Probability Theory for Smarter Real Estate Investing

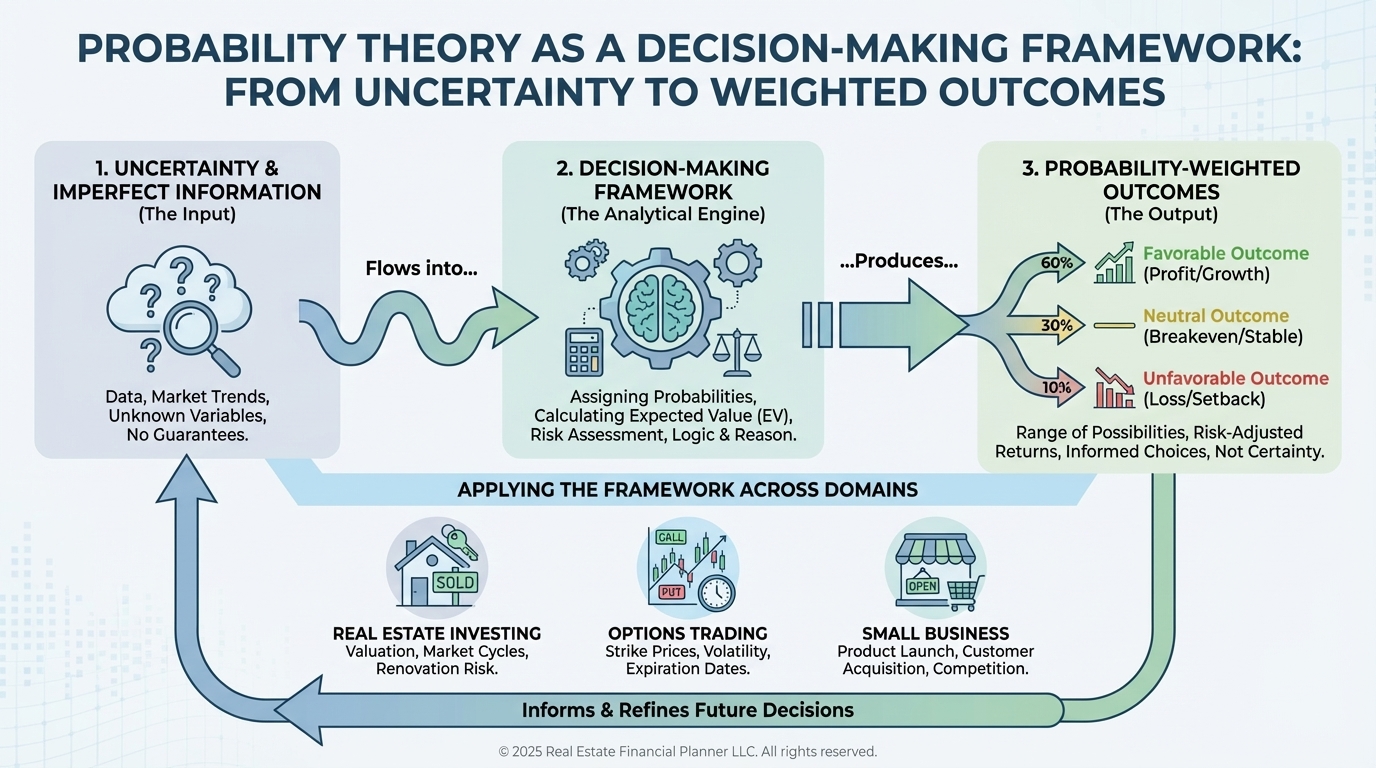

An overview of probability theory as a practical decision-making framework for real estate investors, stock and options traders, and small business owners who operate under uncertainty.

Probability Theory: A Practical Framework for Decisions Under Uncertainty

Most investing and business decisions are made without knowing how things will turn out.

You don’t choose between certainty and uncertainty.

You choose between different probabilities.

Probability theory is the language that describes those probabilities. Not as abstract math, but as a way to think clearly when outcomes are incomplete, risk is uneven, and decisions must still be made.

This article introduces the major ideas from probability theory that repeatedly show up in real-world decisions. Each concept will be explored in much more detail elsewhere. The goal here is orientation, not mastery.

Why Probability Theory Matters

People often think probability applies only to gambling or trading.

In reality, it applies anywhere:

•

Outcomes are uncertain

•

Decisions are irreversible

•

Risk changes over time

That includes:

•

Buying or selling real estate

•

Managing options positions

•

Running and exiting a business

Probability theory doesn’t eliminate risk.

It helps you price it accurately.

The Big Ideas in Probability Theory

Below are the core concepts you’ll see repeatedly throughout this section.

Each one deserves its own deep dive. Here, we focus on what it is and why it matters.

Probability and Likelihood

Probability describes how likely an outcome is relative to other outcomes.

Real Estate Investors:

Used when estimating rent stability, vacancy risk, price appreciation ranges, or deal success after contingencies are removed.

