Blaise Pascal's Probability Guide to Real Estate Investing

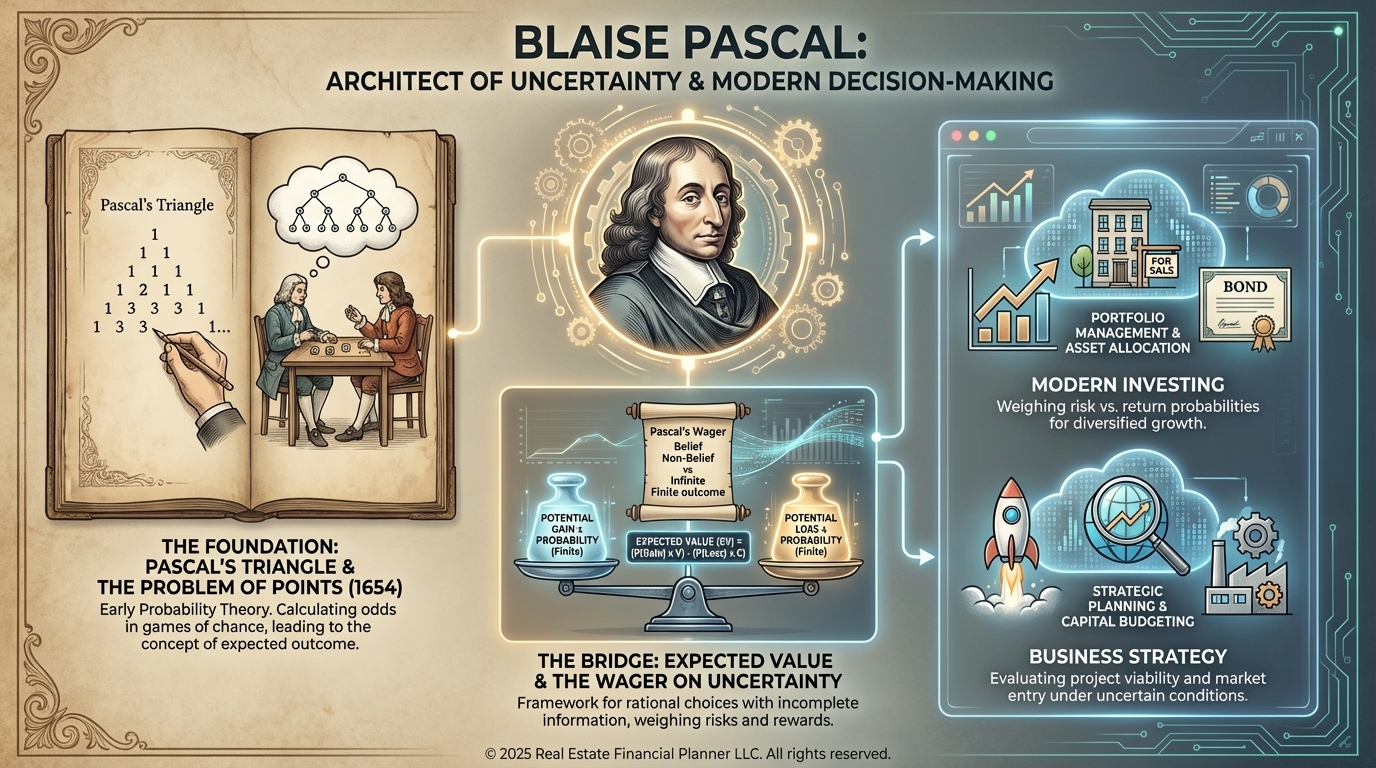

An introduction to Blaise Pascal and his foundational role in probability theory, expected value, and decision-making under uncertainty that still shapes investing and business decisions today.

Blaise Pascal: Probability, Decisions, and Acting Without Certainty

Most important decisions must be made without knowing how things will turn out.

That reality isn’t new.

In the seventeenth century, Blaise Pascal helped formalize how humans can reason, decide, and act when outcomes are uncertain. His work laid the groundwork for probability theory, expected value, and many of the decision-making frameworks investors and business owners rely on today—often without realizing it.

Pascal didn’t study probability to gamble better.

He studied it to understand how to choose when certainty isn’t available.

Who Was Blaise Pascal?

Blaise Pascal was a French mathematician, physicist, philosopher, and theologian.

He contributed to:

•

Early probability theory

•

The foundations of statistics

•

Decision-making under uncertainty

•

Game theory concepts like fair division

Much of his probability work came from correspondence with Pierre de Fermat while solving what became known as the Problem of Points.

That problem forced a new way of thinking:

Decisions should be based on what is likely to happen next, not what has already happened.That idea still underpins modern investing logic.

Pascal and the Birth of Probability Theory

Before Pascal, uncertainty was handled intuitively or emotionally.

