Accelerated Depreciation: How Real Estate Investors Unlock Massive Tax Savings Early

Accelerated depreciation lets real estate investors front-load tax deductions and boost cash flow fast. Avoid costly mistakes and model the impact before you buy.

When I help clients analyze deals, accelerated depreciation is one of the most commonly missed advantages.

Even experienced investors focus on rent, appreciation, and financing, while quietly overpaying taxes year after year and accepting lower cash flow.

I made the same mistake early on.

When I was rebuilding after bankruptcy, cash flow mattered more than anything. What changed my trajectory wasn’t buying “better” properties. It was learning how to keep more of what those properties already produced.

Accelerated depreciation is one of the cleanest ways to do that.

It does not increase risk.

It does not require leverage.

It simply changes when you take deductions you are already entitled to.

That timing difference is everything.

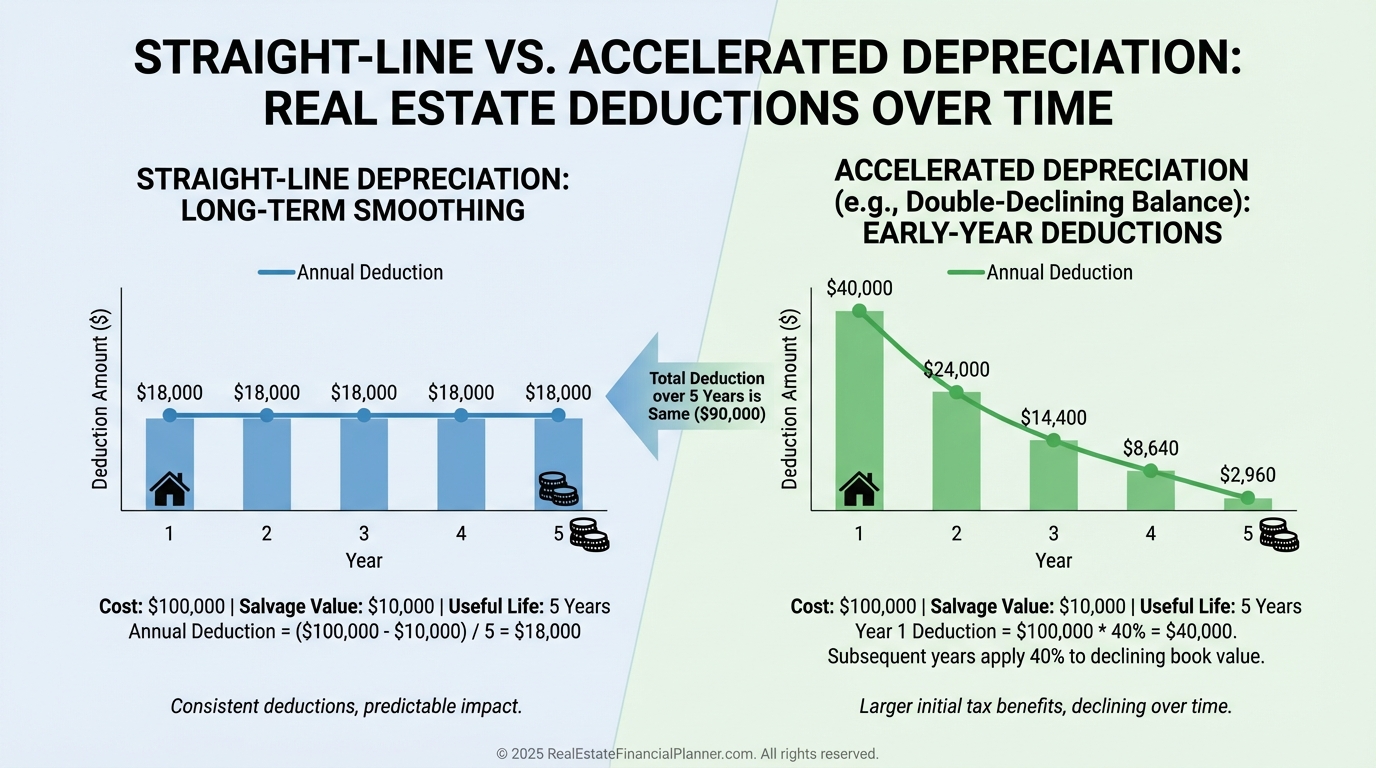

The Baseline: How Normal Depreciation Actually Works

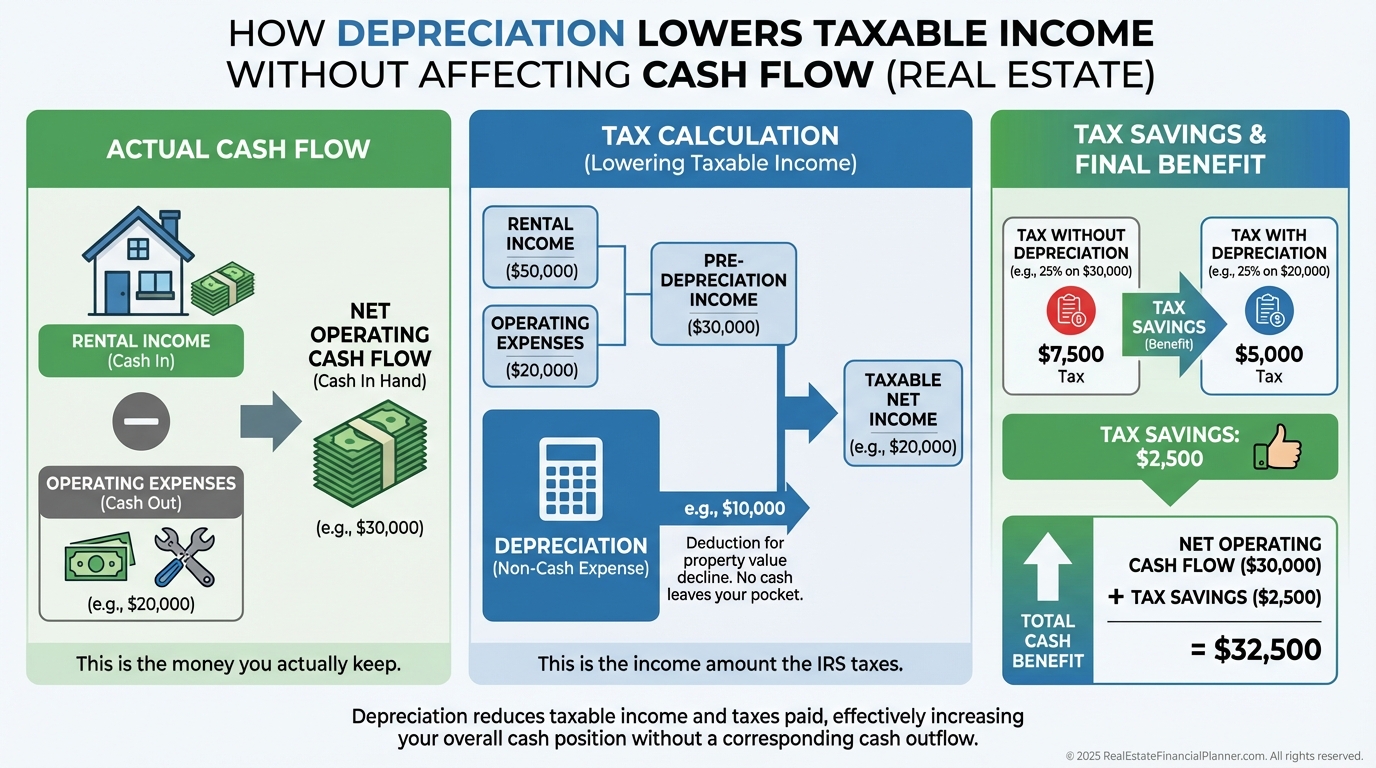

Depreciation is a non-cash expense that reduces taxable income.

For residential rentals, the IRS spreads depreciation over 27.5 years.

For commercial property, it is 39 years.

If you buy a residential rental with $275,000 allocated to the building, you deduct about $10,000 per year.

That deduction reduces taxable income whether or not your property cash flows.

When I model deals in Real Estate Financial Planner™, this deduction often turns a “break-even” property into one that quietly produces real spendable income after taxes.

But standard depreciation is only the starting point.

