, or RV pads.

Improving the Property Itself

Some improvements materially change what the market will pay.

Others allow you to split and monetize previously unused space.

Consider:

Subdividing Units for upstairs/downstairs rental separation.

Upgrading Curb Appeal to justify higher rents.

Adding Solar and packaging utilities.

Offering Furnished Rentals when the market rewards it.

Converting to Multifamily where zoning permits.

Charging for Improvements like fencing or upgraded amenities.

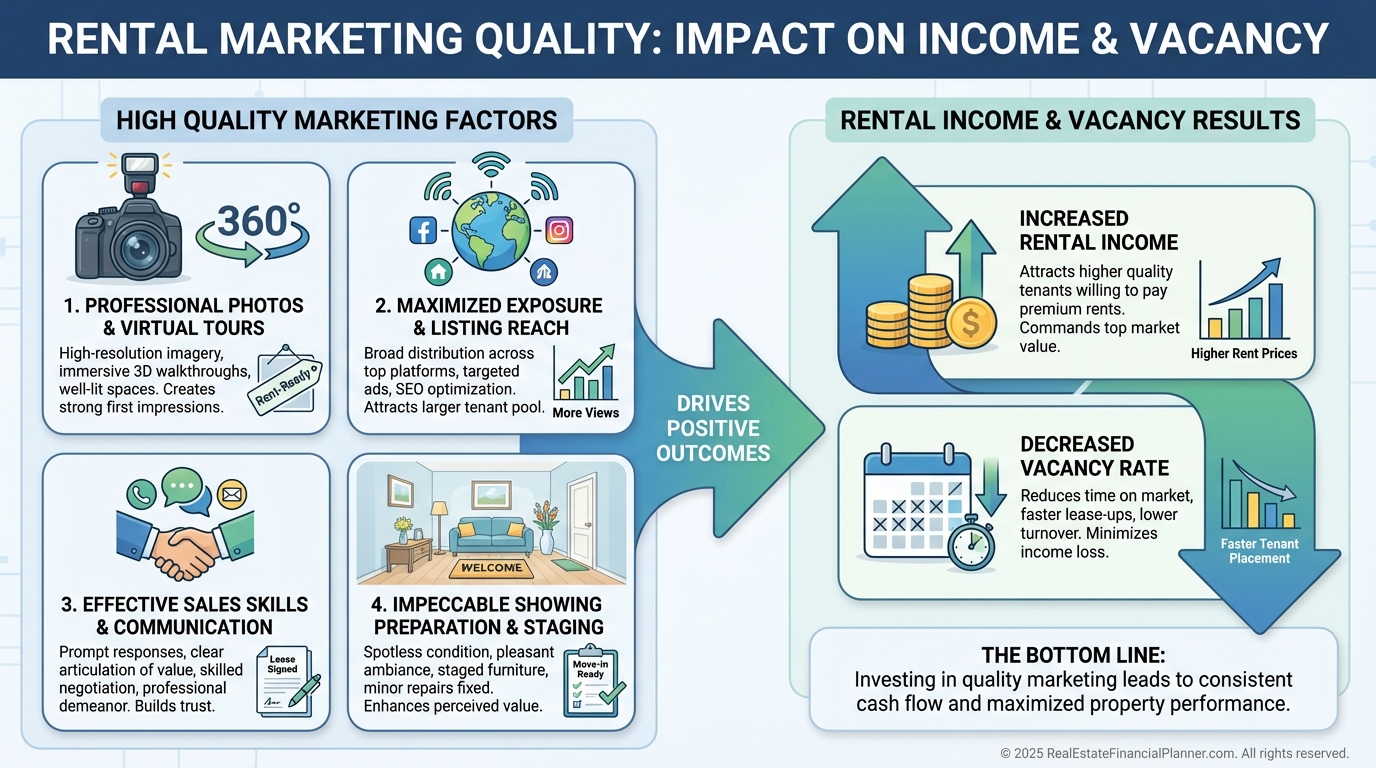

Marketing the Property for Rent

Better marketing reduces vacancy and increases perceived value.