Cash-Secured Put Sellers:

Used when evaluating assignment likelihood, delta as a proxy for probability, and how odds shift as expiration approaches.

Small Business Owners:

Used when assessing the likelihood of growth, failure, customer concentration risk, or the success of a strategic decision.

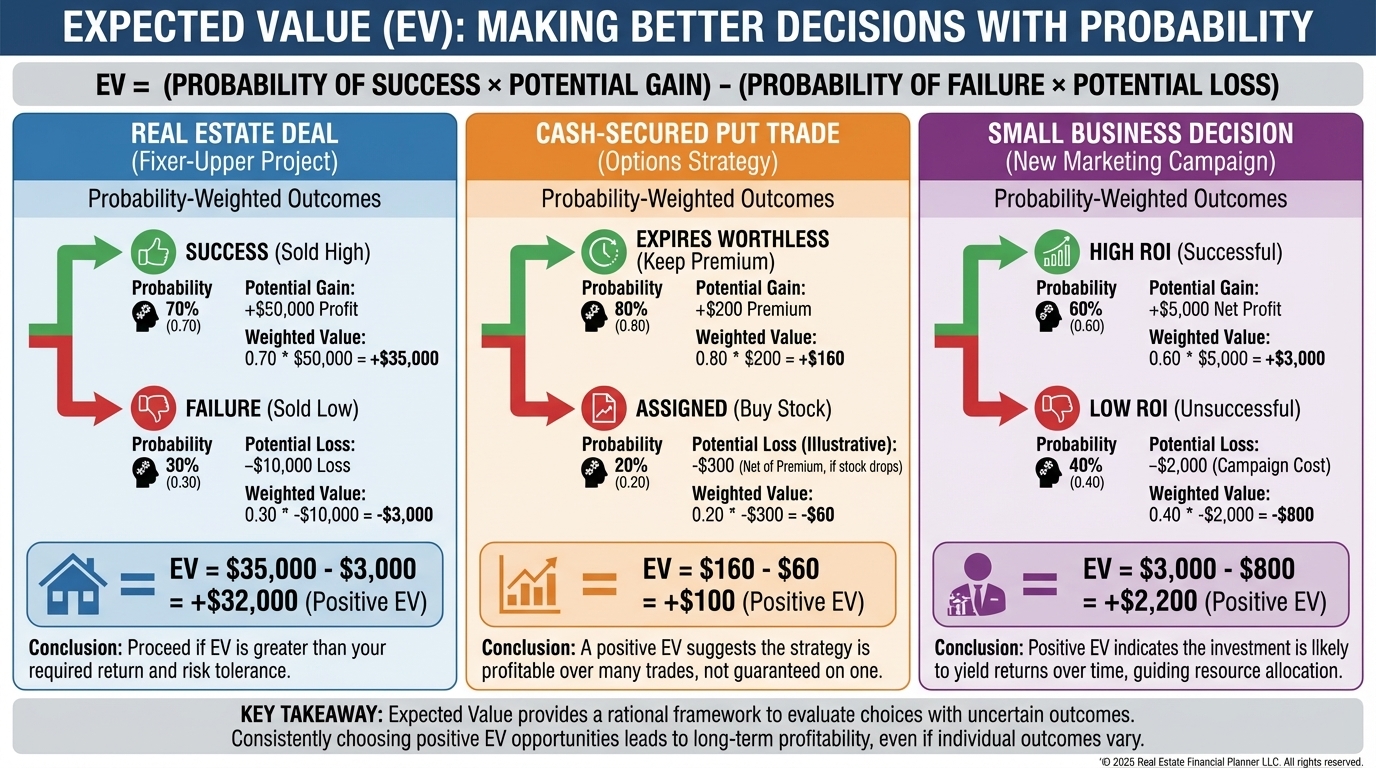

Expected Value (EV)

Expected value combines probability and payoff into a single forward-looking number.

EV answers the question:

“What is this decision worth on average if repeated many times?”

Real Estate Investors:

EV appears in deal analysis, renovation decisions, and negotiations when outcomes are asymmetric.

Cash-Secured Put Sellers:

EV drives decisions about holding, closing, rolling, or accepting assignment.

Small Business Owners:

EV informs hiring, expansion, buyouts, and whether a risky opportunity is worth pursuing.

Risk vs. Uncertainty

Risk involves known probabilities.

Uncertainty involves unknown or unstable probabilities.

Most people treat them as the same thing. They aren’t.

Real Estate Investors:

Known expenses are risk. Unknown deferred maintenance is uncertainty.

Cash-Secured Put Sellers:

Modeled volatility is risk. Sudden regime changes are uncertainty.

Small Business Owners:

Stable demand is risk. Regulatory or platform changes are uncertainty.

Understanding the difference changes how you price decisions.

Incomplete Information

Most decisions are made before all facts are known.

Probability theory explains how to act anyway.

Real Estate Investors:

Buying before perfect market clarity exists.