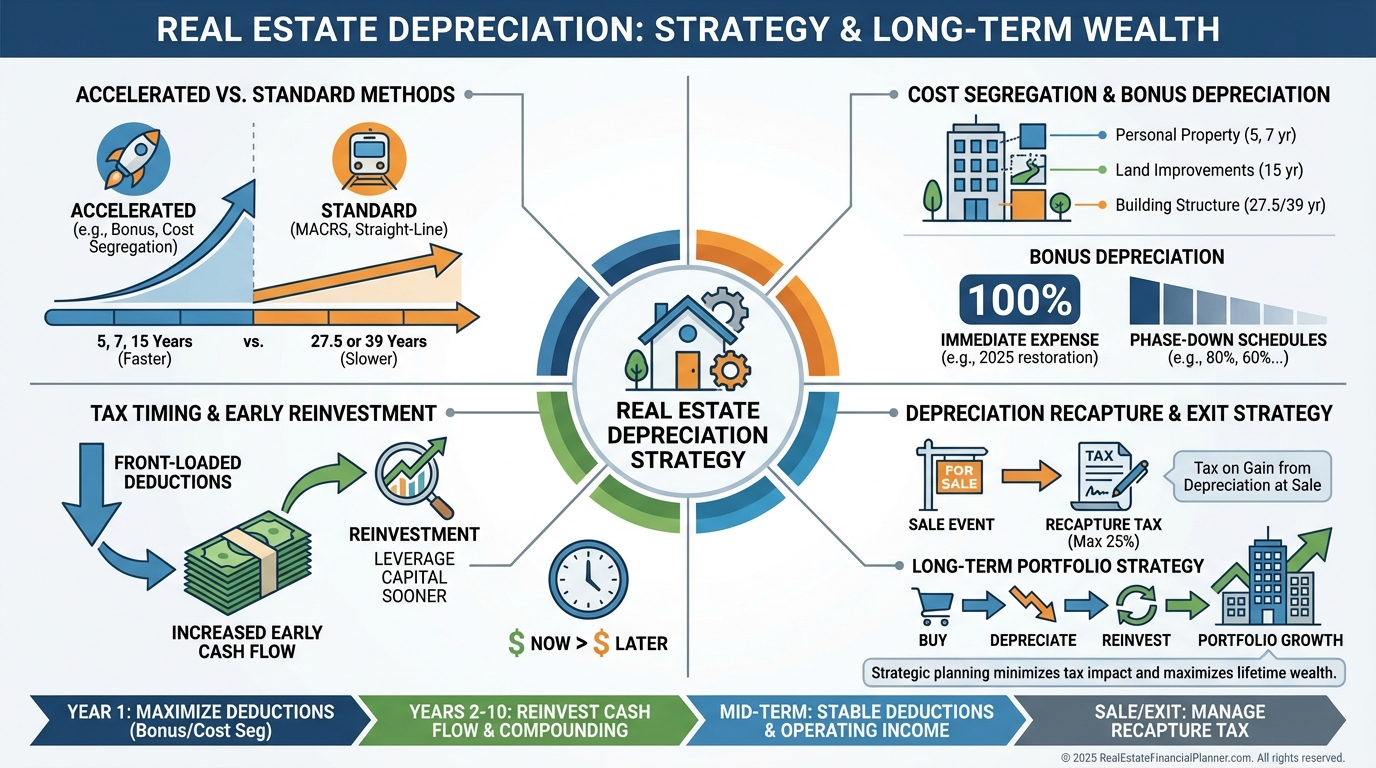

What Accelerated Depreciation Actually Does

Accelerated depreciation front-loads deductions you would have taken anyway.

Instead of spreading deductions evenly over decades, you take a large portion in the early years.

Nothing magical happens to the building.

Only the accounting changes.

