Put Options for Real Estate Investors: A Practical Guide

This module explains what put options are, how they work, and how investors use them to generate income, hedge risk, or speculate on price declines.

Tags

Put options are one of the most flexible tools in options trading because they can be used to generate income, buy stocks at a discount, or protect downside risk.

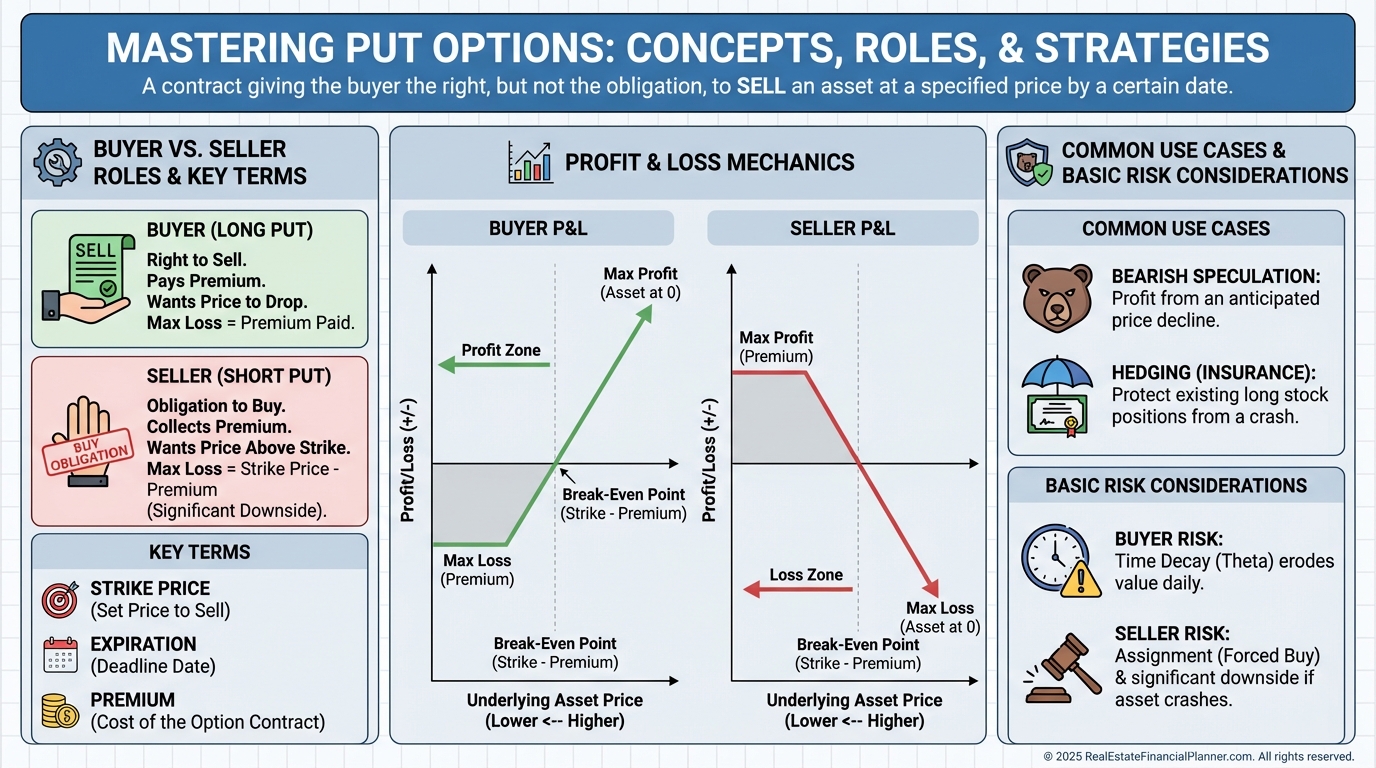

At a basic level, a put option gives the buyer the right—but not the obligation—to sell a stock at a specific price (called the strike price) on or before a specific date (the expiration).

The seller of the put option takes the opposite side of that contract.

How Put Options Work

When you buy a put option, you are betting that the stock price will fall. If the stock drops below the strike price before expiration, the put option increases in value. You can either sell the option for a profit or exercise it to sell shares at the higher strike price.

When you sell a put option, you collect a premium upfront. In exchange, you agree to buy the stock at the strike price if the option is exercised.

This distinction—buyer versus seller—is critical, because the risks and rewards are very different.

Key Terms You Need to Know

A few core terms show up in every put option trade:

Strike Price: The price at which shares can be sold (for the buyer) or must be bought (for the seller).

Expiration Date: The date the option contract ends.

Premium: The upfront payment the seller receives and the buyer pays.

In-the-Money (ITM): The stock price is below the strike price.

Out-of-the-Money (OTM): The stock price is above the strike price.

Understanding these terms makes reading an options chain far less intimidating.

Common Uses of Put Options

Put options are commonly used in three ways.

First, speculation. Traders buy puts when they expect a stock to decline and want leveraged downside exposure with defined risk.

Second, income generation. Investors sell cash-secured puts to collect premium while being willing to buy the stock at a lower price.

Third, risk management. Long-term investors buy protective puts as insurance against a market or stock-specific drop.

The same instrument behaves very differently depending on how you use it.

Risk and Reward Basics

For a put buyer, the maximum loss is limited to the premium paid. The potential profit increases as the stock price falls.

For a put seller, the maximum profit is the premium received. The risk comes from being forced to buy shares at the strike price if the stock drops sharply.

This asymmetry is why many conservative strategies focus on selling puts only on stocks you are happy to own.

Why Put Options Matter

Put options let you shape risk intentionally instead of reacting emotionally. Whether you want downside protection, steady income, or a disciplined way to buy stocks, puts give you a framework to define outcomes in advance.

Used thoughtfully, they turn uncertainty into something you can plan around instead of fear.