Cash-Secured Put Sellers:

Managing trades without knowing future price paths.

Small Business Owners:

Making strategic decisions without full visibility into competitors or markets.

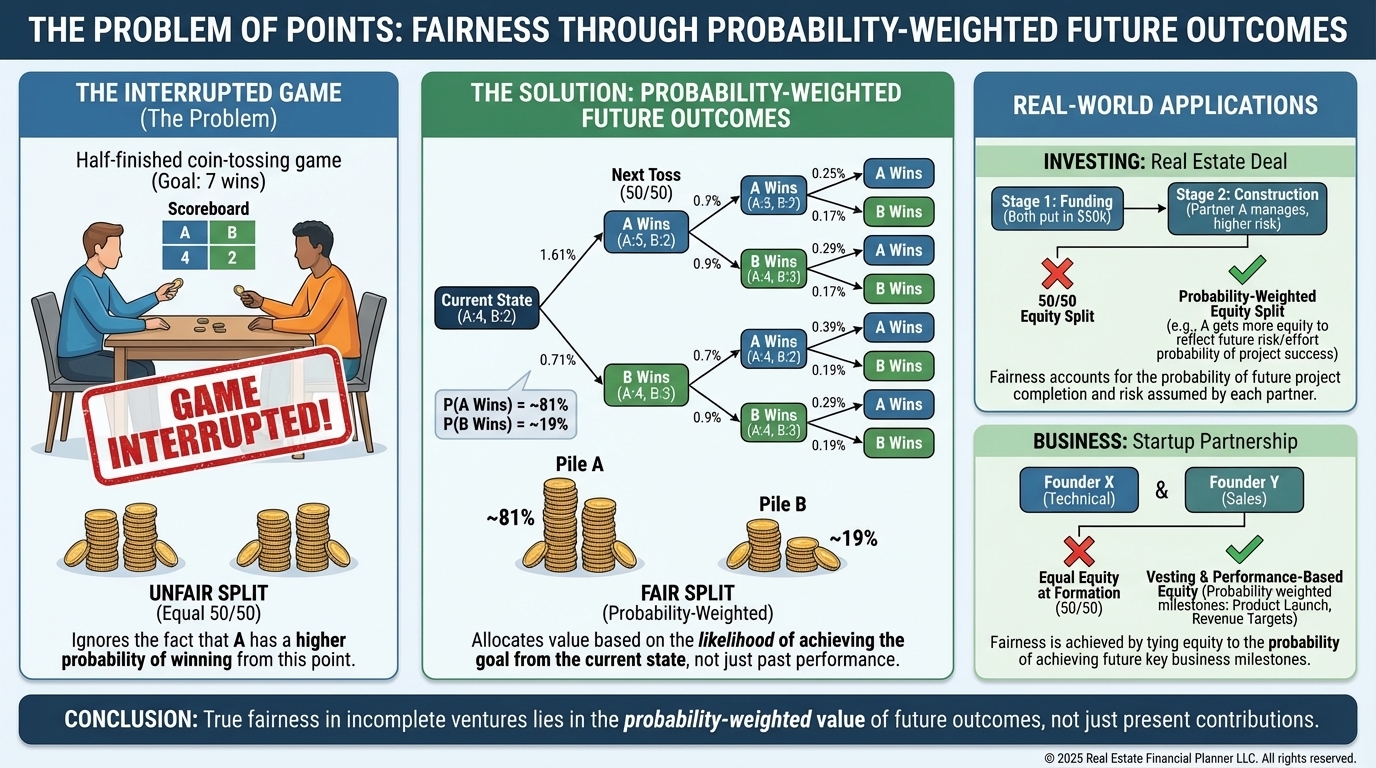

The Problem of Points

The Problem of Points shows why equal splits are often unfair when future probabilities differ.

It teaches that:

•

Past effort doesn’t determine fairness

•

Future likelihood does

This concept shows up in:

•

Deal renegotiations

•

Early exits

•

Buyouts

•

Trade management decisions

Probability Collapse Over Time

As time passes, uncertainty narrows.

This changes decision quality dramatically.

Real Estate Investors:

Risk drops after inspections, leasing, or stabilization.

Cash-Secured Put Sellers:

Probabilities shift sharply as expiration approaches.

Small Business Owners:

Early-stage uncertainty gives way to clearer outcomes as businesses mature.

Recognizing probability collapse helps prevent late-stage mispricing.

How This Section Is Structured

Each major idea introduced here will have:

•

Its own dedicated blog post

•

Often a deeper course or module

•

Practical examples specific to real estate investors, stock and option traders and business owners

You don’t need to learn probability theory all at once.

You need to recognize where it already shows up in your decisions.

Final Thought

Probability theory isn’t about predicting the future.

It’s about making better decisions when the future is unknown.

If you invest, trade, or own a business, you are already using probability—whether you realize it or not. This section helps you do it consciously, consistently, and with fewer avoidable mistakes.

That’s where better results usually come from.