Focus on:

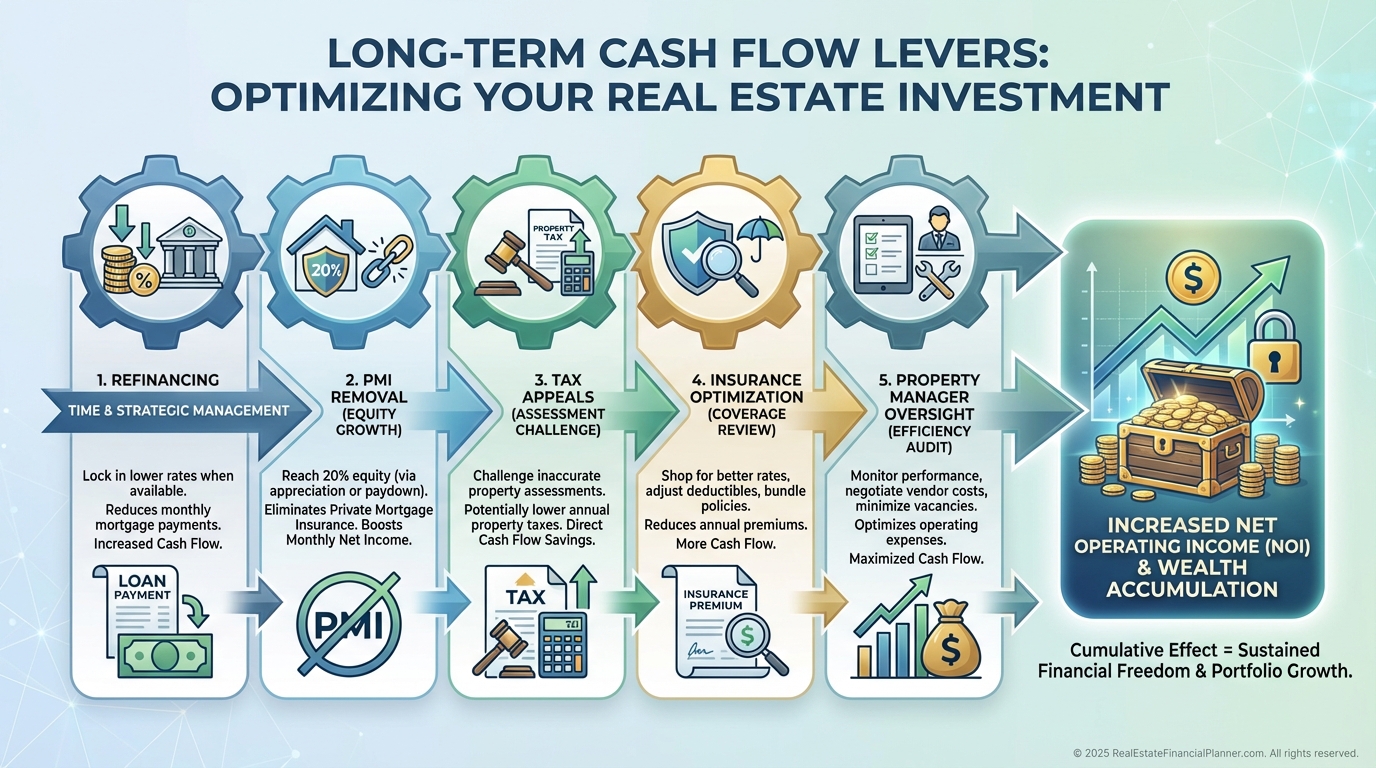

Steady-State Property Ownership

This phase is where long-term investors quietly win or lose tens of thousands of dollars.

Small decisions compound.

Refinancing at the right time.

Managing insurance correctly.

Reviewing your property manager.

Correcting tax assessments.

These are the moves that build wealth slowly and reliably.

