Pierre De Fermat's Math for Real Estate Investing

An introduction to Pierre de Fermat and his foundational role in probability theory and structured reasoning that underlies modern investing, trading, and business decision-making.

Pierre de Fermat: Structure, Probability, and Thinking Clearly About Unfinished Outcomes

Many of the most important ideas in probability theory didn’t emerge from classrooms or textbooks.

They emerged from disputes.

Pierre de Fermat entered probability theory not as a professional mathematician solving abstract problems, but as a thinker helping resolve practical questions about fairness, incomplete outcomes, and rational decision-making.

Alongside Blaise Pascal, Fermat helped create the mathematical framework that allows people to reason clearly when outcomes are uncertain and processes are unfinished.

That framework still governs how investors and business owners think about risk today.

Who Was Pierre de Fermat?

Pierre de Fermat was a French lawyer by profession and a mathematician by passion.

He is best known for:

•

Foundational work in probability theory

•

Contributions to analytic geometry

•

Early ideas related to optimization and maxima

•

Formal reasoning about incomplete processes

Unlike Pascal, Fermat focused less on philosophy and more on structure—how to break problems into logical components that could be evaluated fairly and consistently.

That focus made probability usable.

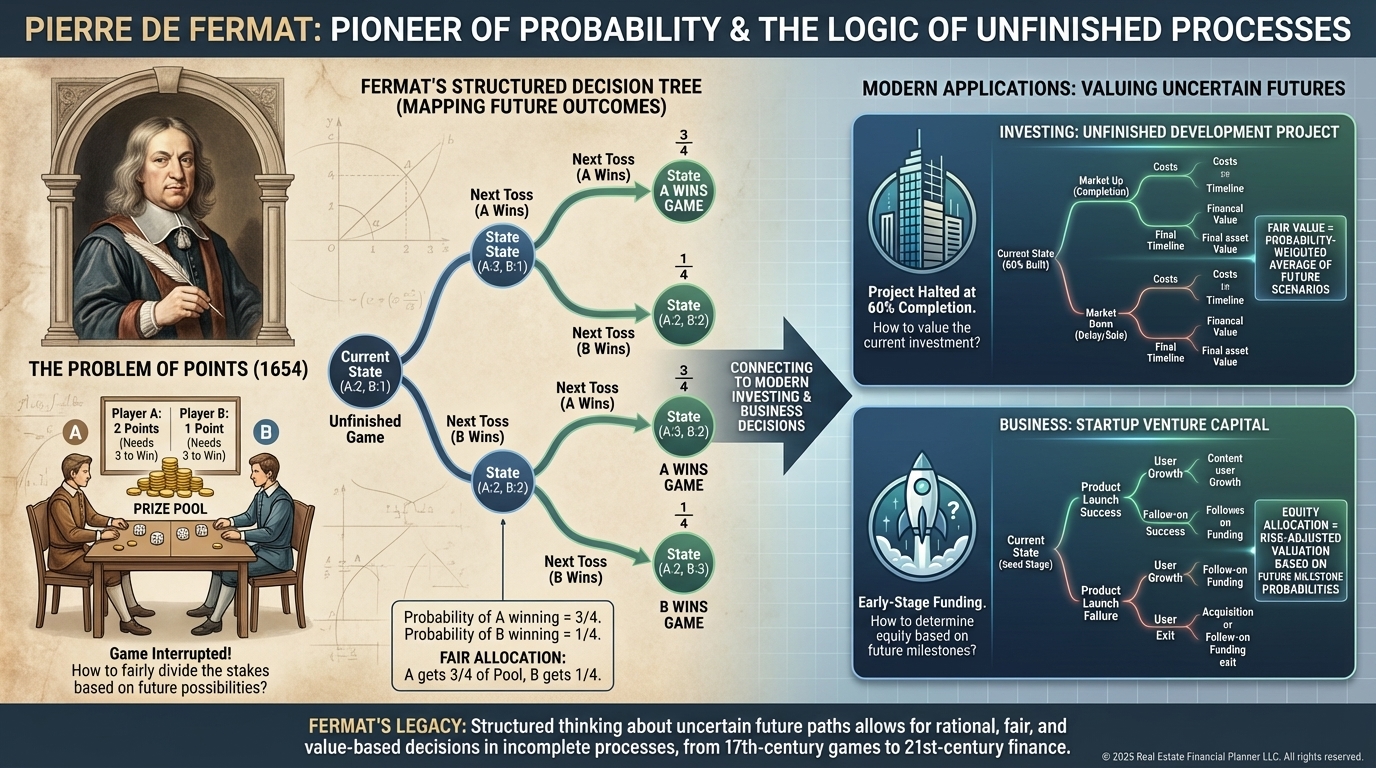

Fermat and the Problem of Points

Fermat’s most influential work in probability came from correspondence with Blaise Pascal while addressing the Problem of Points.

The problem asked:

If a game ends early, how should the prize be divided fairly?Fermat’s contribution was methodological.

