How 1031 Exchanges Accelerate Real Wealth: The Ultimate Investor’s Guide to Tax-Deferred Portfolio Growth

Unlock how a 1031 exchange defers taxes, protects equity, and multiplies your buying power. Learn how investors avoid costly mistakes and build wealth faster.

When you’re rebuilding—like I was after my bankruptcy—you gain a new appreciation for every dollar you can keep working inside your portfolio.

I didn’t have the luxury of making avoidable mistakes.

And when I started teaching local investors how to analyze deals, I realized many of them were unknowingly planning to give up tens of thousands of dollars in capital gains and depreciation recapture on every sale.

That’s when I started modeling 1031 exchanges into The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

When you see the difference in long-term net worth—especially True Net Equity™—the impact is undeniable.

A 1031 exchange isn’t a loophole.

It’s a framework Congress intentionally created more than a century ago to keep capital flowing into real estate and the broader economy.

And if you want to accelerate your path to financial independence, you need this tool in your kit.

What a 1031 Exchange Really Is (And Why It Matters)

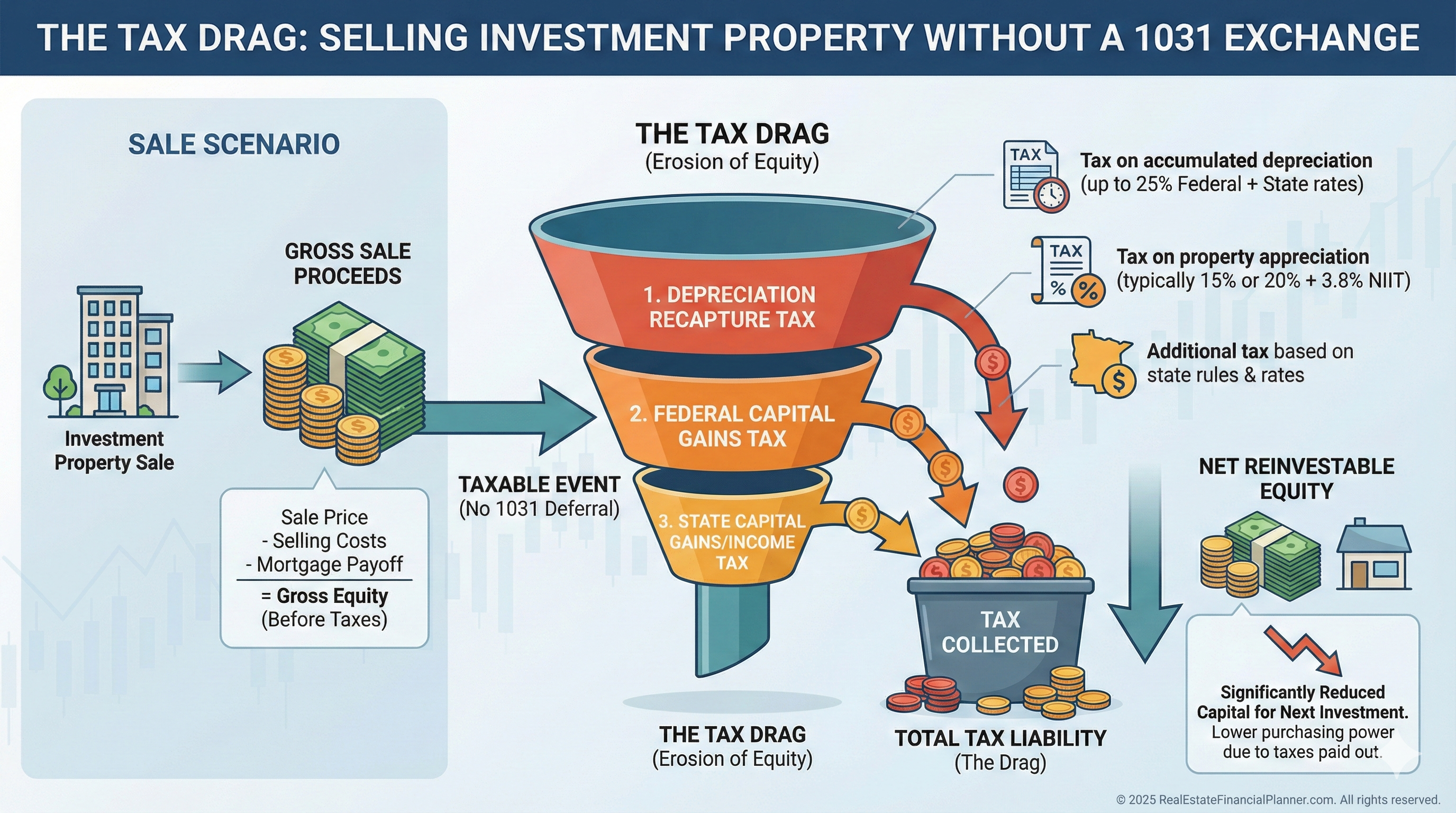

A 1031 exchange allows you to defer capital gains taxes, depreciation recapture taxes, and state taxes when you sell an investment property and reinvest into another like-kind property.

Most investors casually gloss over the word “defer.”

But this detail is the engine behind exponential portfolio growth.

When you defer taxes, you’re not waiting passively.

You’re reallocating those dollars into properties that produce:

•

Appreciation

•

Tax benefits

And when you add reserves into the equation, you’re essentially magnifying your Return in Dollars + Reserves Quadrant™.

This is why I tell clients:

“Your biggest hidden investor is the IRS—and through a 1031 exchange, they agree to leave their money in the deal.”

That is leverage without borrowing.