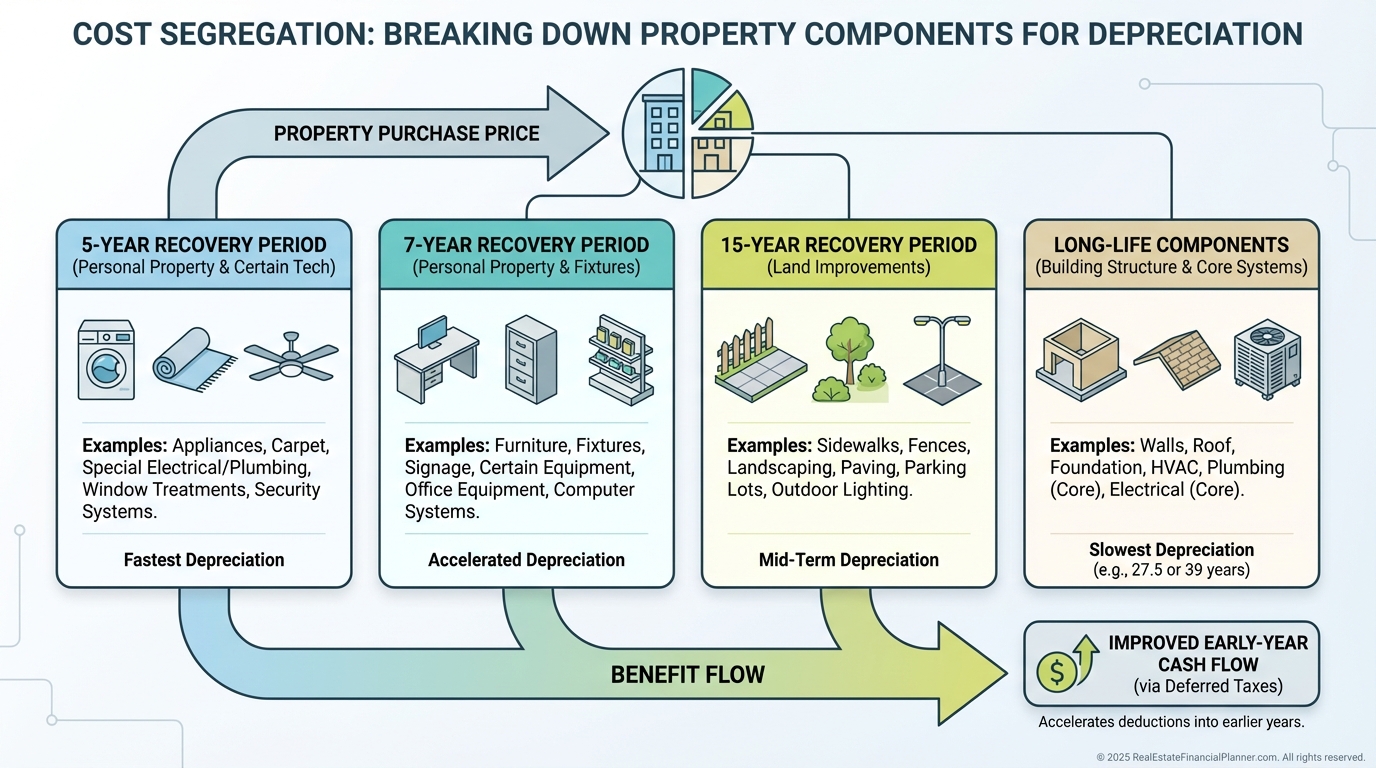

The primary tool is a cost segregation study.

This engineering-based analysis breaks the property into components with shorter depreciation lives, typically five, seven, or fifteen years.

When I review cost segregation reports for clients, I’m not asking, “How big is the deduction?”

I’m asking, “How does this change cash flow, reinvestment speed, and risk exposure?”

Bonus Depreciation: The Turbocharger

Bonus depreciation accelerates things even further.

For qualifying components identified through cost segregation, you can deduct a large portion of depreciation immediately in the year the property is placed in service.

