The Problem of Points for Cash-Secured Put Sellers

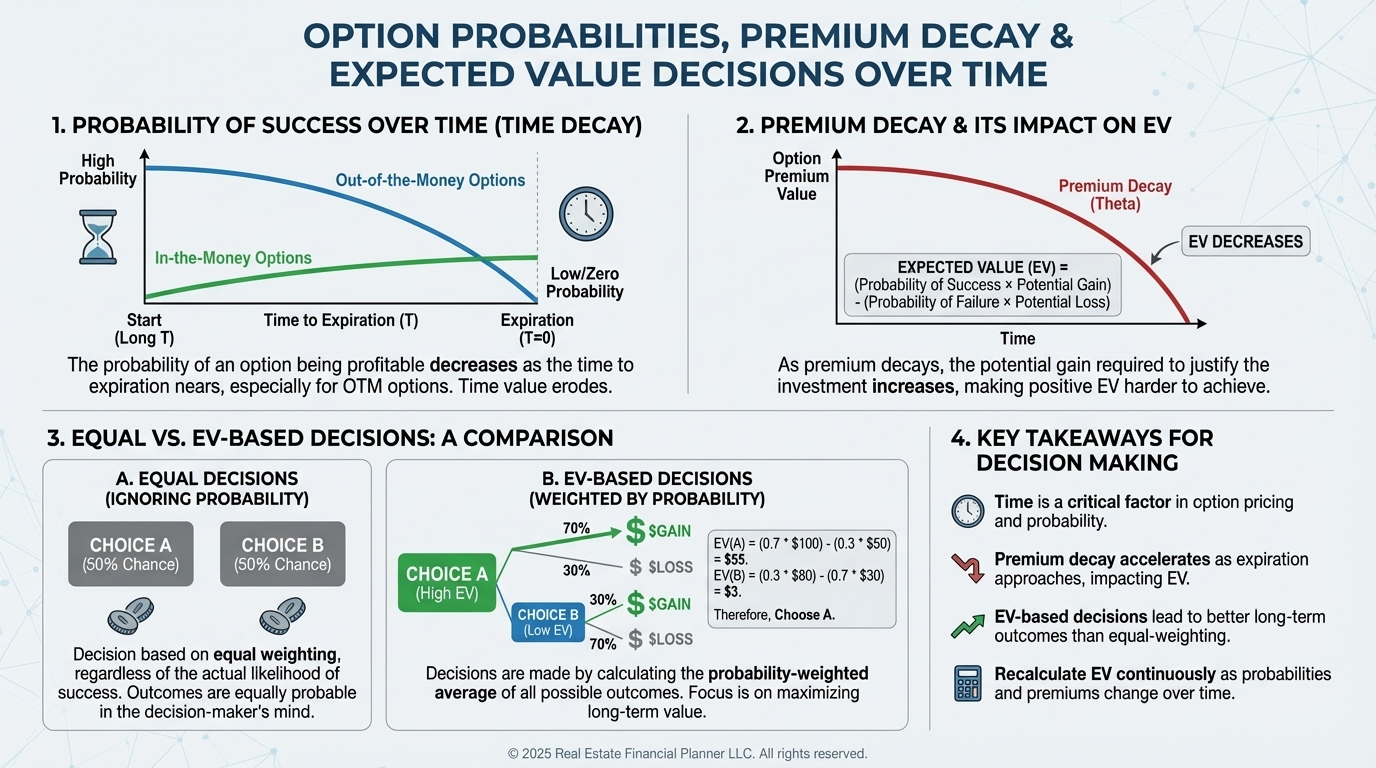

This article applies the Problem of Points to options trading decisions such as closing early, rolling, or holding to expiration. You’ll see why past premium earned doesn’t determine fairness—future probability does.

Why Early Decisions Are Rarely Neutral

Selling cash-secured puts is a probability business.

You are constantly deciding whether to:

•

Hold

•

Close early

•

Roll

•

Accept assignment

Many traders frame these decisions emotionally.

The Problem of Points shows why that’s dangerous.

The Parallel to Probability Games

When you sell a put:

•

You start with uncertainty.

•

Time passes.

•

Outcomes narrow.

As expiration approaches, probabilities shift dramatically.

Treating early and late decisions as equivalent is a mistake.

Example: Closing a Put Early

You sell a put with 45 days to expiration.

Two weeks later:

•

The option has lost most of its value.

•

The probability of assignment is low.

Some traders say, “I’ve earned half the premium, so I’ll close.”

That ignores what matters:

•

The remaining risk

•

The probability-weighted outcome

Closing early versus holding isn’t about symmetry.

It’s about expected value from here.

Why Neutral Decisions Aren’t Neutral

The Problem of Points explains why:

•

Early exits can be overcautious

•

Late exits can be overpriced

•

Rolling decisions must be forward-looking

Past premium earned is irrelevant.

Only future probability matters.

Final Thought

Cash-secured put selling isn’t about avoiding loss.

It’s about pricing probability accurately.

The Problem of Points gives you the mental framework to do that consistently.