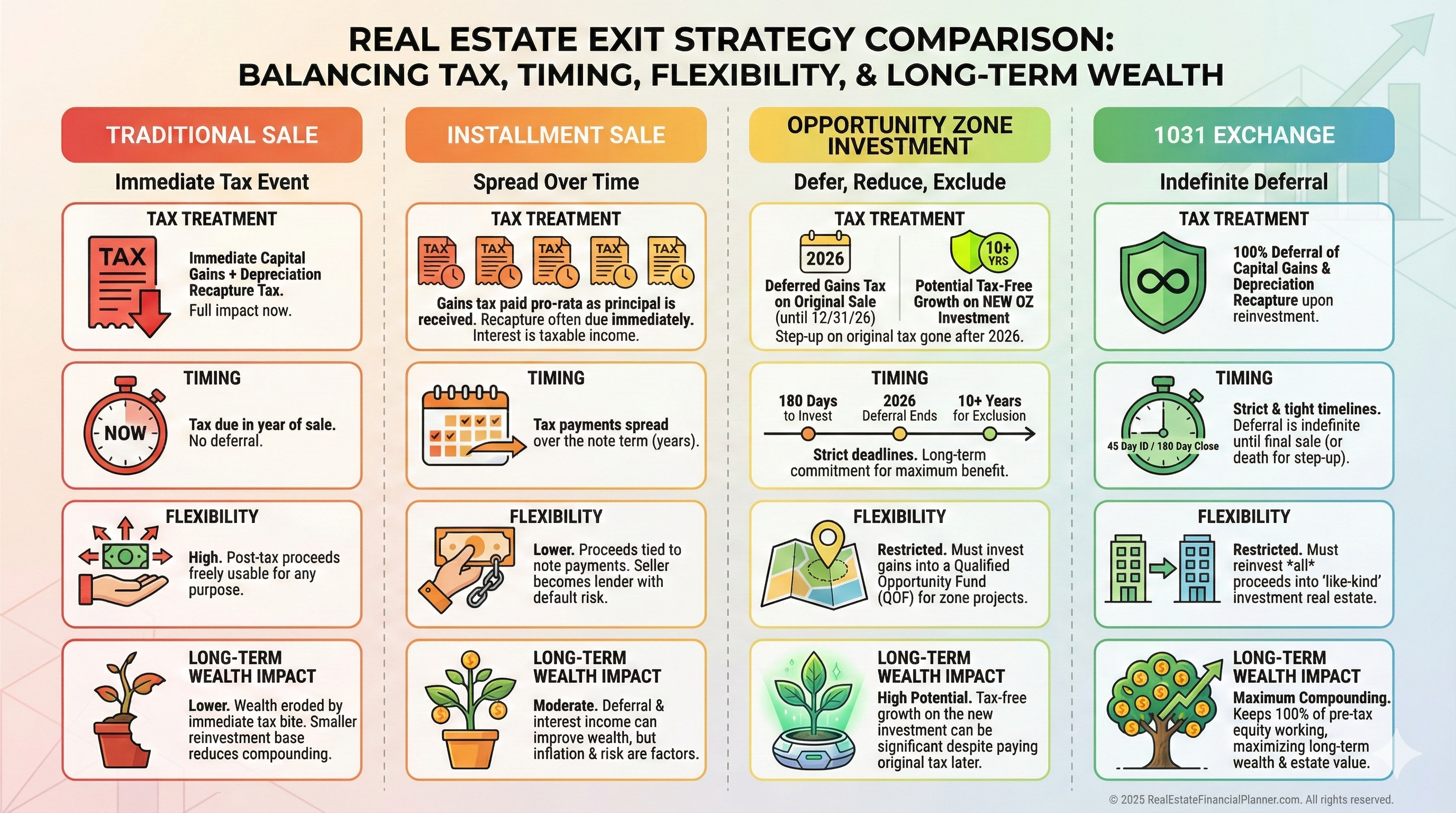

Other Exit Strategies Don’t Come Close

Before I teach investors how to use 1031 exchanges, we start with what the alternatives look like.

A standard sale triggers taxes immediately.

An installment sale spreads out the tax bill but doesn’t eliminate it.

Opportunity Zone investments restrict you to narrow geographic areas and long holding periods.

A 1031 exchange allows you to keep full control of your capital.

And when you’re playing a long game—building a portfolio that throws off durable, resilient income—control matters.

Why 1031 Exchanges Boost Key REFP Metrics

When you analyze deals using REFP frameworks, a 1031 exchange doesn’t just save taxes—it reshapes your entire financial model.

Here’s how it affects the core metrics I walk clients through:

Your Internal Rate of Return (IRR) increases.

You’re reinvesting pre-tax dollars instead of starting from scratch with diminished equity.

Your Cash-on-Cash Return improves.

More equity means stronger leverage ratios and more purchasing power.

Your Return on True Net Equity™ transforms.

True Net Equity™ helps you model the real cost of accessing equity once taxes and selling costs are considered.

A 1031 exchange preserves that equity in full, which dramatically changes the numerator and denominator of the Return on True Net Equity™ Quadrant.

Your Return on Equity + Reserves (ROEQ+R™) stays productive.

Instead of taking a tax hit and letting your reserves sit idle in a bank account, you're rolling everything into a property that produces returns on every quadrant.

When clients see these changes side-by-side, the decision becomes obvious.

This is one of the rare strategies where the math consistently aligns with common sense.

