Occam's Razor

An introduction to Occam’s Razor as a decision-making principle for investors and business owners who must choose between competing explanations under uncertainty.

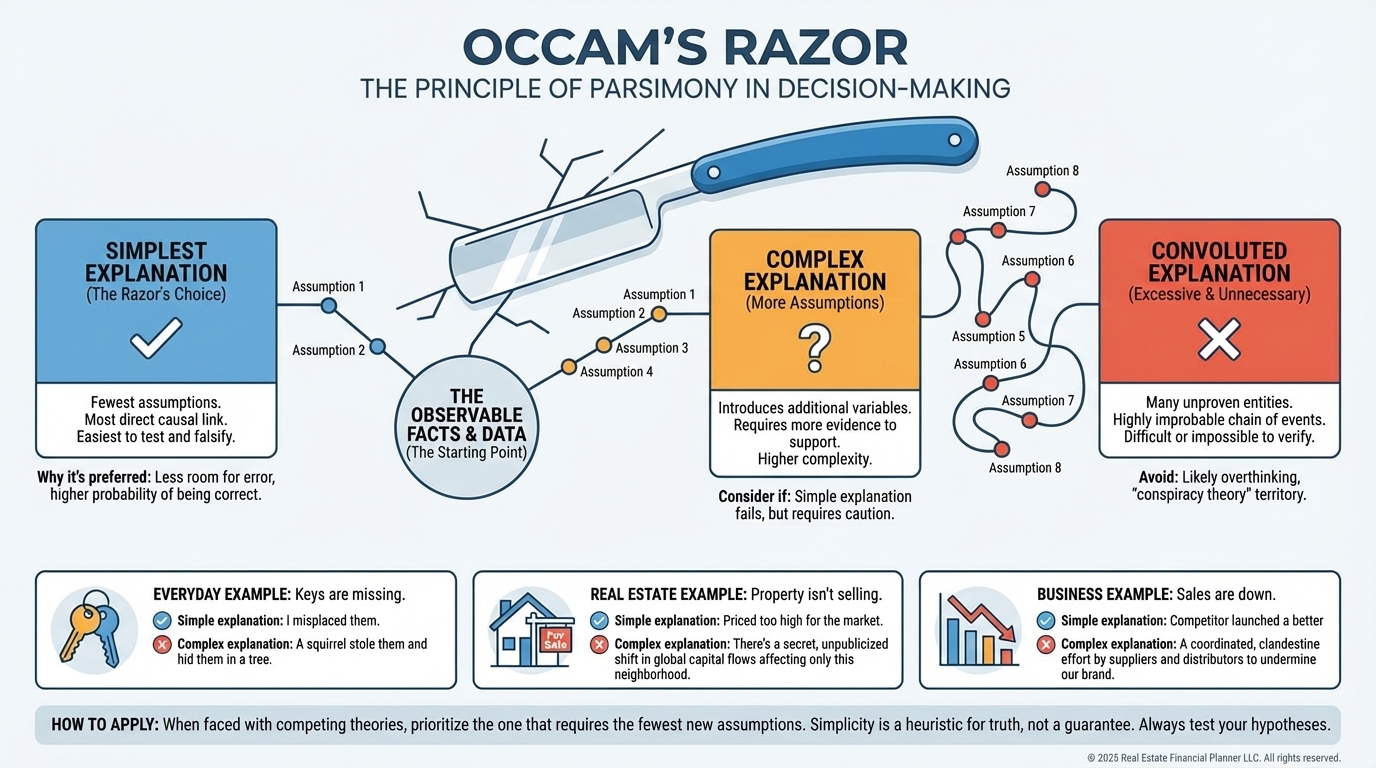

Occam’s Razor: Why the Simplest Explanation Often Wins

When something unexpected happens, most people add complexity.

They invent extra assumptions.

They layer on explanations.

They build stories to make the outcome feel controlled.

Occam’s Razor offers a different approach.

It says that when multiple explanations fit the facts, the simplest one is usually the best place to start. Not because it’s always correct, but because unnecessary complexity increases the chance of error.

This idea shows up constantly in investing and business, especially when decisions must be made without complete information.

What Is Occam’s Razor?

Occam’s Razor is a principle of reasoning that states:

Among competing explanations that fit the available evidence, prefer the one that makes the fewest assumptions.It does not say the simplest explanation is always true.

It says complexity must earn its place.

Every additional assumption increases the number of ways you can be wrong.

Why Occam’s Razor Matters in Probability and Statistics

Probability theory deals with uncertainty.

Occam’s Razor helps you decide which uncertainty model to trust.

When outcomes are incomplete:

•

You don’t know the full story

•

You don’t have all the data

•

You still need to act

In those situations, simpler probability models are often more reliable than elaborate ones built on fragile assumptions.

