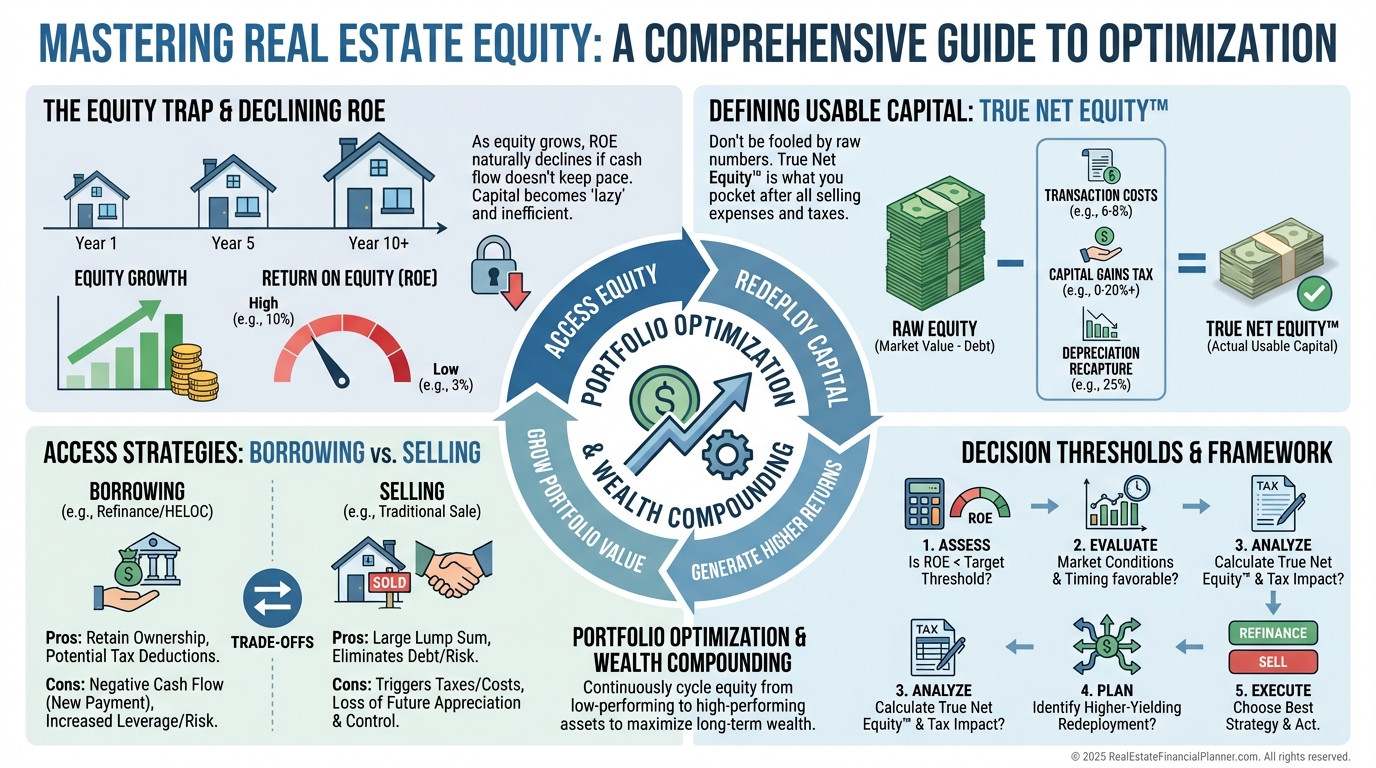

Accessing Equity Without Killing Your Returns: How Smart Investors Redeploy Trapped Capital

Accessing equity the wrong way quietly destroys returns. Learn how to unlock equity strategically using True Net Equity™ and avoid common investor mistakes.

Most investors misunderstand accessing equity. This guide shows how to redeploy trapped capital, protect returns, and make data-driven decisions with confidence.

When I help investors review their portfolios, the same pattern shows up again and again.

Their net worth looks fantastic.

Their return on equity quietly keeps falling.

That disconnect confuses people.

It feels wrong that a “successful” property can slowly become a mediocre performer.

I learned this lesson the hard way rebuilding after bankruptcy.