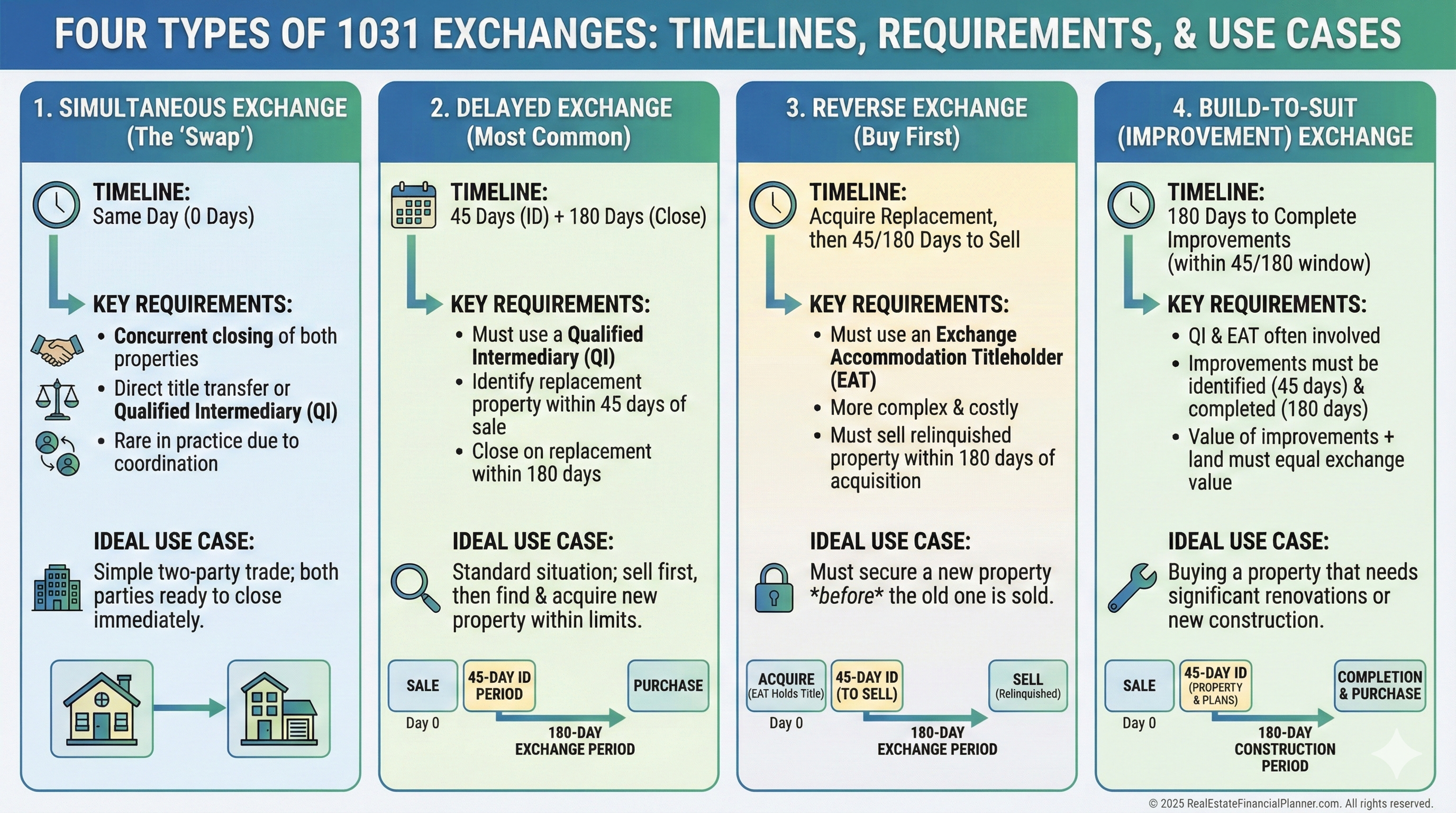

The Four Types of 1031 Exchanges

You have options when structuring an exchange, but here’s the truth:

Most investors only ever use one type—the delayed exchange—because it’s the most practical.

But each version has a place.

Simultaneous Exchange

Both closings happen the same day.

Extremely rare.

Everything must line up perfectly.

Delayed Exchange

The most common.

You sell first, identify up to three replacement properties within forty-five days, and close within one hundred eighty days.

This is where most investors begin—and where most get into trouble if they’re not prepared.

Reverse Exchange

You buy first, sell second.

Useful in competitive markets where you can’t risk losing a replacement property.

Complicated, expensive, and requires more liquidity.

Build-to-Suit (Construction) Exchange

You can use exchange funds for improvements on the replacement property.

Great for value-add strategies if you plan correctly.