This is why Occam’s Razor frequently appears alongside:

•

Expected value

•

Risk assessment

•

Model selection

•

Forecasting

Where People Go Wrong

Complex explanations feel sophisticated.

They also:

•

Hide uncertainty

•

Encourage overconfidence

•

Make bad decisions harder to notice

Occam’s Razor acts as a brake on that instinct.

It forces you to ask:

“What assumptions am I adding that I don’t actually need?”Applying Occam’s Razor in the Real World

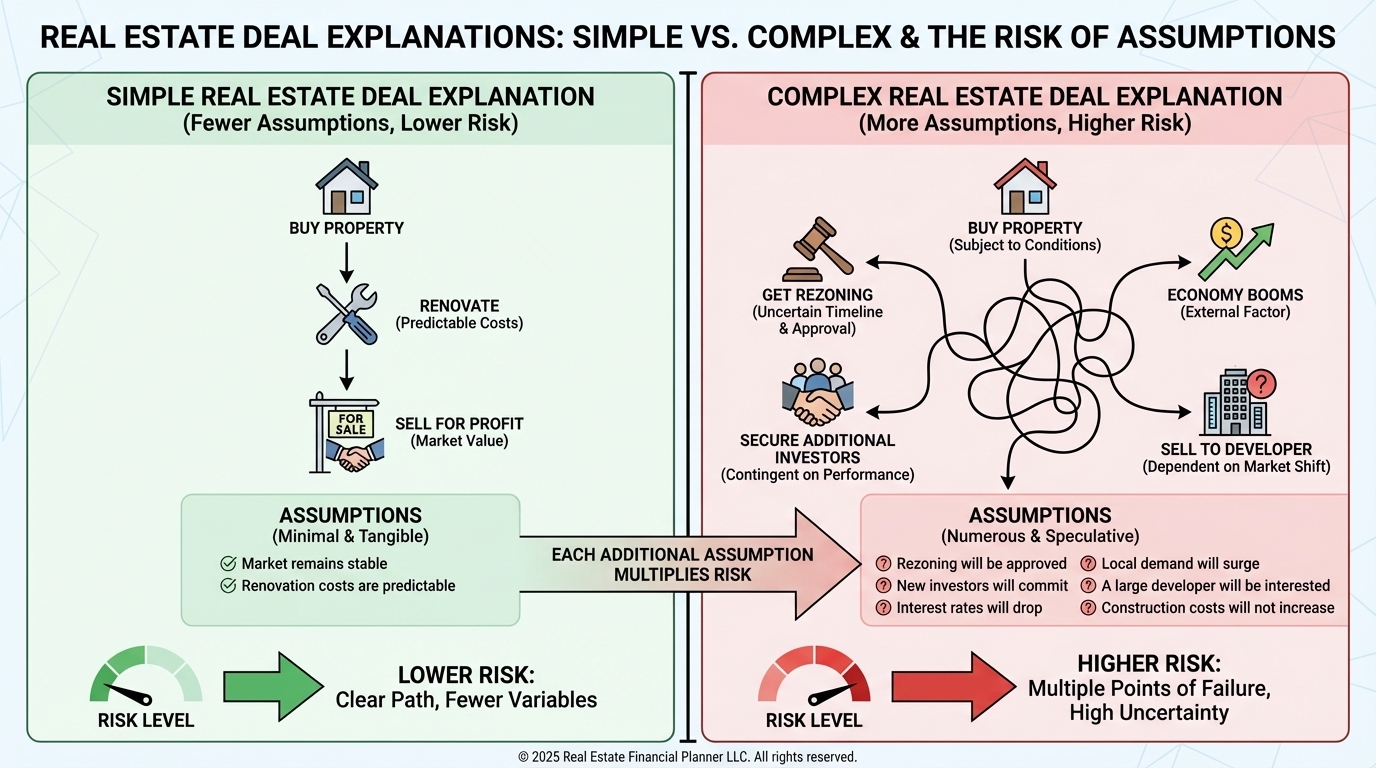

Real Estate Investors

In real estate, complexity often shows up as storytelling.

•

“Rents will rise because of X, Y, and Z.”

•

“This market is different because of these five factors.”

•

“Vacancy won’t matter because demand is strong.”

Occam’s Razor suggests starting with simpler explanations:

•

Rents rise when supply is constrained.

•

Prices fall when affordability breaks.

•

Vacancy happens when units are overpriced.

This doesn’t eliminate nuance.

It prevents rationalizing fragile deals.

Cash-Secured Put Sellers

Options trading invites overthinking.

Traders often build elaborate narratives around:

•

Short-term price movements

•

News interpretations

•

Market sentiment

Occam’s Razor pulls you back to basics:

•

Price plus probability

•

Time decay

•

Volatility

The simplest explanation for why a put is cheap is often that:

•

The market assigns a low probability to assignment

Before inventing a story, check the probabilities.