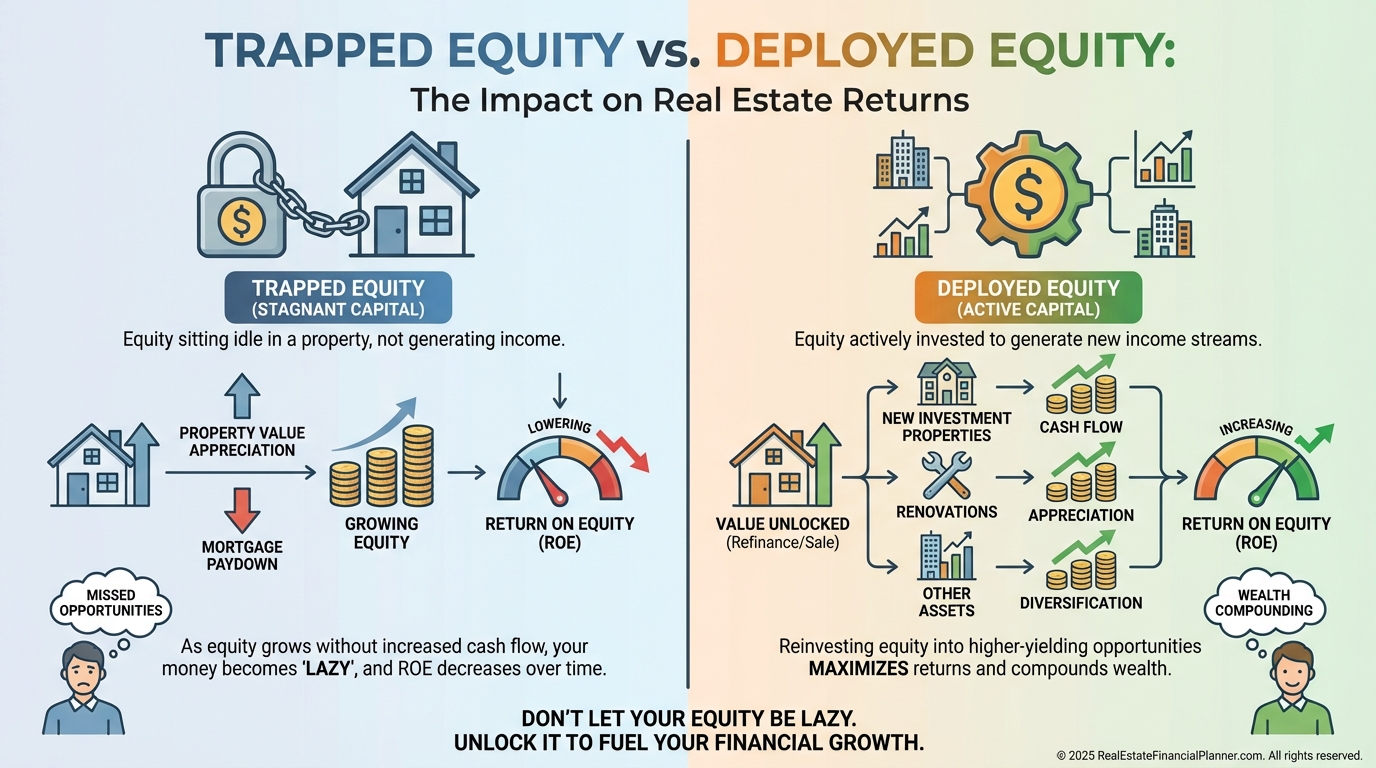

Equity feels safe, but idle equity has a cost.

Accessing equity is not about pulling cash for lifestyle upgrades.

It is about redeploying capital so your portfolio keeps working as hard as you do.

What Equity Really Is (And What It Is Not)

Equity is simply the gap between what your property is worth and what you owe.

If a property is worth $500,000 and the loan balance is $300,000, you have $200,000 in equity.

That number looks clean.

It is also misleading.

Equity grows through several channels working at the same time.

•

Property Appreciation grows your value as the market rises.

•

Debt Paydown increases equity with every principal payment.

•

Forced Appreciation comes from raising rents or improving the property.

•

Market Dynamics amplify gains in growing areas and crush them in declining ones.

Here is the key mistake.

Equity on paper is not the same as usable equity.

Until you borrow against it or sell, equity produces no new opportunities.