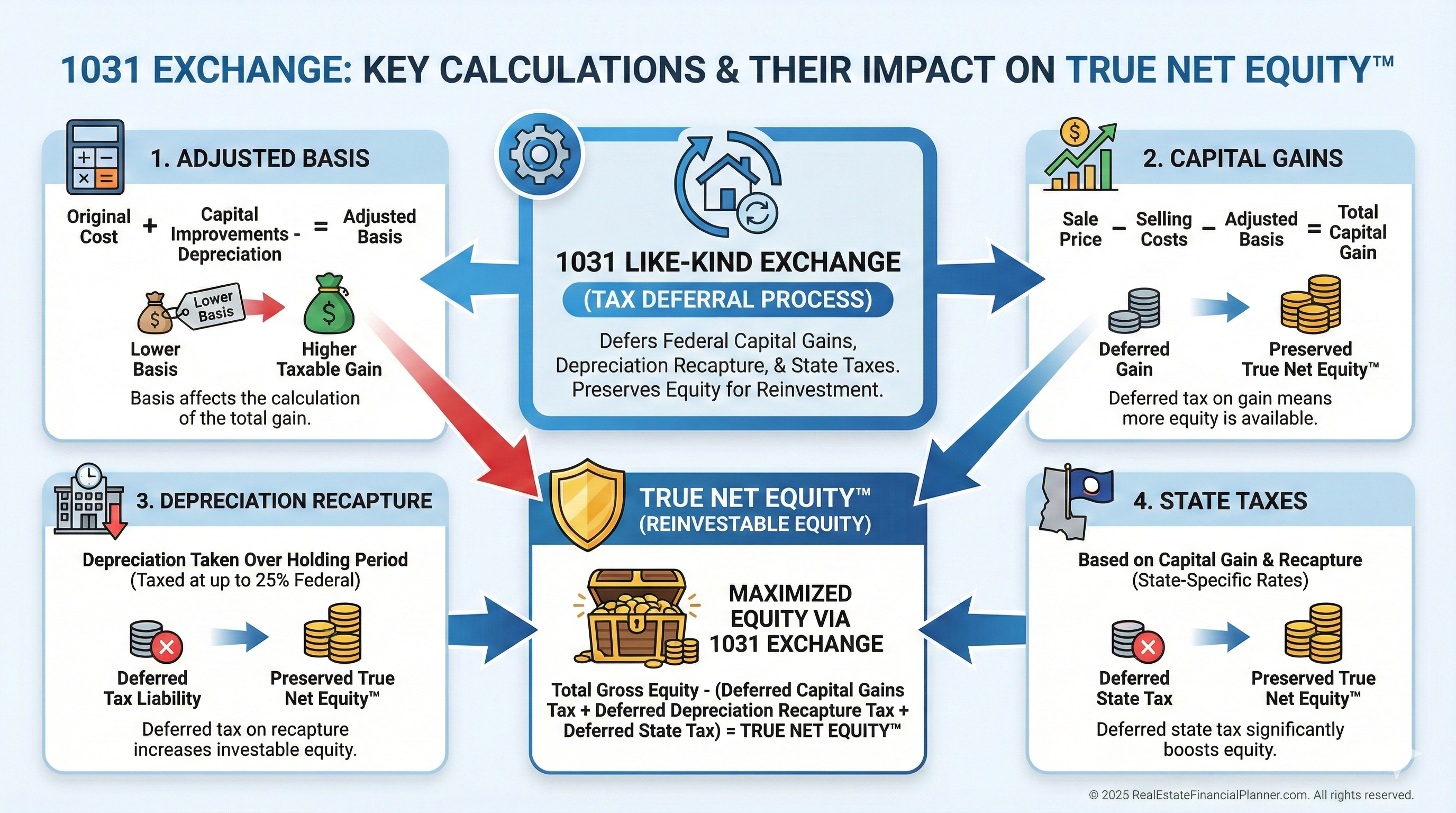

How to Calculate the Real Benefit of a 1031 Exchange

Now let’s go deeper.

When I walk investors through whether they should do a 1031 exchange, we start with True Net Equity™.

This clarifies their real equity, after subtracting:

•

Seller closing costs

•

Depreciation recapture

•

Capital gains taxes

•

State taxes

True Net Equity™ gives you clarity:

“How much equity do I actually control if I sell this property?”

A 1031 exchange preserves almost all of it.

Let’s walk through a case study.

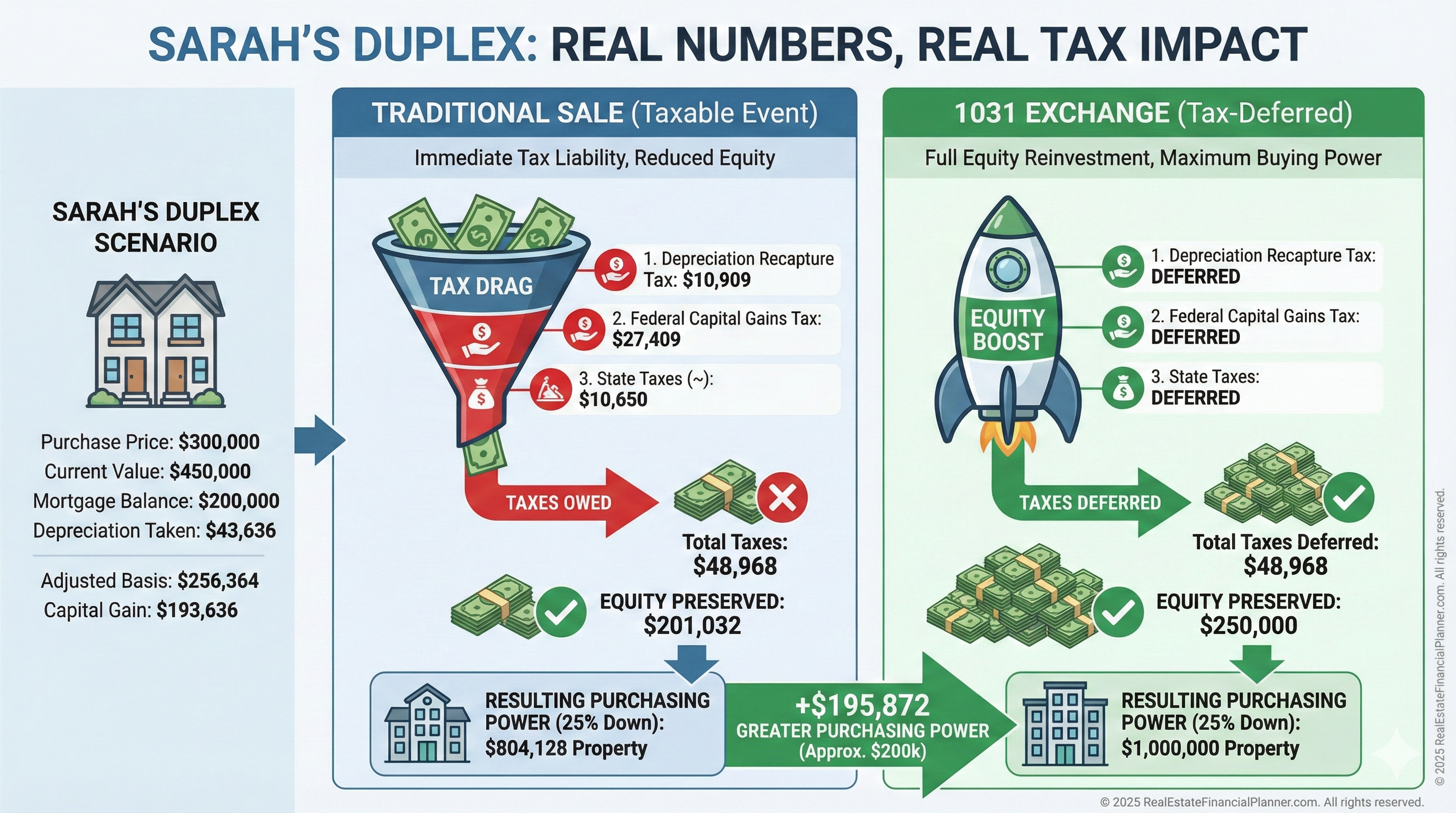

Case Study: Sarah’s Duplex

Sarah bought a duplex for $300,000.

Years later, it’s worth $450,000.

She wants to level up—but doesn’t want to lose momentum rebuilding her portfolio.

Here’s where investors get stuck.

They look at their equity and assume:

“I’ll walk away with all of that.”

You won’t.

Not without a 1031.

Let’s walk through her real numbers:

•

Purchase price: $300,000

•

Current value: $450,000

•

Mortgage balance: $200,000

•

Depreciation taken: $43,636

•

Adjusted basis: $256,364

•

Capital gain: $193,636

Tax bill:

•

Depreciation recapture: $10,909

•

Federal capital gains: $27,409

•

State taxes: ~$10,650

Total taxes: $48,968

In a standard sale, after paying the mortgage and taxes, she keeps about $201,032.

With a 1031 exchange, she keeps all $250,000 of her equity.

That’s a $48,968 difference.