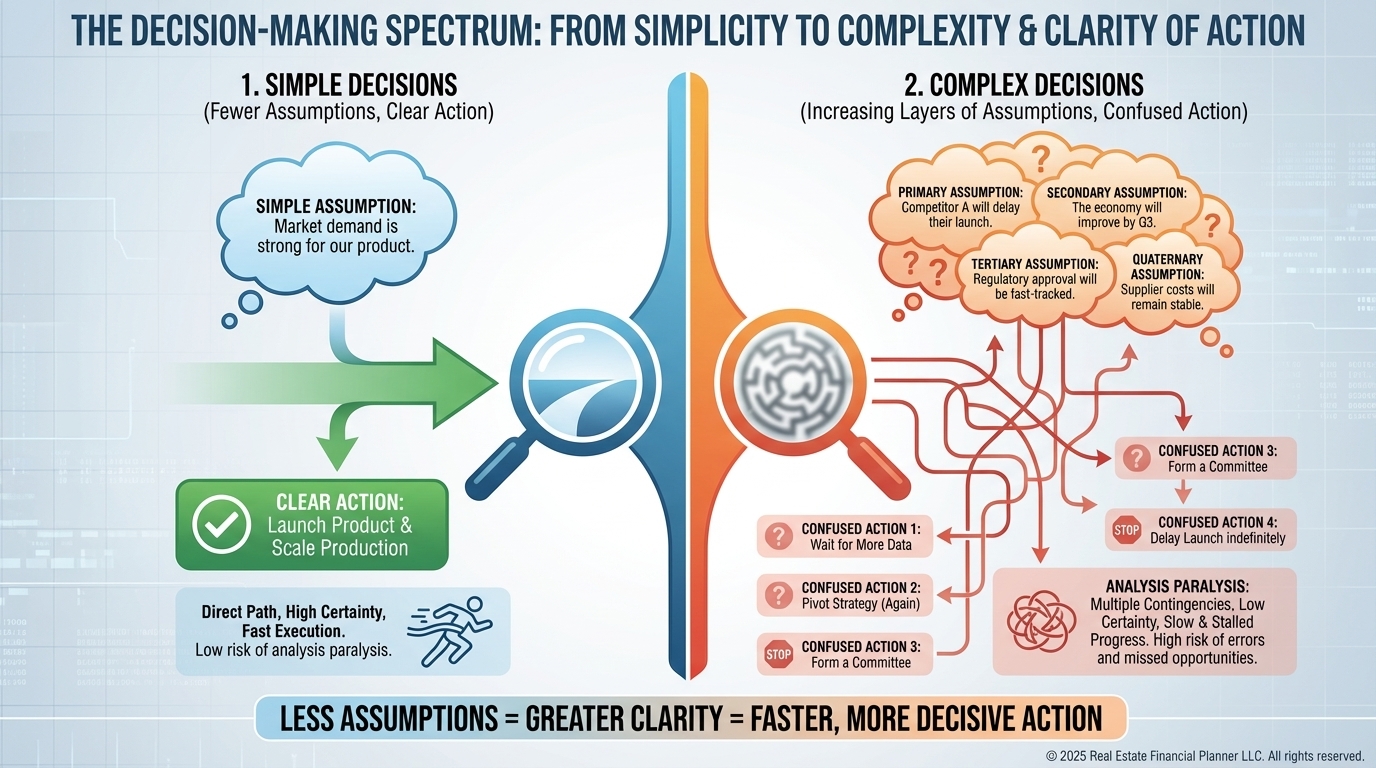

Small Business Owners

In business, complexity often hides uncertainty.

•

“Sales dipped because of seasonality, marketing changes, and customer psychology.”

•

“Growth stalled due to multiple external factors.”

Occam’s Razor asks:

•

Did pricing change?

•

Did demand weaken?

•

Did costs rise?

Simple explanations often reveal actionable problems faster than layered narratives.

What Occam’s Razor Does Not Mean

Occam’s Razor does not mean:

•

Ignoring complexity when it’s real

•

Oversimplifying nuanced systems

•

Refusing to update beliefs

It means complexity must be justified by evidence, not comfort.

As new data arrives, the “simplest explanation” may change.

That’s a feature, not a flaw.

How This Fits Into the Broader Framework

Occam’s Razor works alongside:

•

Probability and likelihood

•

Expected value

•

Risk versus uncertainty

•

Incomplete information

Together, these ideas help you:

•

Avoid overfitting explanations

•

Reduce fragile assumptions

•

Make calmer decisions under pressure

Each of these concepts will be explored in more depth elsewhere.

Final Thought

Most bad decisions aren’t caused by ignorance.

They’re caused by unnecessary complexity layered on top of uncertainty.

Occam’s Razor doesn’t guarantee you’ll be right.

It improves your odds by keeping your thinking clean when information is incomplete.

And in investing and business, that’s usually enough to matter.