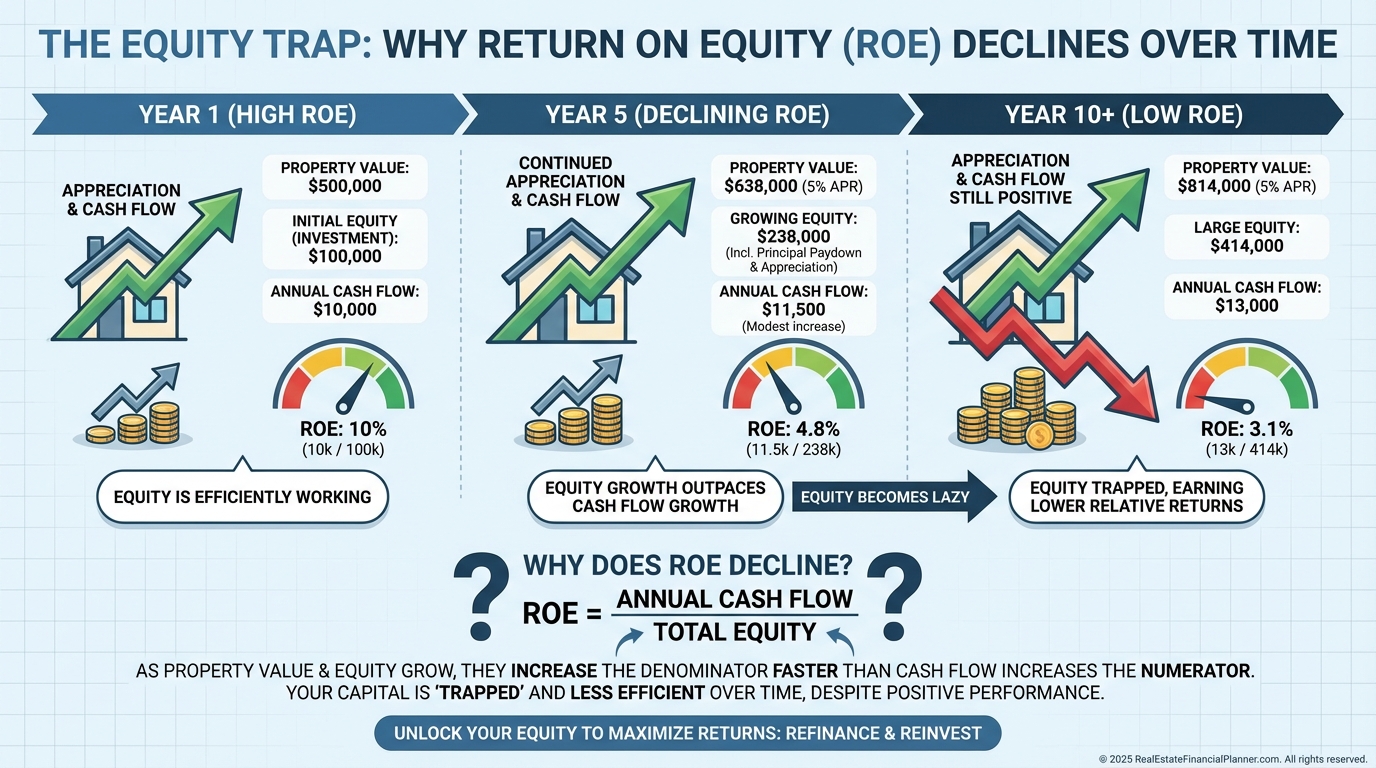

Why Return On Equity Always Declines

Every investor eventually runs into this math problem.

As equity grows, returns get diluted.

This is not a strategy failure.

It is arithmetic.

I model this constantly inside the Return Quadrants™ because it changes behavior fast.

•

Appreciation Returns Shrink as equity rises, even if prices keep climbing.

•

Cash Flow Returns Flatten as growing equity absorbs the same income.

•

Debt Paydown Returns Decline until they disappear entirely once the loan is gone.

•

Cash Flow from Depreciation™ stays fixed in dollars but drops as a percentage every year.

Left alone long enough, every rental drifts toward raw, unleveraged appreciation plus cap-rate-only performance.

Why Raw Equity Lies To You

This is where most investors make expensive decisions.

They plan using raw equity.

They execute using real dollars.

That gap matters.

When I analyze deals, I never use raw equity for decisions.

I use True Net Equity™.

True Net Equity™ subtracts the costs required to actually access your capital.

•

Selling Costs like commissions and closing fees.

•

Capital Gains Taxes at federal and state levels.

•

Depreciation Recapture that surprises first-time sellers.

•

Refinance Costs that reduce usable proceeds.

A property showing $300,000 of equity might only deliver $215,000 you can actually deploy.

That difference changes every return calculation.