At 75% leverage, that becomes nearly $200,000 of additional purchasing power.

When you model these numbers inside the Return Quadrants™ or ROEQ+R™, the compounding effect becomes painfully clear.

Key Components Every Investor Must Calculate

When I help clients evaluate whether a 1031 exchange makes sense, there are four numbers we compute every single time.

Skipping even one of them leads to wildly inaccurate conclusions.

These calculations also feed directly into True Net Equity™ and your Return on True Net Equity™ Quadrant.

Adjusted Basis

Your adjusted basis determines your capital gain.

It’s your:

Original purchase price

Capital improvements

– Accumulated depreciation

Most investors underestimate their depreciation because they never revisited their tax returns.

If you get this wrong, every number downstream collapses.

Capital Gains

This is simply the sale price minus your adjusted basis.

But the consequences of miscalculating it are enormous because this number directly dictates your federal and state tax liability.

Depreciation Recapture

This is the silent tax investors forget.

You depreciated the property each year.

Now the IRS wants twenty-five percent of that back.

And yes, it’s due even if you didn’t claim depreciation on your tax return.

State Tax Implications

States vary widely.

California tracks your exchanges and requires specific documentation.

Other states treat the tax deferral more simply.

When running REFP scenarios, I always encourage investors to model state taxes separately to avoid false optimism.

Where to Get the Right Data (Not the Guesswork)

When you model a 1031 exchange, your conclusions are only as accurate as the data you feed into the spreadsheet.

This is where many investors—especially DIY sellers—go wrong.

Here’s what I review with clients:

•

•

Tax returns for depreciation schedules

•

Broker price opinion (BPO) or appraisal for current market value

•

Property tax records for historical anchoring (not valuation)

•

Amortization schedule for current loan balance

Everything else is estimation or fantasy.

When I rebuilt my portfolio after bankruptcy, I learned the hard way:

You can’t outrun the math.

You can only clarify it.

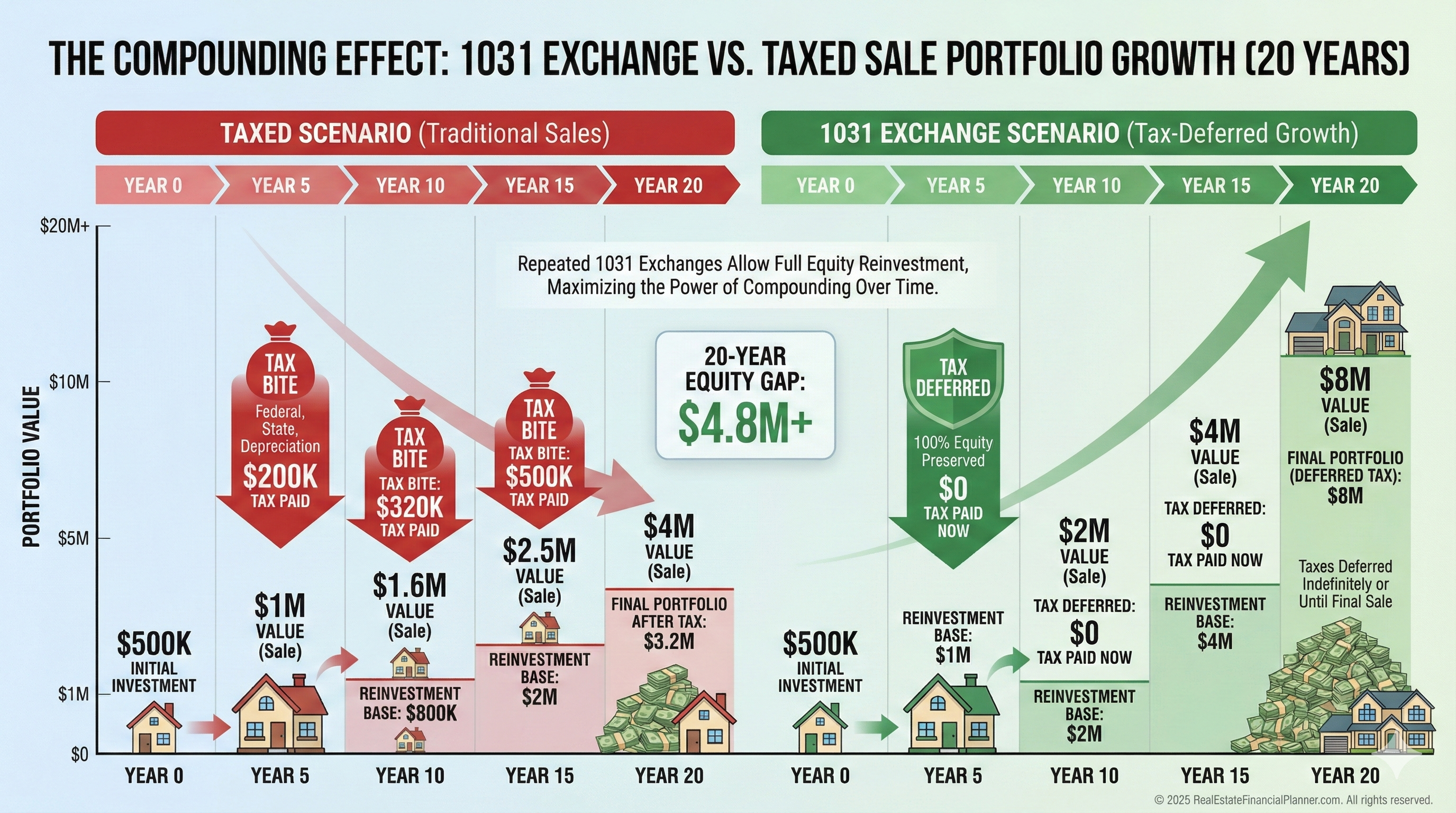

The Transformative Power of Serial Exchanges

A single 1031 exchange is meaningful.

A lifetime of exchanges is transformative.

Let me show you what I mean.

Early in my career—before the bankruptcy—I watched investors casually sell properties, pay their taxes, and move on.

After the bankruptcy, when I had to start over, I didn’t have that luxury.

Every dollar needed to multiply.

When you run the model for a series of exchanges every five to seven years, the compounding effect becomes almost unbelievable.

