The Hidden Math of Amortization That Builds (or Destroys) Your Real Estate Wealth

Amortization quietly shapes your equity growth and long-term returns. Learn how smart investors analyze amortization to make better financing decisions.

Amortization looks simple on paper, but most investors misunderstand how it actually affects their wealth.

When I rebuilt my portfolio after bankruptcy, I realized that amortization was one of the few forces working for me every single month, whether markets went up, down, or sideways. That insight changed how I evaluate every property, every refinance, and every return calculation.

When you understand amortization, you stop making decisions based only on monthly payment amounts. You begin evaluating how each financing choice affects long-term equity growth, True Net Equity™, and Return in Dollars Quadrant™ outcomes.

And once you see the full picture, your investment decisions get dramatically better.

What Amortization Really Does for You

It is one of the most reliable wealth-building engines available to real estate investors.

But here’s the part most investors miss: amortization isn’t linear. In the first few years, almost the entire payment is interest. Principal paydown barely moves. It takes time for amortization to accelerate into something meaningful.

When I walk investors through The World’s Greatest Real Estate Deal Analysis Spreadsheet™, the amortization table is usually the first place their eyes widen. They see how small principal is in the early years, and how quickly it accelerates later.

Understanding this curve is essential because it shapes your true returns.

Why Investors Misjudge Amortization

Many investors confuse amortization with other concepts. That confusion often leads to mistakes that cost tens of thousands over the life of a single loan.

Amortization builds equity. Depreciation reduces taxable income. Interest-only loans improve cash flow but create no equity through paydown. Partially amortizing loans introduce balloon risks.

When clients bring me deals, one of the first things I calculate is how amortization impacts their Return in Dollars Quadrant™. Most are shocked when they see that principal reduction often contributes twenty to forty percent of their total return.

If you track only cash flow, you’re missing a huge portion of the wealth your properties are generating.

How Amortization Is Calculated (and Why It Matters)

You don’t need to be a mathematician to understand amortization, but you do need to appreciate the mechanics.

When I help clients model a purchase or analyze whether to refinance, I always run their amortization schedule—often for multiple scenarios. This is especially important when evaluating whether a refinance actually improves wealth or simply resets the amortization clock in a destructive way.

The standard amortization formula determines your monthly payment, but it also quietly determines how much equity you’ll build over time.

And here’s the part most lenders never highlight: resetting your amortization schedule after five, seven, or ten years wipes out years of progress. In many cases, the “smaller payment” ends up costing far more in the long run.

This is one of the reasons I always evaluate refinancing through the lens of True Net Equity™ and opportunity cost. A lower payment does not automatically mean a better outcome.

How Amortization Improves Your Financing Position

Every month that amortization reduces your balance, your True Net Equity™ increases, your debt-to-income (DTI) ratio improves, and your loan-to-value (LTV) gets stronger.

This matters when you apply for new loans, especially portfolio loans.

When I help clients structure a multi-property Nomad™ plan, amortization is a key part of the strategy. Over five to ten years, amortization alone often creates enough equity for down payments on additional properties—without needing aggressive appreciation or big cash flow.

This is one of the reasons amortization should be tracked monthly, not yearly.

Common Amortization Mistakes That Hurt Investors

After teaching hundreds of real estate investing classes, I see a consistent pattern of amortization mistakes that quietly erode returns.

Many investors:

•

Count only cash flow and ignore principal reduction.

•

Refinance too often.

•

Choose loan terms that don’t match their hold period.

•

Misunderstand how early extra payments change the loan’s trajectory.

•

Optimize for payment size instead of long-term wealth.

If you are not actively evaluating amortization in your portfolio, you’re likely leaving money on the table.

Seeing these mistakes visually often helps investors finally understand the stakes.

Turning Amortization Into a Strategic Advantage

Amortization becomes most powerful when you use it deliberately.