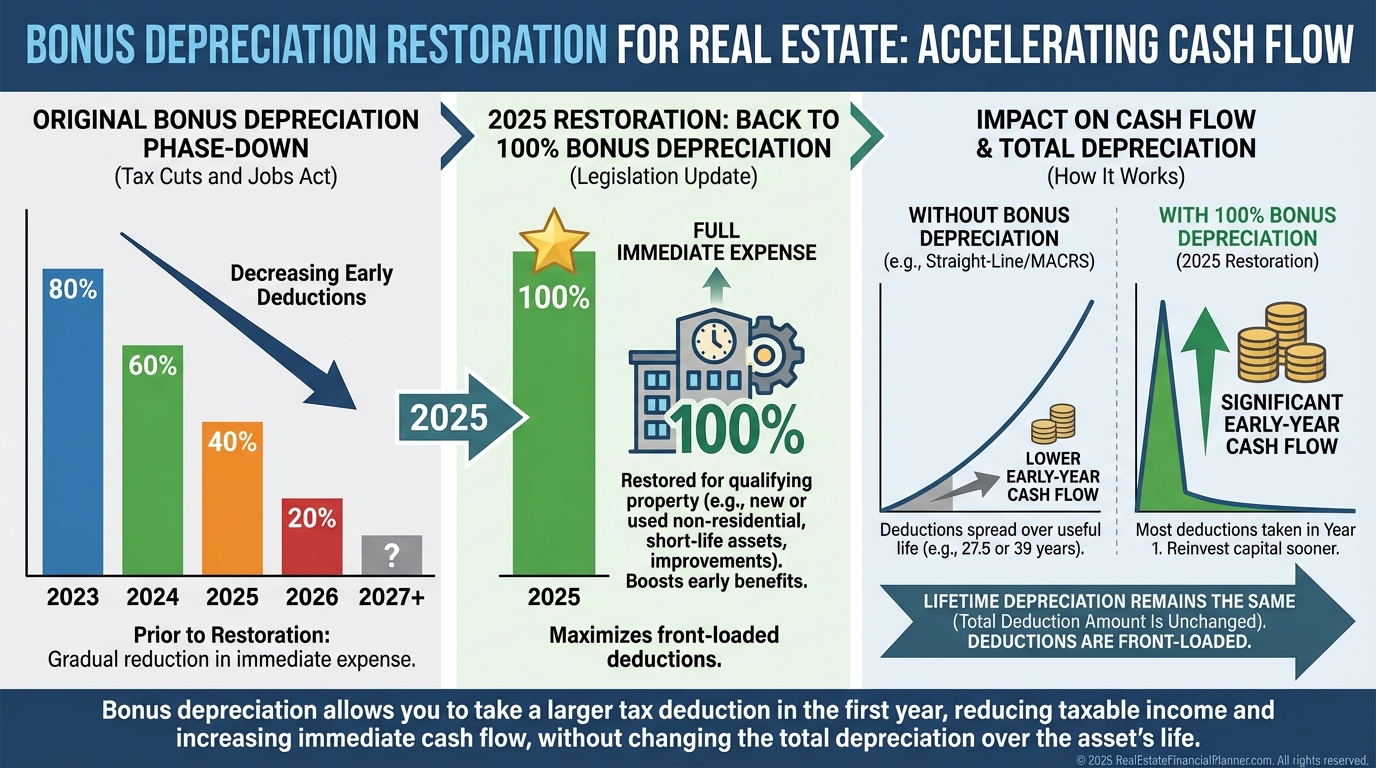

Originally, bonus depreciation was scheduled to phase down starting in 2023, which led many investors to assume its usefulness was fading.

That assumption is now outdated.

Beginning in 2025, bonus depreciation was restored to one hundred percent for qualifying property, dramatically extending its relevance for real estate investors who plan properly.

When I run scenarios for clients, I never treat bonus depreciation as “extra” savings.

I treat it as a timing lever.

You are not creating new deductions.

You are pulling future deductions into the present.

That shift matters because early tax savings can be reinvested, used to build reserves, or deployed to reduce portfolio risk during the most fragile years of ownership.

Used intelligently, bonus depreciation improves early cash flow without changing the long-term economics of the deal.