Imagine an investor named Marcus:

Year 1: Buys a $250,000 fourplex

Year 5: Exchanges into a $375,000 property

Year 10: Exchanges into a $560,000 property

Year 15: Exchanges into an $840,000 property

Year 20: Exchanges into a $1,250,000 property

If Marcus paid taxes at each sale, he might have stalled around $600,000 to $700,000 total property value.

Serial exchanges create a staircase that taxes can’t interrupt.

How 1031 Exchanges Affect Property Values and Financing

Here’s something most beginners don’t realize:

A 1031 exchange doesn’t just preserve equity—it increases your borrowing capacity.

Because lenders lend based on the down payment you bring to the table, every dollar of deferred tax becomes a prerequisite for more leverage.

Increased Buying Capacity

If you defer $50,000 in taxes, that’s $50,000 that can now serve as the down payment for a much larger property.

At 75% loan-to-value:

$50,000 → controls $200,000 more real estate.

Leverage Multiplication

When you model this inside REFP’s Return in Dollars Quadrant™, appreciation, debt paydown, cash flow, and tax benefits all increase because your denominator (your actual cash invested) is so much more efficient.

Portfolio Acceleration

1031 exchanges let you avoid “resetting the clock” every time you sell.

Instead of losing twenty to thirty percent of your equity to taxes and closing costs, you move forward at full speed.

Financing Constraints You Must Navigate

Lenders look favorably at 1031 buyers because it signals professionalism.

But exchanges create specific underwriting requirements.

Debt Replacement Requirement

If you had a $300,000 loan on the property you sold, your replacement property must carry at least $300,000 in debt to fully defer taxes.

If you reduce debt, you create something called "mortgage boot"—and the IRS taxes that portion.

This surprises investors nearing retirement who want to de-leverage.

It’s often smarter to structure the exchange differently or combine it with a partial cash-out strategy.

Timing Pressure

The forty-five-day identification period is the killer.

Not the one hundred eighty days to close.

The identification window is unforgiving.

If you want to get the best financing terms, you need to start the loan process early—ideally before you even list the property for sale.

Reserves Matter

Lenders want to see strong reserves, which is where Return on True Net Equity + Reserves™ comes in.

Investors who maintain adequate reserves get better terms, faster approvals, and smoother closings.

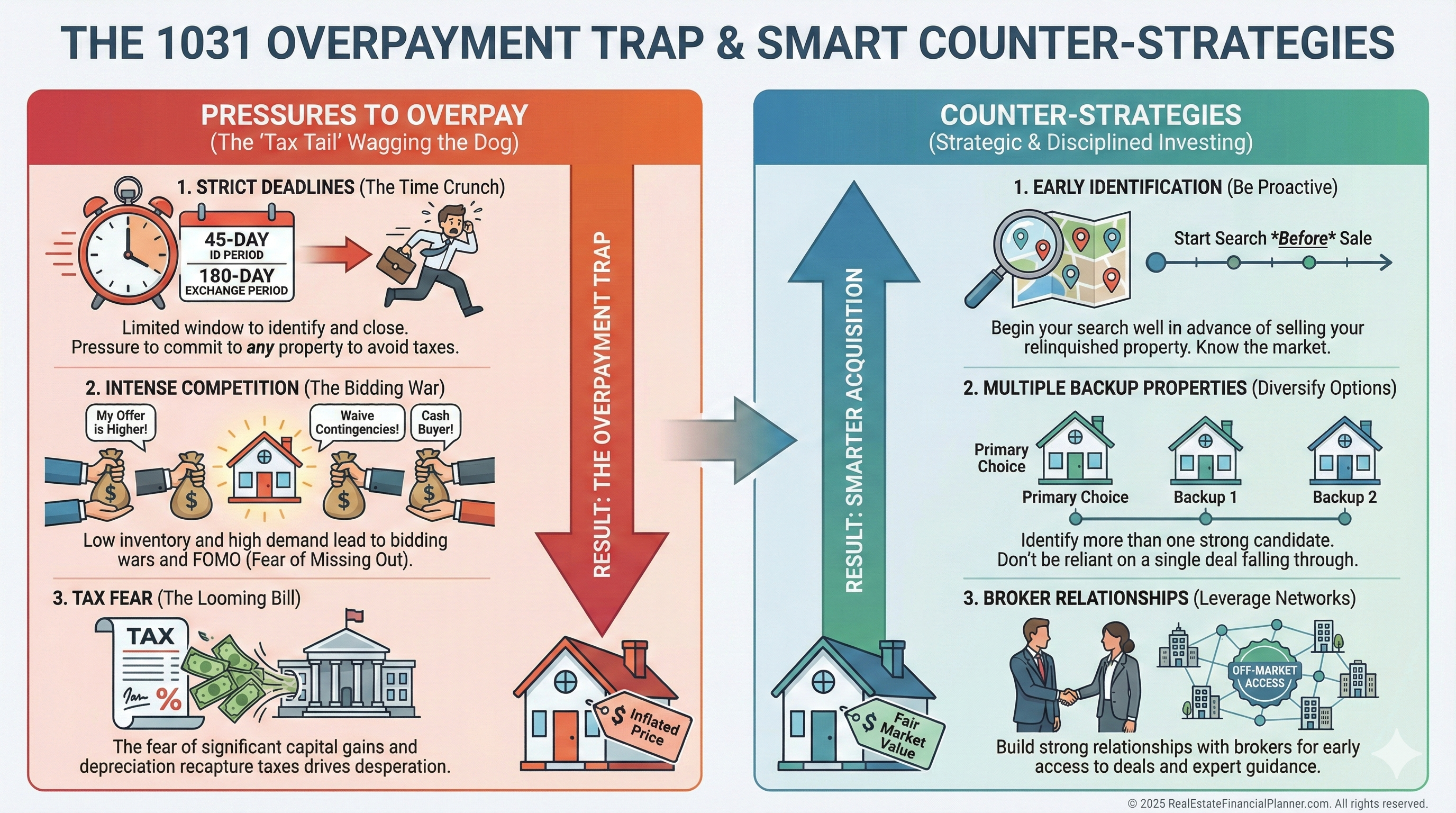

Market Dynamics: Why 1031 Buyers Often Overpay

This is uncomfortable but important.