He showed that:

•

Enumerate all possible future outcomes

•

Weight them by likelihood

•

Allocate value based on probability, not past effort

This was a radical shift.

Fairness became forward-looking and probabilistic, not emotional or retrospective.

Why Fermat’s Thinking Still Matters

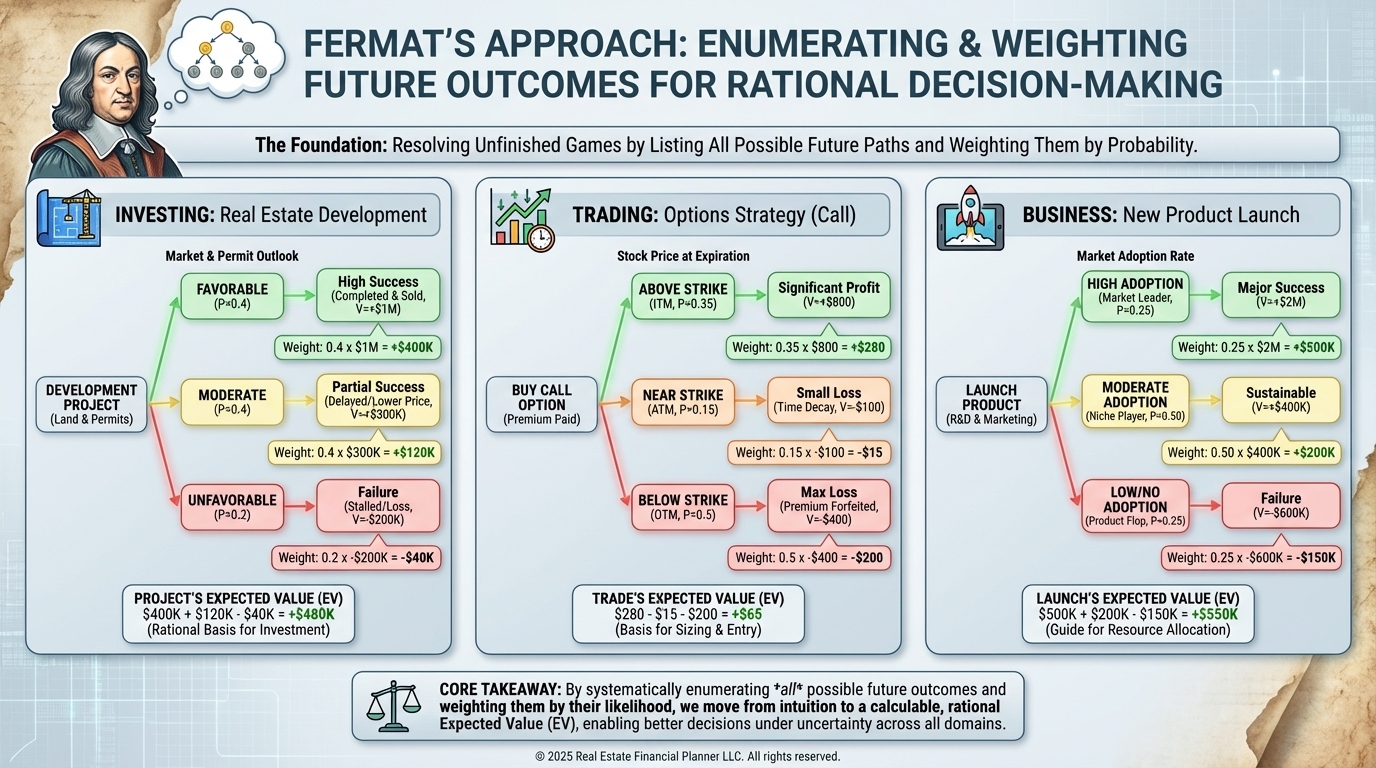

Fermat’s approach introduced a discipline that still applies today:

•

Break complex situations into simpler components

•

Evaluate all plausible future paths

•

Ignore past effort once future probabilities diverge

This is the backbone of:

•

Expected value

•

Risk pricing

•

Decision trees

•

Scenario analysis

Without this structure, probability theory becomes vague and narrative-driven.

Why Fermat Matters to Real Estate Investors

Real estate investors routinely face unfinished processes:

•

Renovations mid-project

•

Lease-ups before stabilization

•

Partnerships before exit

Fermat’s framework encourages investors to:

•

Focus on what can happen next

•

Weight outcomes by likelihood

•

Avoid equal splits when probabilities are unequal

This mindset improves:

•

Deal renegotiations

•

Partnership buyouts

•

Exit timing decisions

It replaces intuition with structure.

Why Fermat Matters to Cash-Secured Put Sellers

Options trading is a live demonstration of Fermat’s thinking.

Every position can be described as:

•

A set of future price paths

•

Each with a probability

•

Each with a payoff

Cash-secured put sellers implicitly use Fermat’s logic when they:

•

Evaluate assignment probability

•

Decide whether to roll or close

•

Compare holding versus exiting early

Without enumerating outcomes, trade management becomes emotional instead of probabilistic.