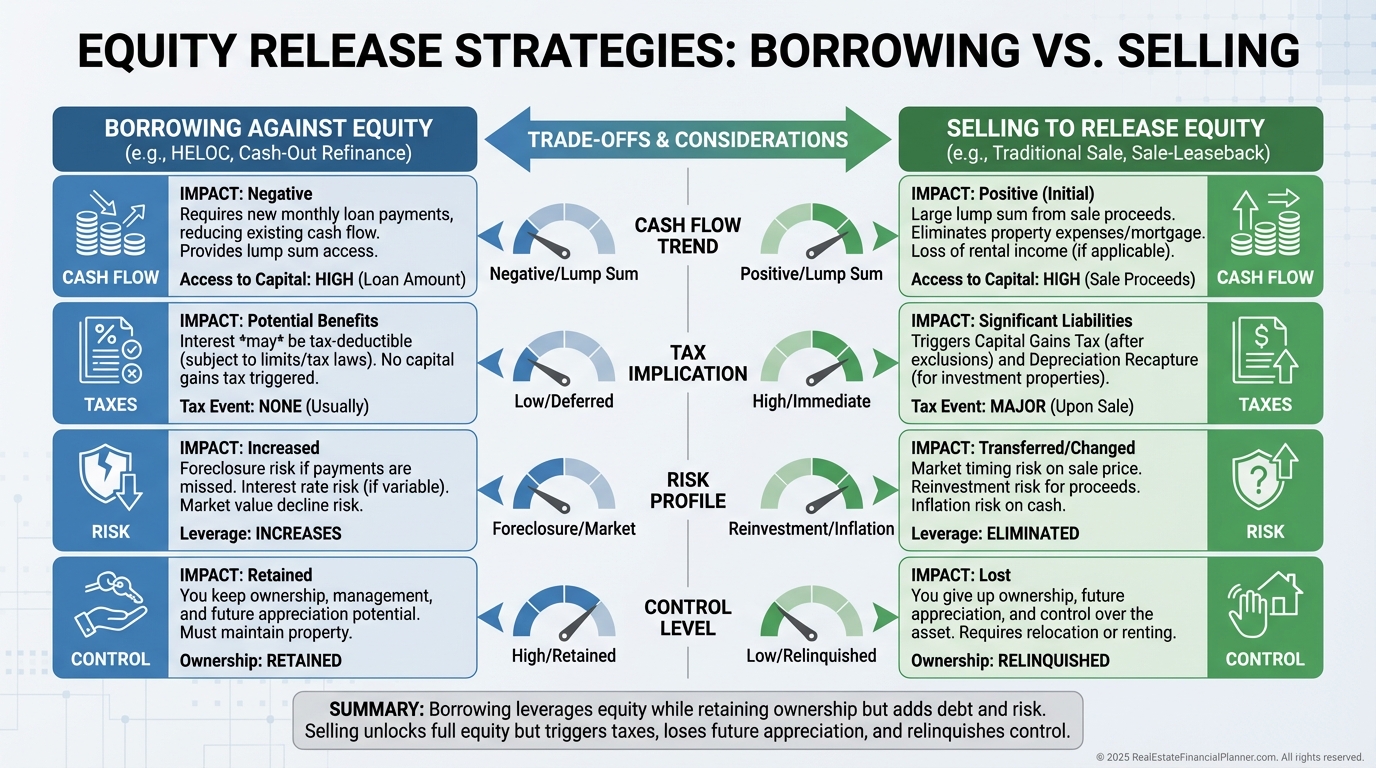

The Two Ways To Access Equity

There are only two real paths.

Borrow or sell.

Everything else is a variation.

Borrowing Against Equity

Borrowing lets you keep the property and its future upside.

•

Cash-Out Refinance maximizes capital but resets amortization.

•

HELOCs provide flexibility but add rate risk.

•

Home Equity Loans give certainty with less flexibility.

•

Private Money often trades speed and looser requirements for higher cost and shorter terms.

When I run refinance scenarios, I model the new Return On True Net Equity™, not just the payment.

If returns drop after the refi, it is not a win.

Selling To Release Equity

Selling converts equity into freedom.

Traditional Sales maximize liquidity.

1031 Exchanges preserve capital by deferring taxes.

Partial Sales or Partnerships rebalance without full exit.

Seller Financing creates income while deferring taxes.

Selling is not failure.

Holding forever is not always discipline.