Pascal helped formalize:

•

Probability as a measurable concept

•

Fairness as a probabilistic idea

•

Decisions as forward-looking calculations

This shift mattered because it replaced:

•

Guessing

•

Storytelling

•

Superstition

...with structured reasoning.

Probability theory became a way to act rationally even when outcomes couldn’t be known in advance.

Expected Value: Pascal’s Most Practical Legacy

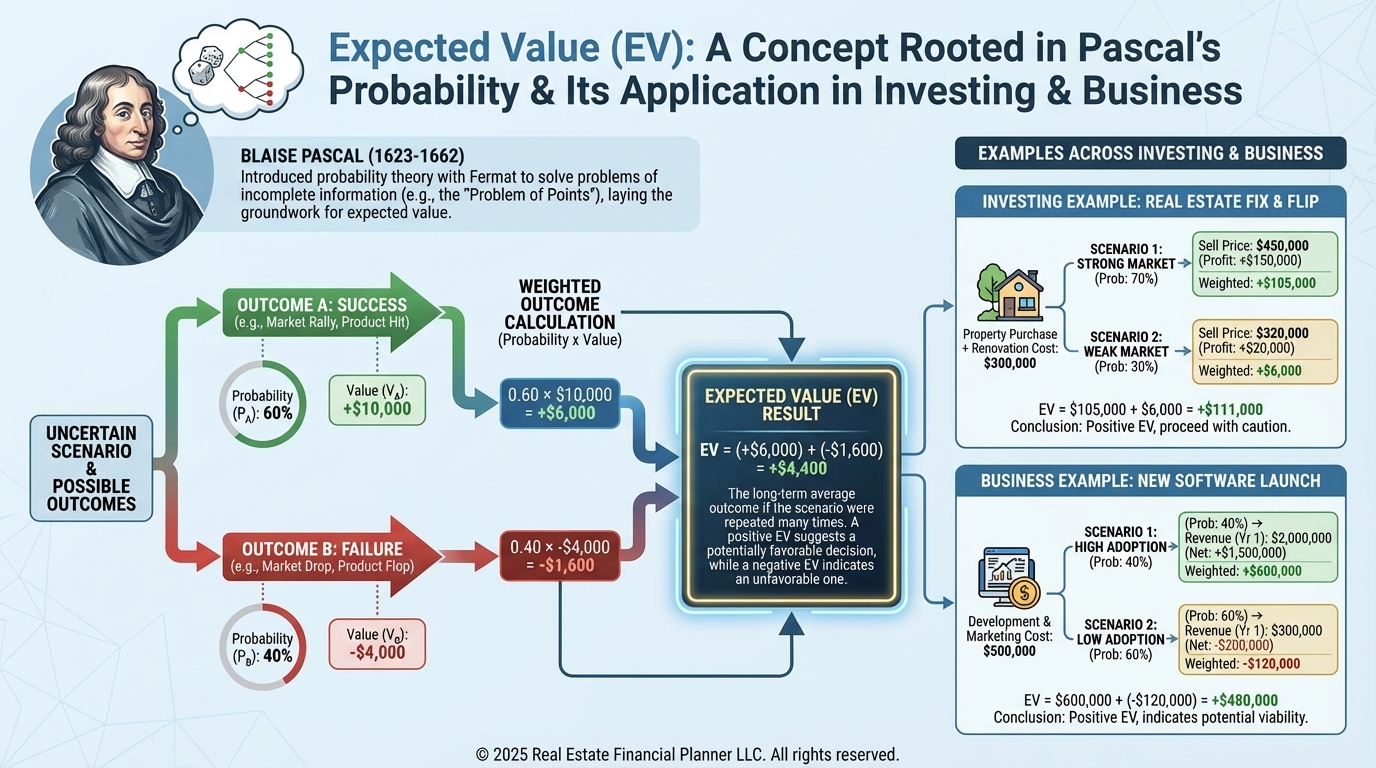

One of Pascal’s most enduring contributions is the idea behind expected value.

Expected value asks:

“What is the average outcome if this decision were repeated many times?”This reframes decisions away from:

•

Single outcomes

•

Emotional reactions

•

Short-term wins or losses

...and toward long-term decision quality.

This way of thinking shows up everywhere today.

Why Pascal Still Matters to Real Estate Investors

Real estate investors constantly face uncertainty:

•

Future rents

•

Market cycles

•

Exit timing

Pascal’s framework encourages investors to:

•

Think in ranges, not certainties

•

Price risk instead of ignoring it

•

Evaluate deals based on likely outcomes, not best-case stories

Deal analysis, negotiation, and portfolio strategy all quietly rely on Pascal’s ideas.