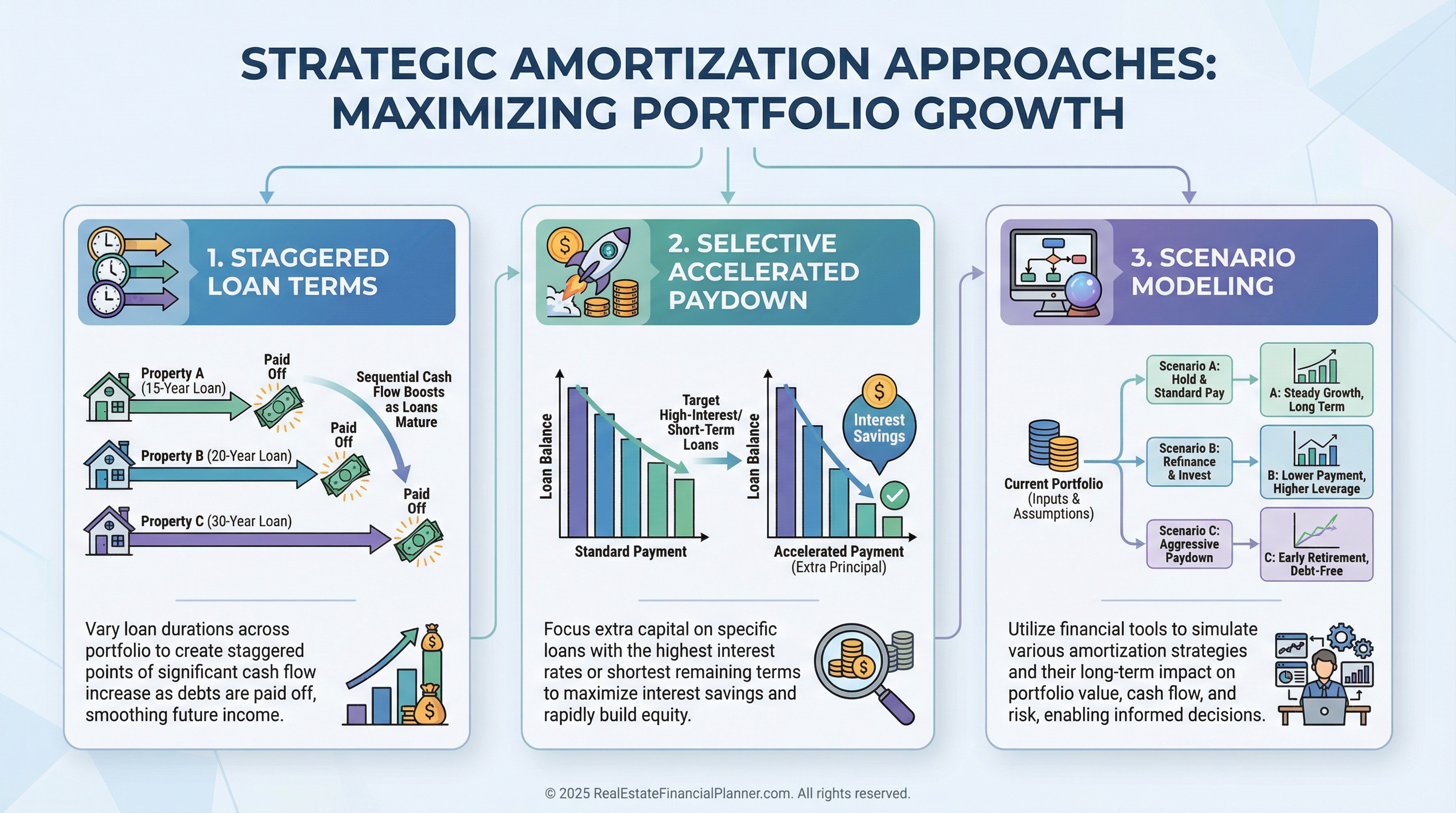

One strategy I often help investors model is staggered loan terms across a portfolio. Shorter terms on high-appreciation properties. Longer terms on cash-flow properties. Combined, those choices create steady equity “events” that fund future purchases.

Another strategy is evaluating extra payments through the lens of opportunity cost. An extra $100 in year one can shave years off a loan. But if that same $100 earns a high return elsewhere, the optimal choice changes.

Real estate investing is a game of tradeoffs, and amortization gives you levers to pull.

Once you start modeling amortization across multiple properties, you begin to see how powerful it really is.

Make Amortization a Monthly Wealth-Building Habit

If you want amortization to work harder for you, start with a simple step this week.

Open your amortization schedule—or generate one using the REFP tools—and calculate:

•

How much principal your properties will pay down this year.

•

How that number changes if you add small extra payments.

•

How a refinance would alter your amortization trajectory.

•

How your Return in Dollars Quadrant™ shifts when you include principal reduction.

Those numbers will show you where your wealth is growing and where it’s slowing.

And once you see the full picture, your decision-making as an investor becomes significantly more strategic.