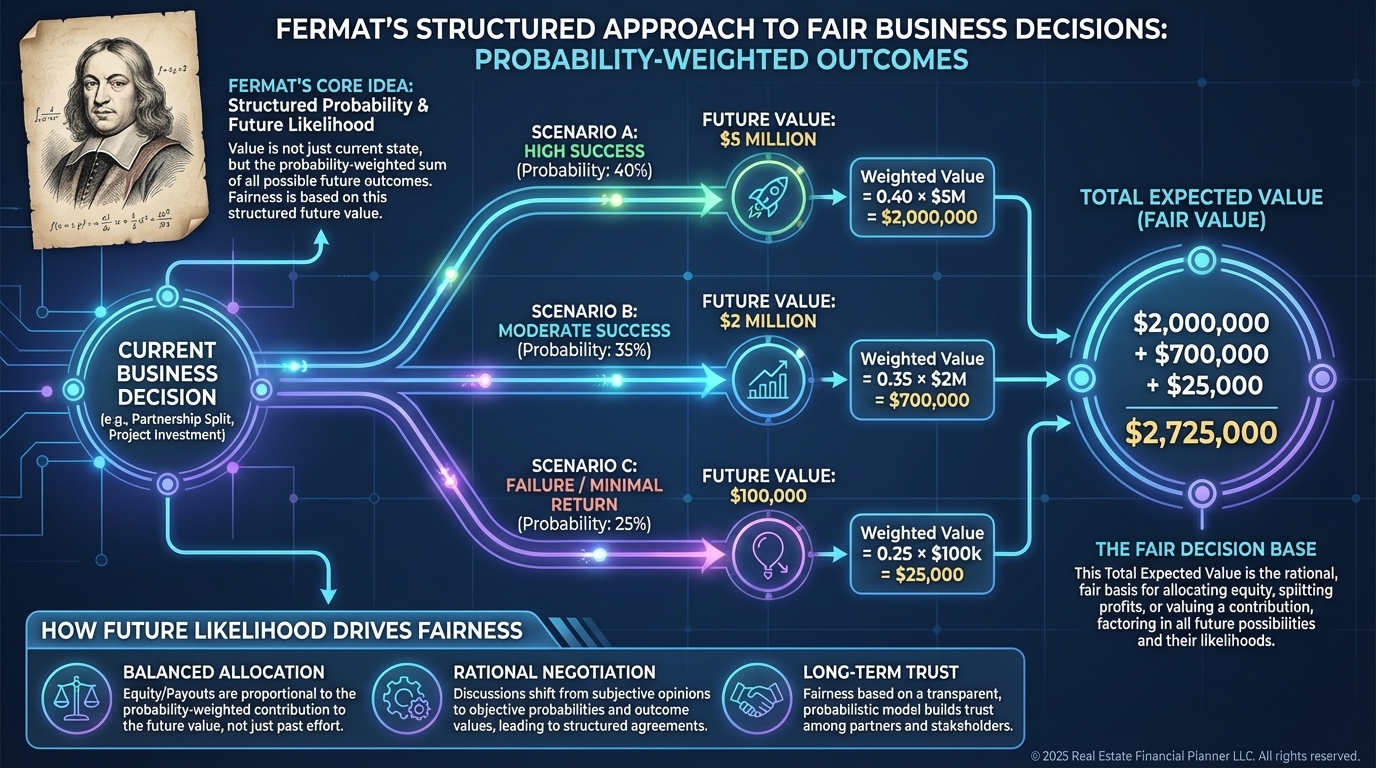

Why Fermat Matters to Small Business Owners

Business decisions often involve incomplete information:

•

A partnership before growth

•

A product before market validation

•

A buyout before outcomes are clear

Fermat’s contribution is the discipline to:

•

Identify plausible future scenarios

•

Assign rough likelihoods

•

Make decisions based on weighted outcomes

This helps owners avoid:

•

Overpaying for exits

•

Undervaluing future upside

•

Making decisions based purely on sunk effort

Fermat’s Quiet Advantage

Fermat didn’t try to explain why uncertainty exists.

He showed how to work with it.

His ideas help separate:

•

What has already happened

•

From what could still happen

That separation is essential for rational decision-making.

How Fermat Fits Into This Section

Fermat represents:

•

Structure over storytelling

•

Enumeration over intuition

•

Forward-looking fairness

His work underlies:

•

The Problem of Points

•

Expected value

•

Decision trees

•

Scenario analysis

Future modules will build directly on these ideas.

Final Thought

Pierre de Fermat didn’t remove uncertainty from decisions.

He made it measurable.

If you invest, trade, or run a business, you are already relying on Fermat’s framework—whether you know it or not.

Learning it explicitly doesn’t make decisions easier.

It makes them more accurate.

And accuracy compounds.