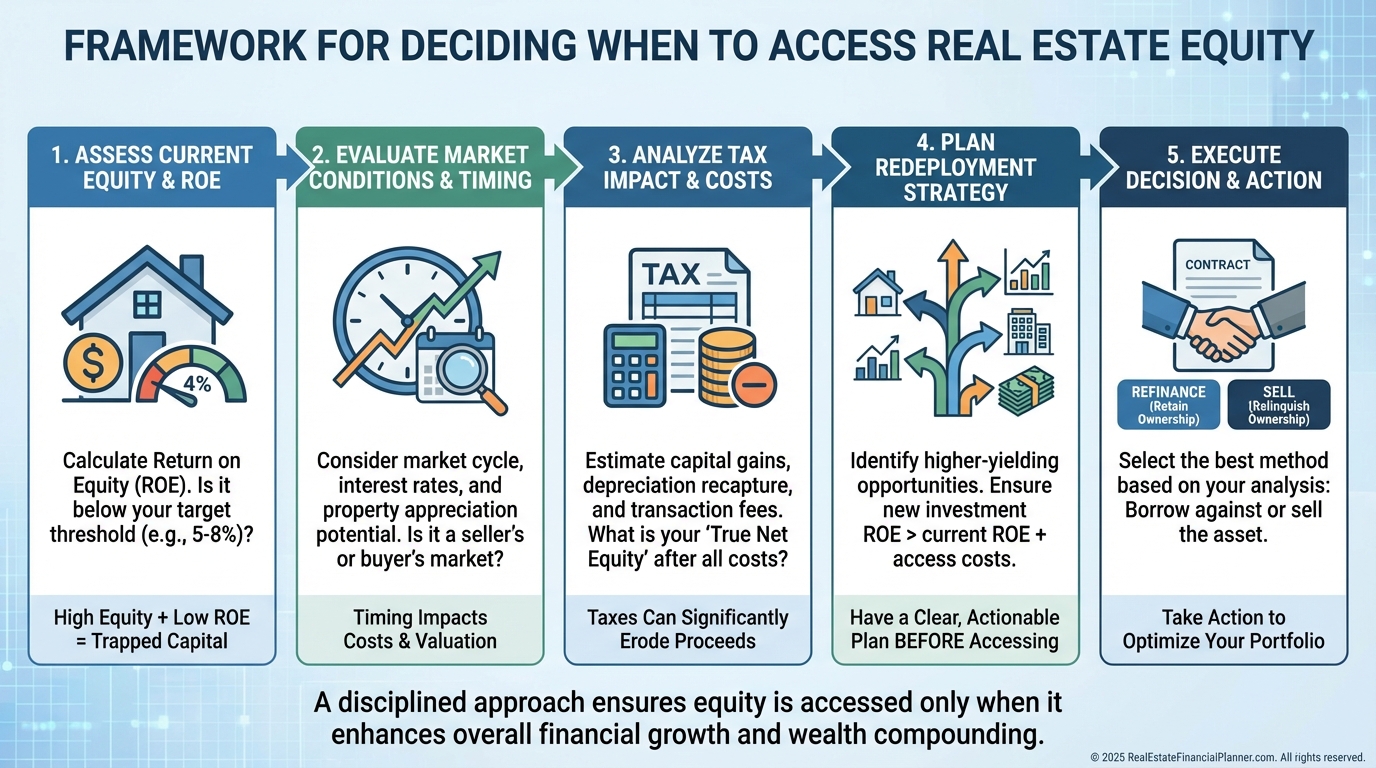

How I Decide When To Access Equity

I avoid gut decisions.

So do my clients.

We set thresholds.

When Return On True Net Equity™ drops below target, we evaluate options.

No emotion required.

Other factors always matter.

•

Interest Rate Environment affects timing and structure.

•

Portfolio Phase determines growth versus stability priorities.

•

Tax Position changes the real cost of each option.

•

Replacement Opportunities must exist before pulling capital.

Accessing equity without a redeployment plan is gambling.

What This Looks Like In Practice

I have seen equity used well and used badly.

The difference is modeling.

One investor refinances and buys two properties that restore portfolio returns.

Another pulls cash and watches leverage climb with no upside.

The math does not care which story you prefer.

That is why I built The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

It forces reality into the conversation early.

Final Thought

Trapped equity feels safe.

It is not neutral.

It is opportunity cost wearing a smile.

Accessing equity intelligently keeps your portfolio aligned with your goals, your risk tolerance, and your timeline.

If you are not measuring Return On True Net Equity™, you are guessing.

And guessing gets expensive over decades.