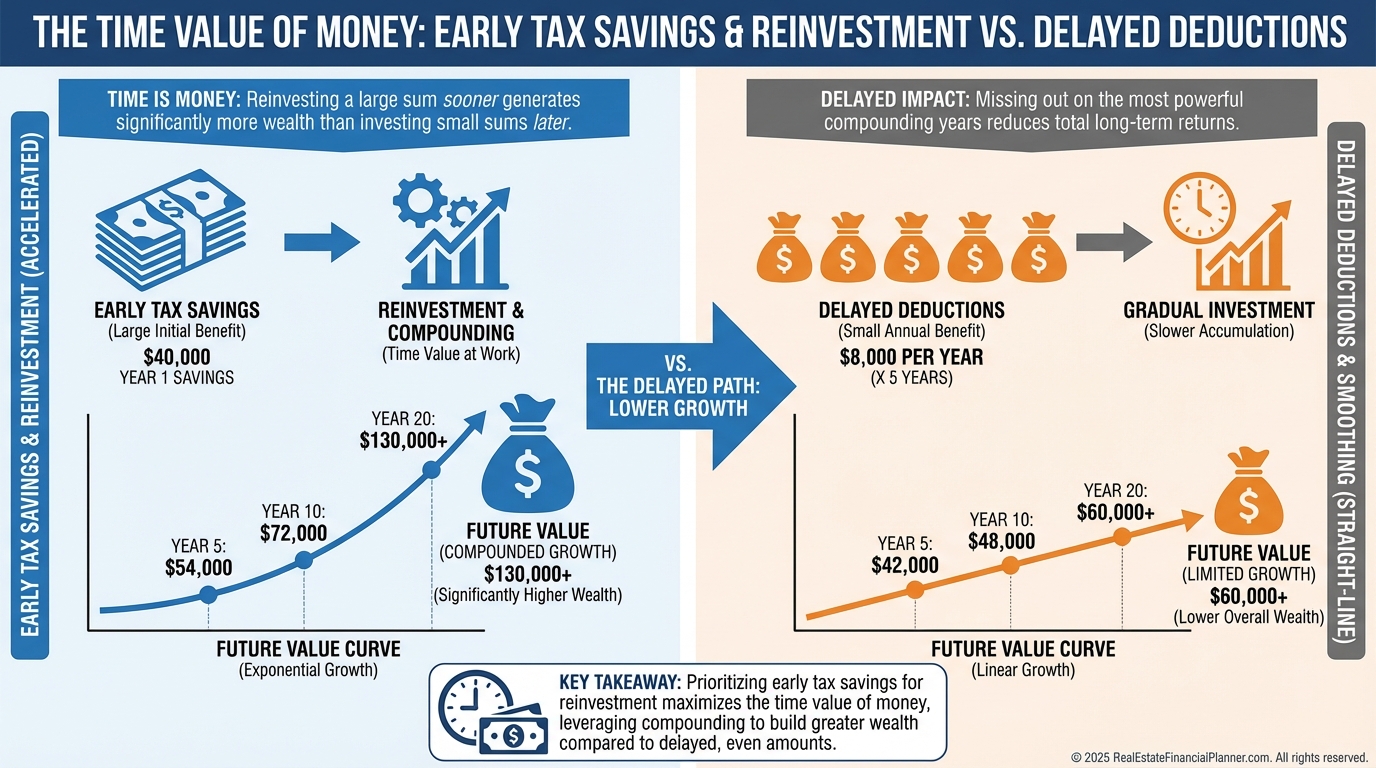

Why Timing Beats Total Amount

This is where many investors misunderstand the strategy.

Accelerated depreciation does not increase total depreciation.

It changes when you get it.

That difference matters because money saved today can be reinvested.

When I analyze this using Return on Equity Quadrant™ thinking, early tax savings increase the effective return on your True Net Equity™.

That capital can fund reserves, reduce risk, or buy your next property sooner.

Spreading deductions evenly looks conservative.

Front-loading them is often safer. Cash-in-hand now is more valuable than cash-in-hand later.

What I Check Before Recommending Cost Segregation

I do not recommend accelerated depreciation blindly.

Here is what I check when reviewing a property or portfolio:

•

Property Characteristics - Newer properties, renovations, and heavy site improvements benefit the most.

•

Holding Period - If you expect to sell quickly without a 1031 exchange, recapture matters more.

•

Income Profile - Real estate professional status changes everything.

•

Reinvestment Plan - Tax savings without a plan often get wasted.

This is why I model scenarios before purchase, not after.

The World’s Greatest Real Estate Deal Analysis Spreadsheet™ lets you see how accelerated depreciation affects cash flow, IRR, and long-term equity outcomes before you commit.

Depreciation Recapture Is Not the Villain

Recapture scares investors who focus on taxes in isolation.

I view it as deferred taxation, not a penalty.

You are effectively receiving an interest-free loan from the IRS.

Many investors defer recapture indefinitely through 1031 exchanges.

Others accept it gladly because the reinvested capital produced returns far exceeding the future tax bill.

This is a planning issue, not a problem.

How Accelerated Depreciation Fits Long-Term Strategy

Accelerated depreciation pairs well with long-term buy-and-hold strategies like Nomad™ and portfolio scaling.

•

It increases early resilience.

•

It strengthens reserves.

•

It lowers stress during the fragile early years of ownership.

When investors ignore it, they often compensate by taking on more leverage instead.

That is backwards.

Final Thoughts and Next Steps

Accelerated depreciation is not a loophole.

It is a deliberate, IRS-sanctioned timing strategy.

Used well, it increases cash flow, accelerates reinvestment, and improves portfolio durability.

If you already own property, review it.

If you are buying your next one, model it first.

The biggest mistake I see is learning about accelerated depreciation after closing.