Key considerations:

Refinancing to extend or improve terms

Removing PMI

Evaluating insurance coverages and deductibles

Contesting taxes

Using higher-quality maintenance materials

Managing or improving your property manager’s performance

Maintaining property to reduce vacancy time

Renting the Property

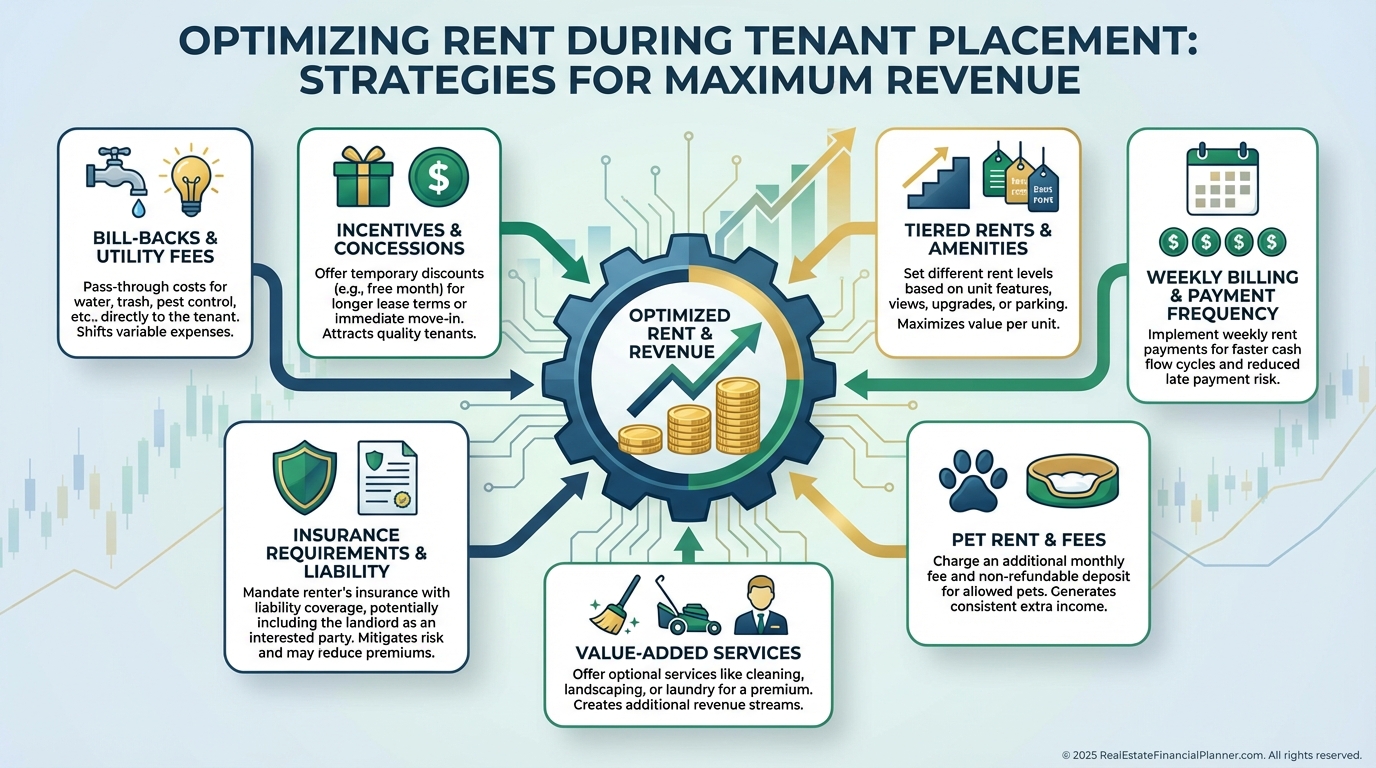

When leasing the property, pricing structure and policy choices can influence cash flow more than many owners expect.

You might explore:

Adding paid services

Requiring longer notice periods

Billing back utilities or HOA fees

Offering incentives for early/on-time rent

Ending leases during peak season

Charging for autopay or non-autopay

Testing rents early

Tiered rent by credit score

Pet rent

Ensuring renter’s insurance compliance

Conclusion

When I built the REFP software, I wanted investors to see the impact of these choices—not just in monthly cash flow, but in long-term True Net Equity™, Return Quadrants™, and eventual financial independence.

Some of these eighty-eight strategies will add a few dollars per month.

Some will add hundreds.

A handful may add over ten thousand dollars in the first year alone.

You don’t need all of them.

You just need the right ones.