Probability and Statistics

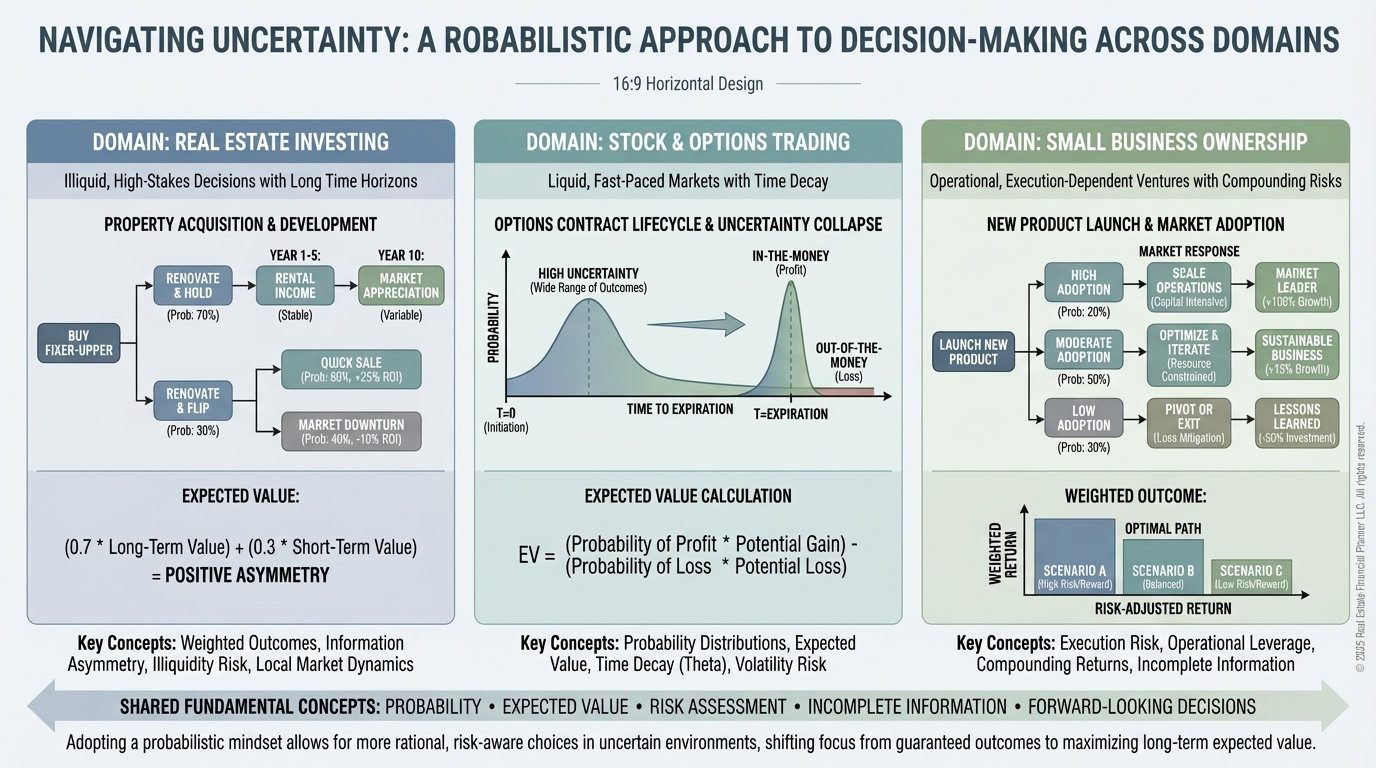

Learn how probability and statistics apply to real estate investing, stock and options trading, and small business ownership—so you can make clearer, smarter decisions with less risk and better long-term results.

Probability and Statistics: Making Better Decisions Under Uncertainty

Most important decisions in investing and business are made without complete information.

You never know exactly what will happen next.

You only know what’s likely.

This section focuses on probability and statistics as decision-making tools, not academic subjects. The goal isn’t to turn you into a mathematician. It’s to help you think more clearly about risk, uncertainty, and expected outcomes so you can make fewer avoidable mistakes over time.

What This Section Covers

The content in this section explores ideas like:

•

Probability and likelihood

•

Expected value

•

Risk versus uncertainty

•

Incomplete information

•

Why “splitting the difference” often misprices reality

These concepts show up repeatedly in real-world decisions, even when people don’t recognize them by name.

Who This Is For

•

Real Estate Investors - You’ll see how probability affects deal analysis, negotiations, partnerships, renovations, exits, and timing decisions—especially when deals don’t go exactly as planned.

•

Stock and Options Traders - You’ll learn how probability and expected value apply to trade management decisions such as holding, closing, rolling, or accepting outcomes as uncertainty collapses over time.

•

Small Business Owners - You’ll explore how probabilistic thinking improves decisions around partnerships, buyouts, growth phases, and situations where past effort and future outcomes don’t align.

You’ll explore how probabilistic thinking improves decisions around partnerships, buyouts, growth phases, and situations where past effort and future outcomes don’t align.

How to Use This Section

You don’t need to read everything in order.

Each module stands on its own, but together they build a more accurate way to think about decisions made under uncertainty. Over time, that perspective compounds into better judgment, calmer choices, and more consistent results.

This section is about thinking clearly when the outcome isn’t guaranteed—because that’s where most real decisions actually live.

Contents

Probability Theory for Smarter Real Estate Investing

An overview of probability theory as a practical decision-making framework for real estate investors, stock and options traders, and small business owners who operate under uncertainty.

Problem Of Points: Real Estate Deal Split Guide

Learn about the Problem of Points, a foundational idea from probability theory that shows why “splitting the difference” is often unfair. You’ll see how this concept leads directly to expected value, risk pricing, and forward-looking decision-making.

Blaise Pascal's Probability Guide to Real Estate Investing

An introduction to Blaise Pascal and his foundational role in probability theory, expected value, and decision-making under uncertainty that still shapes investing and business decisions today.

Occam's Razor

An introduction to Occam’s Razor as a decision-making principle for investors and business owners who must choose between competing explanations under uncertainty.

Pierre De Fermat's Math for Real Estate Investing

An introduction to Pierre de Fermat and his foundational role in probability theory and structured reasoning that underlies modern investing, trading, and business decision-making.