When you’re facing a hard deadline and a five-figure tax penalty, you might accept a lower return just to complete the exchange.

Sellers know this.

Agents know this.

Investors who play the game well know this.

But here’s the solution:

Start Looking Early

The best exchangers begin searching for replacement properties months before selling.

Have Multiple Backup Properties

Don’t identify just one.

Identify three.

Or use the 200% rule strategically.

Build Broker Relationships

The best deals rarely hit the MLS.

When I help an investor with a 1031, I’m on the phone early with agents, property managers, wholesalers, and developers.

This prevents desperation.

And desperation is the biggest cost inside the exchange.

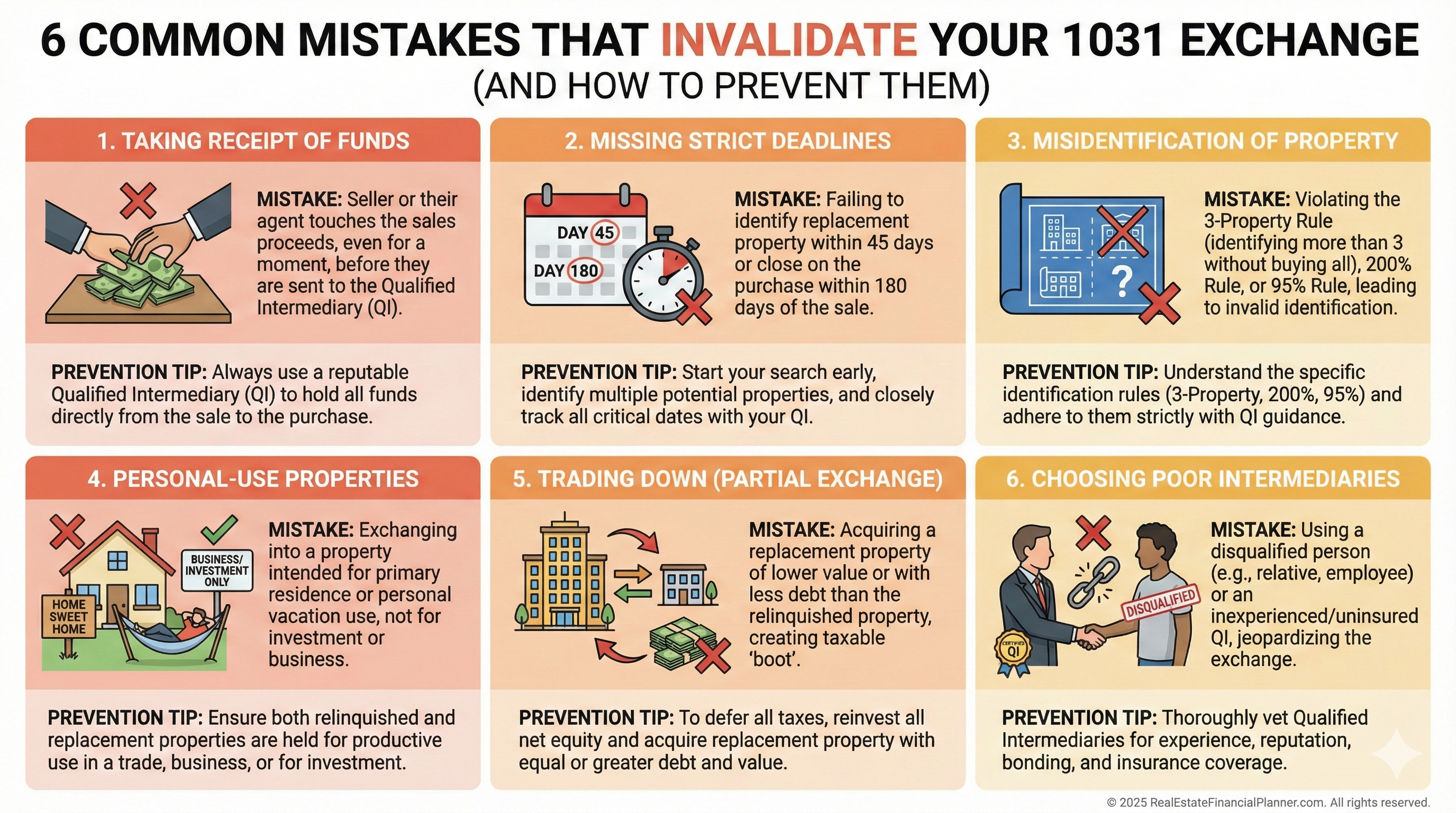

Common Mistakes That Destroy 1031 Exchanges

Even experienced investors lose exchanges because they underestimate how rigid the IRS rules are.

When I rebuilt my portfolio after bankruptcy, I became almost obsessive about avoiding unforced errors.

And with 1031 exchanges, the errors are always preventable.

These are the mistakes I warn clients about constantly.

Taking Receipt of Funds

This one ends the exchange instantly.

If the money touches your account—even for a few minutes—the IRS considers it constructive receipt.

Missing Deadlines

The two deadlines—forty-five days to identify, one hundred eighty days to close—are absolute.

No extensions.

No exceptions.

Not even for holidays or natural disasters.

You must operate with the assumption that the clock is already running.

Improper Identification of Properties

The IRS gives you three ways to identify replacements:

•

Up to three properties of any value

•

More than three properties, as long as their total value does not exceed two hundred percent of the sold property

•

The ninety-five percent rule (rarely used due to complexity)

If you deviate from these rules, the entire exchange collapses.

Buying Properties for Personal Use

Personal residences and vacation homes aren’t allowed unless they meet very strict rental-use criteria.

I’ve seen people try to get creative, and it never ends well.

Trading Down

If your replacement property is lower in value or has less debt than the one you sold, the IRS taxes the difference.

Sometimes “trading down” is strategic.

But most investors do it accidentally.

Choosing the Wrong Intermediary

All QIs are not created equal.

You want one with:

•

Segregated accounts

•

Fidelity bond coverage

•

Reputation in your market

•

Experience with your exchange type

I’ve seen “budget” intermediaries mishandle funds or go out of business mid‐exchange—turning a tax-deferral strategy into a tax disaster.