Why Pascal Matters to Cash-Secured Put Sellers

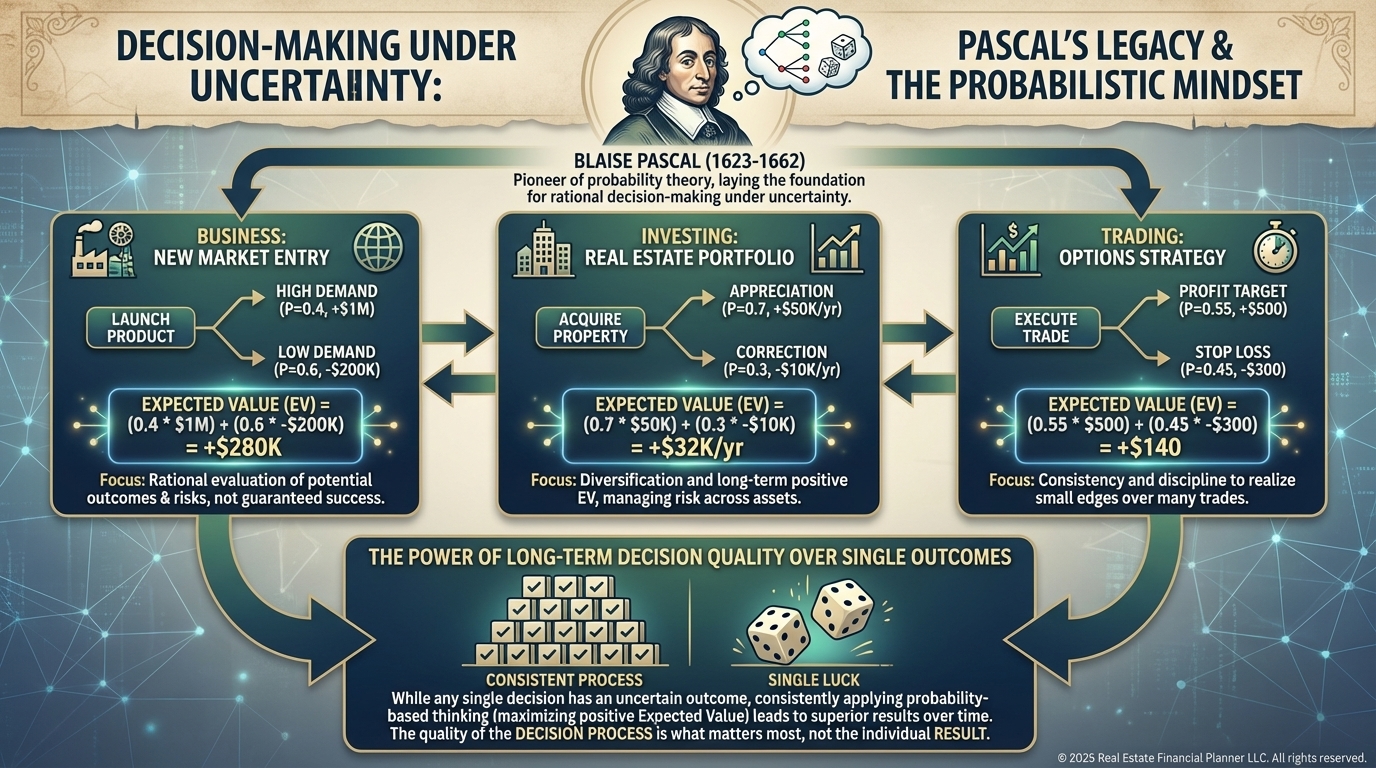

Options trading is probability theory in motion.

Every cash-secured put involves:

•

A probability of assignment

•

A payoff if things go well

•

A loss if they don’t

Pascal’s thinking underlies:

•

Expected value calculations

•

Probability-based trade management

•

Understanding why single losses don’t invalidate good strategies

Without Pascal, options trading becomes narrative-driven instead of probability-driven.

Why Pascal Matters to Small Business Owners

Business decisions rarely come with certainty.

Owners must decide:

•

When to invest

•

When to hire

•

When to exit

•

When to accept risk

Pascal’s ideas encourage:

•

Evaluating decisions over time, not one-off outcomes

•

Separating decision quality from results

•

Acting rationally even when outcomes can’t be guaranteed

This mindset prevents overreacting to short-term noise.

Pascal’s Deeper Insight

Pascal understood something many people still struggle with:

You can make the right decision and get the wrong outcome.

Probability theory doesn’t guarantee success.

It improves the odds over time.

That distinction is critical for anyone whose results depend on repeated decisions.

How This Fits Into This Section

This post introduces Pascal as:

•

A historical figure

•

A conceptual foundation

•

A bridge between math and real-world decisions

Future posts and courses will dive deeper into:

•

The Problem of Points

•

Expected value

•

Risk versus uncertainty

•

Bayesian updating

•

Decision-making hygiene

Pascal’s work sits underneath all of them.

Final Thought

Blaise Pascal didn’t try to eliminate uncertainty.

He accepted it—and showed how to act anyway.

If you invest, trade, or run a business, you are already living inside the world Pascal described. Learning his framework doesn’t make decisions easier.

It makes them clearer.

And clarity compounds.