Strategic Uses for Growth, Diversification, and Retirement

A 1031 exchange isn’t just a tax tool.

It’s a strategic lever for shaping the entire direction of your portfolio.

Here are the most powerful ways I see investors use exchanges to build real, lasting wealth.

Geographic Diversification

When you own rental properties in a single market, you’re exposed to:

•

Local economic conditions

•

Local landlord laws

•

Local political shifts

•

Local appreciation cycles

I’ve helped investors exchange out of states with hostile landlord regulations into more stable, landlord-friendly markets.

For example:

Linda owned a duplex in coastal California worth $800,000 but generating modest cash flow.

She exchanged into a twelve-unit property in Texas.

Same price.

Triple the income.

Lower risk.

Better landlord protections.

This is the hidden power of geographic arbitrage.

Property Type Progression

Most investors move through a natural progression.

Single-Family → Multi-Family

You consolidate units, simplify management, and improve scalability.

Residential → Commercial

Commercial properties often offer longer leases, professional tenants, and triple-net structures that reduce your management load.

Active → Passive

As investors near retirement, they often exchange into properties with:

•

Long-term tenants

•

Minimal repairs

•

Predictable income

This is where Delaware Statutory Trusts (DSTs) come in. DSTs allow you to exchange into fractional ownership of large commercial assets—completely passive, professionally managed, and still eligible for 1031 treatment.

I’ve seen many investors use DSTs to replace the stress of hands-on management with mailbox money.

Exit Strategy Enhancement

1031 exchanges allow you to control when and how you eventually pay taxes.

Some advanced strategies include:

•

Consolidating scattered rentals into one high-quality asset

•

Using a 1031 to transition into an Opportunity Zone for future benefits

•

Deferring taxes until death, at which point heirs may receive a step-up in basis

I’m not advocating tax avoidance.

I’m pointing out that the IRS has written the rules—and smart investors operate within them.

Market Timing and Portfolio Rebalancing

Sophisticated investors use exchanges to reposition their portfolios ahead of market shifts.

Some examples:

•

Selling in overheated markets and buying in emerging ones

•

Exchanging into assets with assumable financing during high-rate environments

•

Swapping low-cash-flow properties for value-add opportunities

•

Exchanging out of C-class neighborhoods before tenant quality deteriorates

When you combine a 1031 exchange with long-term market pattern research, you’re no longer just avoiding taxes—you’re proactively shaping your future returns.

When NOT to Use a 1031 Exchange

This part surprises people.

Sometimes the best move is not doing a 1031 exchange at all.

You might choose a traditional sale if:

•

You have passive losses to offset gains

•

You’re in a low-income year with unusually low tax exposure

•

You need liquidity for a business, investment, or life event

•

You want to deleverage your portfolio

•

You plan to exit real estate investing entirely

A 1031 exchange is a tool, not a requirement.

The smartest investors run both scenarios—exchange vs. sell—inside their REFP plan.

If your Return on True Net Equity™ is extremely low on the replacement property, a 1031 exchange could actually lock you into a poor-performing asset.

This is why numbers come first.

Emotion comes last.

Integrating 1031 Exchanges Into Your Long-Term Plan

When I work with investors on their Real Estate Financial Plan™, the goal isn’t just linear growth—it’s strategic, resilient growth.

To integrate 1031 exchanges effectively, you want to:

•

Map your sell points years in advance

•

Identify target markets and asset classes ahead of time

•

Build broker and lender relationships before you need them

•

Maintain reserves that allow you to act quickly

•

Use Return Quadrants™ to compare long-term outcomes

•

Track True Net Equity™ annually to know when your capital is underperforming

A 1031 exchange becomes powerful when it’s not reactive.

It’s when you use it intentionally—like moving chess pieces, not playing checkers.

Conclusion: How 1031 Exchanges Accelerate Real Wealth

A 1031 exchange is more than a tax strategy.

It’s a structural advantage—one that compounds over decades and reshapes what’s possible for your financial life.

When you start using 1031 exchanges strategically, something shifts.

You begin building wealth with untaxed dollars.

Your buying power expands.

Your loan options improve.

Your Return Quadrants™ accelerate.

Your True Net Equity™ stays intact and productive.

Your timeline to financial independence shortens.

Most investors never realize how much money they quietly surrender to the IRS.

Not because they did anything wrong, but because no one ever walked them through the math.

When I rebuilt after bankruptcy, I didn’t have the luxury of ignoring these details.

Every dollar mattered.

And exchanges became one of the tools that helped me compress the time between “starting over” and “financially independent.”

I’ve seen exchanges turn modest portfolios into meaningful ones.

I’ve seen them rescue investors from markets that stopped working.

And I’ve seen them simplify the transition into retirement, replacing stress with predictable income.

Now it’s your turn to run the numbers—and decide whether this accelerant belongs in your strategy.

Action Steps to Implement a 1031 Exchange Successfully

One: Calculate Your True Net Equity™

Before you consider selling, you need to know your real equity after accounting for taxes and closing costs.

Two: Model Two Scenarios in Your REFP Plan

Compare your outcomes with and without a 1031 exchange.

Look at:

•

Cash flow

•

Net worth

•

True Net Equity™

•

Return on Equity

•

Return on True Net Equity™

•

Time to financial independence

Seeing both paths side by side is what reveals the truth.

Three: Interview Qualified Intermediaries Early

Before you list your property, vet your QI.

A good one prevents the mistakes that destroy exchanges.

Four: Identify Replacement Markets Ahead of Time

Don’t wait until the forty-five-day window starts.

Have candidates ready.

Five: Strengthen Lender Relationships

Better terms = better returns.

Simple as that.

Six: Treat This Like a Long-Term Strategy

The real magic of 1031 exchanges appears over five, ten, fifteen years.

Think in decades, not months.

The Real Difference Between Investors Who Build Wealth and Those Who Don’t

It’s not intelligence.

It’s not timing.

It’s not luck.

It’s clarity.

You now understand the mechanics of 1031 exchanges.

You understand the traps.

You understand how they reshape your returns.

You understand how they integrate with your Real Estate Financial Plan™.

You understand why the best investors use them relentlessly and intentionally.

Most people never get this level of insight.

But you do.

And now you can act on it.